SCC(002916)

Search documents

开源晨会-20251030

KAIYUAN SECURITIES· 2025-10-30 14:49

Group 1: Macro Economic Insights - The "14th Five-Year Plan" has achieved significant accomplishments, marking a good start for the new journey towards the second centenary goal [6] - The "15th Five-Year Plan" is crucial for transitioning towards a modern socialist society, emphasizing the need to address uncertainties and enhance high-quality development [7] - The implicit target for economic growth during the "15th Five-Year Plan" is around 5%, with necessary growth rates for GNI and GDP projected to exceed 6.3% and 4.6% respectively [8] Group 2: Power Industry Insights - The power demand in China has maintained steady growth, with total electricity consumption reaching 7.77 trillion kWh, a year-on-year increase of 4.8% [22] - The coal price has bottomed out, leading to a stabilization of electricity prices, with the average monthly trading price in Jiangsu rising to 395.60 RMB/MWh, an increase of 82.80 RMB/MWh [23] - The electricity market is expected to see a balanced supply-demand situation, with a focus on enhancing the profitability of thermal power and the growth of renewable energy sources [24] Group 3: Company-Specific Performance - The company "特锐德" reported a net profit of 3.59 billion RMB for Q3 2025, with a year-on-year increase of 41.53% and a gross margin of 27.76% [28] - "富特科技" achieved a net profit of 0.70 billion RMB in Q3 2025, reflecting a year-on-year growth of 186.93%, driven by effective cost management and scale effects [37] - "招商积余" reported a revenue of 139.42 billion RMB for the first three quarters of 2025, with a year-on-year increase of 14.65% and a net profit of 6.86 billion RMB [31] Group 4: Electronics Industry Insights - "深南电路" achieved record high revenues and profits in Q3 2025, with total revenue reaching 167.54 billion RMB, a year-on-year increase of 28.39% [56] - The company’s gross margin improved to 31.39%, benefiting from an enhanced product mix and increased utilization rates [57]

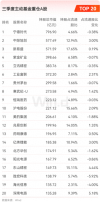

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

深南电路(002916):三季度业绩再创新高 国产PCB龙头深度受益AI大周期

Xin Lang Cai Jing· 2025-10-30 12:41

Group 1: Financial Performance - In the first three quarters of 2025, the company achieved revenue of 16.754 billion yuan, a year-over-year increase of 28.39%, and a net profit attributable to shareholders of 2.326 billion yuan, up 56.3% year-over-year [1] - For Q2 2025, the company reported revenue of 6.301 billion yuan, a year-over-year increase of 33.25% and a quarter-over-quarter increase of 11.11%, with a net profit of 966 million yuan, reflecting a year-over-year growth of 92.87% [1] - Q3 2025 saw a record high in revenue and profit, with a gross margin of 31.39%, indicating successful product structure upgrades [1] Group 2: Business Segments - In the PCB business, demand for high-speed switches and optical modules has significantly increased due to the rising computational power needs in the communication sector [2] - The data center sector is experiencing growth driven by increased capital expenditures from major cloud service providers, particularly in AI computing investments, benefiting the company's PCB business [2] - In the packaging substrate business, the company has seen a notable increase in orders for storage products due to successful mass production of new high-end DRAM products for key clients [2] Group 3: Future Outlook - The company expects net profits for 2025, 2026, and 2027 to be 3.471 billion yuan, 5.255 billion yuan, and 6.921 billion yuan respectively, reflecting an upward revision from previous estimates [3] - Based on the closing price on October 29, 2025, the projected price-to-earnings ratios for 2025, 2026, and 2027 are 43.8, 28.9, and 21.9 times, respectively, maintaining a "buy" rating [3]

深南电路(002916):公司盈利预测及估值

ZHONGTAI SECURITIES· 2025-10-30 12:35

Investment Rating - The report maintains a "Buy" rating for the company [2][9] Core Views - The company is expected to benefit significantly from the high demand in the AI sector, with projected net profits for 2025, 2026, and 2027 being 34.71 billion, 52.55 billion, and 69.21 billion respectively [9] - The company's revenue for the first three quarters of 2025 reached 16.754 billion, showing a year-on-year growth of 28.39%, while the net profit attributable to the parent company was 2.326 billion, reflecting a year-on-year increase of 56.3% [4][5] - The company is expanding its production capacity with ongoing construction projects, which are expected to support future growth [5] Financial Performance Summary - Revenue and Profit Forecast: - 2023A: Revenue of 13,526 million, Net Profit of 1,398 million - 2024A: Revenue of 17,907 million, Net Profit of 1,878 million - 2025E: Revenue of 22,206 million, Net Profit of 3,471 million - 2026E: Revenue of 27,857 million, Net Profit of 5,255 million - 2027E: Revenue of 34,731 million, Net Profit of 6,921 million [2][11] - Growth Rates: - Revenue growth rates are projected at -3% for 2023, 32% for 2024, and 24% for 2025 [2] - Net profit growth rates are projected at -15% for 2023, 34% for 2024, and 85% for 2025 [2] Market Position and Industry Trends - The company is positioned as a leader in the PCB industry, benefiting from increased demand in the communication and data center sectors driven by AI infrastructure investments [7][8] - The company has successfully upgraded its product structure, achieving a gross margin of 31.39% in Q3 2025, indicating strong operational performance [5]

