EASTMONEY(300059)

Search documents

晨会纪要:2025年第186期-20251103

Guohai Securities· 2025-11-03 01:39

Group 1 - The report highlights that Fengshen Co., the only centrally controlled tire listed company in China, has entered a growth phase with a 168% year-on-year increase in net profit for Q3 2025 [2][6][7] - The company achieved a revenue of 5.543 billion yuan for the first three quarters of 2025, representing a 13.58% increase year-on-year, despite a decline in net profit [6][8] - The average selling price of products increased by 7.88% year-on-year to 1198 yuan per tire, contributing to improved profitability [8][10] Group 2 - Dongfang Tower benefited from the potassium fertilizer boom, reporting a 77.57% increase in net profit for Q3 2025, with a revenue of 3.392 billion yuan [16][17] - The company’s gross profit margin increased by 10.23 percentage points to 40.53% due to rising potassium prices [17][19] - The average price of potassium chloride reached 3269 yuan per ton in Q3 2025, up 773 yuan per ton year-on-year [17][19] Group 3 - Longbai Group's net profit decreased by 34.68% year-on-year in Q3 2025, impacted by falling titanium dioxide prices, with a revenue of 6.105 billion yuan [23][24] - The average price of titanium dioxide fell by 2018 yuan per ton year-on-year, leading to a significant profit squeeze [25][27] - The company is pursuing a strategic acquisition of Venator UK's titanium dioxide assets to enhance its global presence [27][29] Group 4 - Shanmei International reported a 30.20% decline in revenue for the first three quarters of 2025, with a net profit drop of 49.74% [32][33] - The company’s coal production increased by 8.73% year-on-year, while trade coal sales fell by 28.50% [35][36] - The average selling price of self-produced coal decreased by 24.72% year-on-year, affecting overall profitability [36][37] Group 5 - Fenhong Media achieved a total revenue of 9.607 billion yuan in the first three quarters of 2025, reflecting a 3.73% year-on-year growth [38][39] - The company’s gross profit margin improved significantly, reaching 74.1% in Q3 2025 [40][41] - The company plans to distribute a cash dividend of 0.5 yuan per share, indicating a commitment to shareholder returns [41][42] Group 6 - Yunnan Rural Commercial Bank reported a 0.67% increase in revenue for the first three quarters of 2025, with a net profit growth of 3.74% [43][44] - The bank's non-performing loan ratio decreased to 1.12%, reflecting improved asset quality [44]

关键点位后如何应对|每周研选

Shang Hai Zheng Quan Bao· 2025-11-02 16:01

Core Viewpoint - The A-share market is experiencing a new round of upward momentum due to the approval of the "14th Five-Year Plan" recommendations, the temporary alleviation of external disturbances, and the disclosure of third-quarter reports, with the Shanghai Composite Index surpassing 4000 points, reaching a ten-year high [1] Group 1: Market Analysis - The current index level of 4000 points is significantly stronger than in 2015, with lower valuation levels, suggesting that there is no need to overly focus on the index itself [3] - Structural opportunities in the A-share market remain, with the importance of timing decreasing as external disturbances have subsided and third-quarter reports have been released [3] - The market is expected to maintain a focus on technology and high-end manufacturing as key areas for growth, with a more balanced market style anticipated compared to the third quarter [5] Group 2: Investment Strategies - Investment strategies for the year-end market include focusing on technology growth and low-position cyclical sectors that benefit from supply-side clearing and structural changes in demand [5][9] - The market is entering a phase where theme investments are becoming more active, with a shift towards long-term thematic clues as short-term performance becomes less correlated with quarterly earnings [7] - Investors are advised to focus on low-valuation sectors with expected profit recovery, such as consumer electronics, while being cautious of frequent style switching due to the clear monthly rotation characteristics of the A-share market [9] Group 3: Future Outlook - The market is likely to enter an upward phase from November to December, driven by policy and liquidity improvements, with a potential for style switching [17] - The focus on technology as a main investment theme remains, but investors need to be precise in timing their investments based on catalysts [19] - The upcoming months are expected to see active participation from growth themes, with opportunities in sectors like AI applications, robotics, and software [21]

