宏观环境

Search documents

富邦科技:公司二级市场表现受宏观环境及行业周期等多重因素影响

Zheng Quan Ri Bao· 2025-11-26 11:44

Group 1 - The core viewpoint of the article is that Fubon Technology acknowledges the impact of macroeconomic conditions and industry cycles on its secondary market performance, while committing to actively communicate the company's value to the market [2] Group 2 - The company emphasizes the importance of maintaining good operational practices as a foundation for its market performance [2]

X @Yuyue

Yuyue· 2025-11-24 21:57

Market Strategy - Emphasize the importance of focusing on market dynamics (筹码博弈) when appropriate and narrative (叙事) when appropriate [1] - Avoid being misled by grand narratives (宏大叙事) or narratives of depletion (枯竭叙事) when market dynamics are crucial [1] - Avoid being shortsighted by focusing solely on market dynamics when long-term vision is required [1] - The decision to adopt a long-term perspective (格局) or a short-term, risk-averse approach (纸手) should be based on the current macroeconomic environment [1]

铁矿石期货日报-20251119

Guo Jin Qi Huo· 2025-11-19 13:31

Report Overview - Research Variety: Iron ore - Report Cycle: Daily - Date of Report: November 17, 2025 - Research Analyst: Feng Jiayu [1] 1. Investment Rating - No investment rating is provided in the report. 2. Core View - On November 17, 2025, the iron ore futures market had prices rising in an upward - trending oscillation. The price increase was driven by rising macro - policy expectations and short - term demand recovery. However, the fundamental situation of iron ore has not fundamentally improved, and the market is in a structural game. Short - term prices are supported by policy expectations and a phased increase in demand, while medium - to long - term prices face pressure from a continuous supply surplus, shrinking steel mill profits, and high port inventories. The price is expected to fluctuate widely in the range of 750 - 820 yuan/ton. Key factors to watch include policy signals from important meetings, the sustainability of the increase in steel mill hot - metal production, and the process of port inventory reduction [11]. 3. Summary by Directory 3.1 Futures Market 3.1.1 Contract Market Conditions - On November 17, 2025, the iron ore i2601 contract showed an upward - trending oscillation. The lowest point was 767.5, the highest was 791, and it closed at 788.5, with a 1.81% increase. The trading volume was 351,300 lots, an increase of 84,900 lots compared to the previous trading day, and the open interest was 481,400 lots, an increase of 1,019 lots from the previous day [2]. 3.1.2 Variety Prices - The 12 iron ore futures contracts showed a backwardation market pattern with near - term contracts stronger than far - term ones. All contracts generally rose, with the increase ranging from 3.5 to 14 points. The total open interest of the variety was 907,493 lots, an increase of 6,657 lots compared to the previous trading day. The i2605 contract had the largest increase in open interest, with an increase of 4,639 lots [5]. 3.2 Spot Market 3.2.1 Basis Data - In the past 5 trading days, the basis of the main iron ore i2601 contract fluctuated slightly, with a maximum of 45.9 yuan/ton, a minimum of 39 yuan/ton, and 39 yuan/ton on the reporting day [8]. 3.2.2 Registered Warehouse Receipts - In the past 5 trading days, the registered warehouse receipts fluctuated slightly, with a maximum of 900 lots, a minimum of 800 lots, and 900 lots on the reporting day [8]. 3.3 Influencing Factors 3.3.1 Demand Side - The steel mill hot - metal production increased slightly to 236,880 tons per day on a month - on - month basis. However, steel mill profits continued to deteriorate, the number of maintenance plans increased, the blast furnace operating rate decreased on a month - on - month basis, and the hot - metal production may decline in a step - by - step manner in the future [9]. 3.3.2 Macroeconomic Environment - Hawkish remarks from Fed officials suppressed the risk appetite for commodities. In China, the year - on - year decline in real estate investment widened, the growth rate of infrastructure investment slowed down, and terminal demand weakened seasonally [10].