深南电路(002916) - 2025年10月30日投资者关系活动记录表

2025-10-30 09:48

Financial Performance - In Q3 2025, the company achieved a revenue of 6.301 billion CNY, a year-on-year increase of 33.25% [1] - The net profit attributable to shareholders reached 966 million CNY, reflecting a significant year-on-year growth of 92.87% [1] Gross Margin Improvement - The overall gross margin showed improvement in Q3 2025, driven by increased demand for storage packaging substrates and enhanced production capacity utilization [2] - The revenue from PCB data center and wired communication businesses continued to grow, contributing to a slight increase in gross margin [2] Business Expansion - The PCB business focuses on communication equipment, with key expansions in data centers (including servers) and automotive electronics [3] - The packaging substrate business saw a revenue increase in Q3 2025, with notable growth in storage packaging substrates [4] Capacity Utilization - The overall capacity utilization remained high in Q3 2025, with significant improvements in the packaging substrate business due to increased demand [6] Raw Material Price Changes - Key raw materials such as copper and gold salts experienced price increases in Q3 2025 due to fluctuations in commodity prices [7] R&D Investment - R&D investment in Q3 2025 amounted to approximately 464 million CNY, accounting for 7.37% of the company's revenue [8] New Projects - The company is developing new factories, including the Nantong Phase IV and Thailand projects, with the Thailand factory currently in trial production [5]

深南电路(002916):三季度业绩亮眼,PCB与载板业务齐飞

CAITONG SECURITIES· 2025-10-30 09:24

Investment Rating - The investment rating for the company is "Accumulate" (maintained) [2] Core Views - The company achieved a revenue of 16.754 billion yuan in the first three quarters of 2025, representing a year-on-year increase of 28.39%. The net profit attributable to shareholders was 2.326 billion yuan, up 56.30% year-on-year [8] - The growth in revenue is driven by the demand for high-speed switches and optical modules in the communication and data center sectors, as well as the recovery in the storage market [8] - The company is expected to see significant capacity expansion with ongoing projects in Nantong and Thailand, which are anticipated to contribute to future revenue growth [8] - The forecast for revenue from 2025 to 2027 is 23.649 billion yuan, 29.081 billion yuan, and 34.338 billion yuan respectively, with net profits projected at 3.479 billion yuan, 4.808 billion yuan, and 6.175 billion yuan [8] Financial Performance Summary - Revenue for 2023 is projected at 13.526 billion yuan, with a growth rate of -3.3%. For 2024, revenue is expected to rise to 17.907 billion yuan, reflecting a growth rate of 32.4% [7] - The net profit for 2023 is estimated at 1.398 billion yuan, with a decline of 14.8%. In 2024, net profit is expected to increase to 1.878 billion yuan, showing a growth of 34.3% [7] - The earnings per share (EPS) for 2025 is projected to be 5.22 yuan, with a price-to-earnings (PE) ratio of 43.7 [7] - The return on equity (ROE) is expected to improve significantly, reaching 20.8% in 2025 and 26.6% by 2027 [7] Market Performance - The company's stock has shown a performance of -13% over the last 12 months compared to the CSI 300 index, which has seen a rise of 158% [4]

深南电路2025年前三季度净利润同比增长56.30%

Zheng Quan Ri Bao Zhi Sheng· 2025-10-30 07:45

Core Insights - The company reported strong financial performance for Q3 2025, with total revenue of 16.754 billion and a net profit of 2.326 billion, reflecting year-on-year growth of 28.39% and 56.30% respectively [1] - In Q3 alone, the company achieved revenue of 6.301 billion, a 33.25% increase year-on-year, and a net profit of 966 million, marking a significant 92.87% growth [1] - The management attributed the performance to opportunities in AI computing power upgrades, structural growth in the storage market, and increased demand for automotive electronics [1] Financial Performance - Total revenue for the first three quarters reached 16.754 billion, with a year-on-year growth of 28.39% [1] - Net profit for the same period was 2.326 billion, showing a year-on-year increase of 56.30% [1] - Q3 revenue was 6.301 billion, up 33.25% year-on-year, while net profit was 966 million, reflecting a 92.87% increase [1] Market Opportunities - The company is capitalizing on the demand for AI accelerator cards, switches, optical modules, servers, and related products, which have seen sustained growth [1] - There is a structural growth opportunity in storage packaging substrate products, leading to increased order revenue [1] - The company is enhancing its market development efforts and optimizing product structure, which contributes to improved profit margins [1] Industry Context - Analysts note that the company's growth is supported by industry trends such as AI computing power upgrades and accelerated global data center construction [2] - Stable orders from key telecommunications equipment manufacturers like Huawei and ZTE provide strong certainty for the company's business growth [2] - The company's "3-In-One" business layout, which focuses on technology and customer synergy, positions it well to benefit from the accelerated development of AI in China [2]