【十大券商一周策略】4000点后如何应对?结构性机会仍存,盘整震荡中布局再平衡

券商中国· 2025-11-02 14:58

Group 1 - The current index level is less significant than the underlying valuation, with structural opportunities still present despite short-term investor caution, particularly in the technology sector [2] - Major industries such as new energy, chemicals, consumer electronics, resources, and machinery are expected to see profit growth, with a focus on traditional manufacturing upgrades and AI applications [2] - The overall market is entering a recovery phase, with improved net profit margins and performance in large-cap stocks, indicating a positive economic outlook [3] Group 2 - The market is expected to experience a period of consolidation, with a shift in investment styles and a focus on sectors like coal, oil, new energy, and non-bank financials [6] - The macroeconomic environment is improving, with potential for policy support and a stable long-term outlook for the A-share market [7] - The focus is shifting towards internal structural optimization and themes such as AI, overseas expansion, and cyclical industries, with an emphasis on sectors like non-ferrous metals and energy storage [8] Group 3 - The market is likely to see a rotation in investment styles, with a focus on sectors that benefit from domestic demand and infrastructure projects [9] - The current high allocation to technology stocks may lead to increased volatility, but the long-term outlook remains optimistic with a potential recovery in earnings [12] - The upcoming period may witness a transition from a growth-driven market to one that emphasizes value and cyclical stocks, particularly in resource sectors [10][11]

东方财富(300059):Q3营收同比翻倍 佣金两融业务驱动增长

Xin Lang Cai Jing· 2025-11-01 08:48

Core Viewpoint - Dongfang Caifu reported strong financial performance for Q3 2025, with significant year-on-year growth in revenue and net profit [2][3]. Financial Performance - In Q3 2025, the company achieved total operating revenue of 4.733 billion yuan, a year-on-year increase of 100.65% [2]. - The net profit attributable to shareholders reached 3.53 billion yuan, reflecting a year-on-year growth of 77.74% [2]. - For the first three quarters, the net profit attributable to shareholders was 9.097 billion yuan, up 50.57% year-on-year, nearing last year's total [3]. Business Segments - The primary driver of revenue growth was the securities business, with net commission and fee income reaching 6.640 billion yuan, an increase of 86.79% compared to 3.555 billion yuan in the same period last year [3]. - Interest net income from margin financing and securities lending was 2.405 billion yuan, showing a year-on-year growth of 59.71% [3]. - As of Q3 2025, the scale of funds lent reached 76.578 billion yuan, a growth of 30.11% since the beginning of the year [3]. Balance Sheet - As of the end of Q3 2025, total assets amounted to 380.255 billion yuan, a 24.12% increase from the beginning of the year [3]. - The company actively financed on the liability side, with short-term financing bonds and short-term loans increasing to 27.250 billion yuan and 8.159 billion yuan, respectively, marking significant growth of 71.55% and 47.51% [3]. Profit Forecast and Investment Rating - The company maintains a "buy" rating, with revenue forecasts for 2025-2027 at 15.443 billion yuan, 17.682 billion yuan, and 20.124 billion yuan, representing year-on-year growth rates of 33.08%, 14.50%, and 13.81% [4]. - Projected net profits for the same period are 12.815 billion yuan, 14.773 billion yuan, and 16.971 billion yuan, with growth rates of 33.35%, 15.28%, and 14.88% [4]. - Earnings per share (EPS) are expected to be 0.81 yuan, 0.93 yuan, and 1.07 yuan, with corresponding price-to-earnings (PE) ratios of 32.67, 28.34, and 24.67 [4].