深南电路(002916):公司信息更新报告:2025Q3营收和利润均创新高,产能加速释放

KAIYUAN SECURITIES· 2025-10-30 07:45

Investment Rating - The investment rating for the company is "Buy" (maintained) [1] Core Insights - The company achieved record high revenue and profit in Q3 2025, with a revenue of 63.01 billion yuan, representing a year-over-year increase of 33.25% and a quarter-over-quarter increase of 11.11%. The net profit for Q3 was 9.66 billion yuan, showing a year-over-year increase of 92.87% and a quarter-over-quarter increase of 11.20% [5] - The gross margin improved to 31.39%, up 6.00 percentage points year-over-year and 3.80 percentage points quarter-over-quarter, driven by enhancements in PCB product structure and increased utilization rates in substrate production [5] - The net profit margin reached 15.35%, reflecting a year-over-year increase of 4.76 percentage points and a stable quarter-over-quarter change [5] - The company is optimistic about future profit growth, raising profit expectations for 2025, 2026, and 2027, with projected net profits of 34.80 billion yuan, 47.04 billion yuan, and 58.28 billion yuan respectively [5] Financial Performance Summary - For the first three quarters of 2025, the company reported total revenue of 167.54 billion yuan, a year-over-year increase of 28.39%, and a net profit of 23.26 billion yuan, a year-over-year increase of 56.30% [5] - The projected earnings per share (EPS) for 2025, 2026, and 2027 are 5.22 yuan, 7.06 yuan, and 8.74 yuan respectively, with corresponding price-to-earnings (P/E) ratios of 43.6, 32.3, and 26.1 [5][8] - The company is actively expanding high-end production capacity, with new projects including the Nantong Phase IV and a factory in Thailand, which is currently in trial production [7] Business Structure and Market Demand - The PCB business is undergoing continuous structural adjustments, with significant demand growth driven by AI server and related product investments. The company has seen substantial order growth for AI accelerator cards, high-speed switches, and optical modules [6] - The substrate business has benefited from a rapidly growing storage market, with full customer orders and improved profit margins due to the successful introduction and mass production of new high-end DRAM products [6]

A股新王加冕:电子行业登顶,深圳公司霸榜

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 03:52

Core Insights - The electronic industry has become the largest sector in the A-share market, with a total market value of 13.6 trillion yuan, surpassing the banking sector [1][2] - Shenzhen is a key hub for the electronic industry, housing 115 listed companies, including one with a market value exceeding one trillion yuan and five with values over 100 billion yuan [2][3] - The shift towards AI and advanced technologies is driving growth in the electronic sector, particularly in areas like semiconductors and consumer electronics [4][5] Industry Overview - As of October 28, 2025, the electronic industry's market value accounts for 12.8% of the total A-share market, while the banking sector represents 10.8% [1] - Shenzhen leads in the number of electronic companies, with significant players in various segments, including semiconductors, printed circuit boards (PCBs), and consumer electronics [1][6] - The electronic industry encompasses several sub-sectors, including semiconductors, PCBs, displays, optical components, and consumer electronics, with Shenzhen having a presence in all these areas [5][7] Company Highlights - Industrial Fulian (601138.SH) is the only company with a market value exceeding one trillion yuan, valued at approximately 1.604541 trillion yuan, and has seen a 65% increase in cloud computing revenue [3][4] - Luxshare Precision (002475.SZ) is expanding into the Nvidia supply chain, which may become a significant profit driver [4] - Other notable companies include: - Shenzhen South Circuit (002916.SZ) and Pengding Holdings (002938.SZ), both leading in the PCB sector and transitioning towards AI server markets [4][5] - Jiangbolong (301308.SZ) reported a 54.6% year-on-year revenue increase, reaching 6.539 billion yuan [5] - Yingshi Innovation (688775.SH) has seen a 67.18% increase in revenue, reaching 6.611 billion yuan [5] Regional Development - Shenzhen is undergoing a transformation from a manufacturing base to a center for electronic innovation and research, supported by policies and talent [7] - The city has implemented measures to strengthen its semiconductor and integrated circuit industry, with a focus on investment and development [6] - The semiconductor industry in Shenzhen is projected to grow to 256.4 billion yuan by 2024, reflecting a 26.8% year-on-year increase [6]

深南电路:公司综合产能利用率仍处于相对高位

Zheng Quan Shi Bao Wang· 2025-10-30 02:48

Core Viewpoint - The company, Shenzhen Sannuo Circuit (002916), reported a high overall capacity utilization rate during an institutional survey on October 29, 2023, indicating strong operational performance in its PCB and packaging substrate businesses [1]. Group 1: Company Performance - The overall capacity utilization rate for the PCB business remains at a relatively high level as of Q3 2025 [1]. - The packaging substrate business has seen a significant increase in capacity utilization due to rising demand in the storage market and for application processor chip products [1].