东方财富的前世今生:2025年三季度营收25.43亿行业排32,净利润90.97亿居第7

Xin Lang Cai Jing· 2025-10-31 05:29

Core Viewpoint - Dongfang Caifu is a leading one-stop internet financial service platform in China, with a focus on securities, financial e-commerce, financial data services, and internet advertising services [1] Group 1: Business Performance - In Q3 2025, Dongfang Caifu reported revenue of 2.543 billion yuan, ranking 32nd among 50 companies in the industry, while the top company, CITIC Securities, had revenue of 55.815 billion yuan [2] - The net profit for the same period was 909.7 million yuan, ranking 7th in the industry, with CITIC Securities leading at 23.916 billion yuan [2] Group 2: Financial Ratios - As of Q3 2025, the asset-liability ratio for Dongfang Caifu was 76.63%, higher than the industry average of 68.82% [3] - The gross profit margin was 84.13%, exceeding the industry average of 42.78% [3] Group 3: Executive Compensation - The chairman's salary increased from 4.2722 million yuan in 2023 to 5.0198 million yuan in 2024, a rise of 747,600 yuan [4] - The general manager's salary rose from 4.0231 million yuan in 2023 to 4.9879 million yuan in 2024, an increase of 964,800 yuan [4] Group 4: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 8.84% to 1.0139 million, while the average number of circulating A-shares held per account increased by 9.70% to 13,200 shares [5] Group 5: Analyst Predictions - Huachuang Securities noted strong performance in Q3 2025 across all business lines, with significant growth in commission income, interest income, and operating income [6] - CITIC JianTou expects continued growth in brokerage and margin financing businesses, with revenue projections for 2025-2027 at 15.65 billion yuan, 16.72 billion yuan, and 17.26 billion yuan respectively, and net profits of 12.47 billion yuan, 14.23 billion yuan, and 15.263 billion yuan [7]

新易盛获融资资金买入近54亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:08

Market Overview - The Shanghai Composite Index fell by 0.73% to close at 3986.9 points, with a daily high of 4025.7 points [1] - The Shenzhen Component Index decreased by 1.16% to 13532.13 points, reaching a maximum of 13700.25 points [1] - The ChiNext Index dropped by 1.84% to 3263.02 points, with a peak of 3331.86 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24911.76 billion yuan, with a financing balance of 24732.7 billion yuan and a securities lending balance of 179.06 billion yuan, reflecting a decrease of 75.56 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12657.39 billion yuan, down by 39.35 billion yuan, while the Shenzhen market's balance was 12254.37 billion yuan, decreasing by 36.21 billion yuan [2] - A total of 3456 stocks had financing funds for purchase, with the top three being Xinyi Technology (53.65 billion yuan), Zhongji Xuchuang (46.23 billion yuan), and Sunshine Power (36.47 billion yuan) [2] Fund Issuance - Four new funds were issued yesterday, including two mixed funds and two stock funds, all launched on October 30, 2025 [3][4] Top Trading Activities - The top ten net buying amounts on the Dragon and Tiger List included Jiangte Electric (27681.86 million yuan), Tianji Shares (20137.13 million yuan), and Guodun Quantum (16408.1 million yuan) [5] - The highest price increase was seen in Jiangte Electric with a rise of 9.98%, followed by Tianji Shares with a 10.0% increase [5]

券商三季报排位大洗牌:国信证券跃升2位,招商证券掉队降4名

Xin Lang Zheng Quan· 2025-10-31 04:05

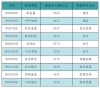

Core Insights - The third quarter performance of 50 A-share listed securities firms shows that all achieved profitability, but only 32 firms experienced both revenue and net profit growth, indicating a recovery in the industry beyond traditional brokerage and proprietary trading businesses [1][3]. Revenue Performance - CITIC Securities led the revenue rankings with 55.815 billion yuan, followed by Guotai Junan at 45.892 billion yuan, creating a significant gap with other firms [1]. - Huatai Securities, GF Securities, and China Galaxy ranked third, fourth, and fifth, with revenues of 27.129 billion yuan, 26.164 billion yuan, and 22.751 billion yuan respectively [1]. Net Profit Rankings - The top ten securities firms by net profit for the first three quarters are CITIC Securities, Guotai Junan, Huatai Securities, China Galaxy, GF Securities, Guoxin Securities, Dongfang Caifu Securities,招商证券, Shenwan Hongyuan, and CITIC Construction Investment [3]. - CITIC Securities achieved a net profit of 23.159 billion yuan, while Guotai Junan followed closely with 22.074 billion yuan [3]. Year-on-Year Changes - The top ten firms saw slight changes in rankings compared to the previous year, with Huatai Securities and CITIC Construction Investment dropping one position, and招商证券 falling four places [3]. - Notably, Guoxin Securities improved by two positions, while China Galaxy, GF Securities, Shenwan Hongyuan, and Zhongjin Company each moved up one position [3]. Performance of Smaller Firms - Smaller securities firms demonstrated stronger performance resilience, with 12 firms doubling their net profit year-on-year, including Guolian Minsheng and Huaxi Securities [5]. - Guolian Minsheng's net profit surged by 345.3%, while Huaxi Securities increased by 316.89% compared to the previous year [5]. Business Segment Performance - The significant growth in the securities industry is attributed to the recovery of market conditions, with brokerage business fees reaching 112.785 billion yuan, a 72.24% increase year-on-year [6]. - Investment banking revenue also showed signs of recovery, with a total of 28.294 billion yuan, reflecting a 37.52% year-on-year growth [6]. - Asset management revenue saw a slight increase of 2.32%, totaling 33.305 billion yuan [6].

人工智能三维共振支撑国产芯片及云计算发展,数字经济ETF(560800)盘中蓄势

Xin Lang Cai Jing· 2025-10-31 03:17

Core Viewpoint - The digital economy theme index has shown fluctuations, with specific stocks performing variably, while the government supports mergers and acquisitions in strategic emerging industries [1][2]. Group 1: Digital Economy Index Performance - As of October 31, 2025, the CSI Digital Economy Theme Index (931582) decreased by 1.44% [1]. - Leading stocks included Deepin Technology (300454) with a rise of 6.51%, while Lattice Technology (688008) led the decline with a drop of 7.24% [1][4]. - The digital economy ETF (560800) experienced a turnover of 1.41% during the trading session, with a total transaction value of 9.5176 million yuan [1]. Group 2: Market Trends and Government Support - The Beijing municipal government has issued opinions to support mergers and acquisitions aimed at promoting high-quality development of listed companies, focusing on strategic emerging industries [1]. - Key sectors for development include artificial intelligence, healthcare, integrated circuits, smart connected vehicles, cultural industries, and renewable energy [1]. Group 3: ETF and Index Composition - The digital economy ETF closely tracks the CSI Digital Economy Theme Index, which includes companies with high digitalization levels [2]. - As of September 30, 2025, the top ten weighted stocks in the index accounted for 54.31% of the total index weight, with Dongfang Fortune (300059) being the highest at 8.64% [2].

奇德新材:接受东方财富等投资者调研

Mei Ri Jing Ji Xin Wen· 2025-10-30 13:00

Group 1 - The core viewpoint of the article highlights that Qide New Materials (SZ 300995) has engaged with investors, indicating a proactive approach to investor relations and transparency [1] - For the first half of 2025, Qide New Materials reported that 87.76% of its revenue came from the plastics industry, while other businesses contributed 12.24% [1] - As of the report, Qide New Materials has a market capitalization of 3.6 billion yuan [1] Group 2 - The company’s board secretary, Chen Yunfeng, participated in the investor meeting, suggesting a direct line of communication between the management and investors [1]

5家券商前三季净利超百亿,中信国泰海通突破200亿

Bei Ke Cai Jing· 2025-10-30 12:31

Core Insights - Five brokerage firms reported net profits exceeding 10 billion yuan for the first three quarters of 2025, indicating strong performance in the industry [1] Group 1: Company Performance - CITIC Securities achieved a net profit of 23.159 billion yuan [1] - Guotai Junan Securities reported a net profit of 22.074 billion yuan [1] - Huatai Securities, China Galaxy Securities, and GF Securities also surpassed 10 billion yuan in net profits, with figures of 12.733 billion yuan, 10.968 billion yuan, and 10.934 billion yuan respectively [1] - Guosen Securities and Dongfang Caifu are close to the 10 billion yuan mark, with net profits of 9.137 billion yuan and 9.097 billion yuan respectively [1]