黑色建材日报-20251119

Wu Kuang Qi Huo· 2025-11-19 01:40

1. Report Industry Investment Rating No relevant content provided. 2. Core View of the Report - The steel demand has officially entered the off - season, with high inventory pressure on hot - rolled coils. In the short term, prices are likely to continue weak and volatile due to weak off - season demand and high plate inventory. However, with policy implementation and macro - environment improvement, steel demand may see a marginal inflection point later [2]. - For the black sector, compared to short - selling, finding positions to go long for a rebound may be more cost - effective. The height of the rebound depends on the introduction and strength of stimulus policies. The macro factor is more important than the weak fundamentals that have been priced in [9]. - In the long run, the easing expectation remains unchanged, and the steel consumption end still has the basis for gradual recovery [2]. 3. Summary by Related Catalogs Steel Market Quotes - The closing price of the rebar main contract was 3090 yuan/ton, down 7 yuan/ton (-0.22%) from the previous trading day. The registered warehouse receipts were 86,672 tons, with no change. The main contract's open interest was 1.655469 million lots, down 74,279 lots. The Tianjin aggregated price of rebar was 3240 yuan/ton, with no change, and the Shanghai aggregated price was 3230 yuan/ton, up 10 yuan/ton [1]. - The closing price of the hot - rolled coil main contract was 3286 yuan/ton, down 16 yuan/ton (-0.48%) from the previous trading day. The registered warehouse receipts were 120,567 tons, with no change. The main contract's open interest was 1.217174 million lots, down 46,346 lots. The Lecong aggregated price of hot - rolled coils was 3300 yuan/ton, down 20 yuan/ton, and the Shanghai aggregated price was 3280 yuan/ton, down 30 yuan/ton [1]. Strategy View - Rebar shows a situation of both supply and demand decline and continuous inventory reduction, with a neutral overall performance. Hot - rolled coils have weak terminal demand, unable to effectively absorb production, and inventory continues to increase counter - seasonally [2]. - Affected by the Fed's hawkish remarks, market sentiment declined, and the consumption market cooled down in the short term. But in the long run, the easing expectation remains unchanged, and steel consumption is expected to gradually recover [2]. Iron Ore Market Quotes - The main contract (I2601) of iron ore closed at 792.00 yuan/ton, with a change of +0.44% (+3.50), and the open interest changed by - 10,108 lots to 471,300 lots. The weighted open interest was 908,000 lots. The price of PB fines at Qingdao Port was 795 yuan/wet ton, with a basis of 53.55 yuan/ton and a basis ratio of 6.33% [4]. Strategy View - On the supply side, the overseas iron ore shipments in the latest period rebounded significantly, with increases in both Australian and Brazilian shipments. On the demand side, the average daily pig iron output was 236,880 tons, up 2,660 tons. The port inventory continued to increase, and the steel mill inventory increased slightly [5]. - High inventory still suppresses the price, but the short - term increase in pig iron output supports the iron ore demand. In the macro - vacuum period, the market is more likely to follow the real - world logic, and the iron ore price is expected to fluctuate within a range [5]. Manganese Silicon and Ferrosilicon Market Quotes - On November 18, affected by the weakening external market sentiment, the main contract of manganese silicon (SM601) fell 1.93% to close at 5680 yuan/ton. The Tianjin spot market price was 5680 yuan/ton, with a basis of 190 yuan/ton. The main contract of ferrosilicon (SF601) fell 1.65% to close at 5474 yuan/ton. The Tianjin spot market price was 5500 yuan/ton, with a basis of 26 yuan/ton [7]. Strategy View - In the past week, the black sector continued to decline and fluctuate. As the time approaches December, the macro - expectations are expected to have a positive impact on sentiment and prices. It is recommended to pay attention to the inflection point of market sentiment and the corresponding price inflection point [8]. - The fundamentals of manganese silicon are still not ideal and lack a major contradiction. If the commodity sentiment recovers and the black sector strengthens, attention should be paid to possible disturbances in the manganese ore segment. The supply - demand fundamentals of ferrosilicon have no obvious contradictions, with low operational cost - effectiveness [9]. Industrial Silicon and Polysilicon Industrial Silicon - Market Quotes: The main contract (SI2601) of industrial silicon closed at 8980 yuan/ton, down 1.10% (-100). The weighted open - interest changed by - 451 lots to 400,728 lots. The spot price of East China non - oxygen 553 was 9350 yuan/ton, with no change, and the basis was 370 yuan/ton [11]. - Strategy View: The supply - side contraction trend is emerging. The demand side shows a decline in polysilicon production and a possible reduction in industrial silicon procurement demand due to the planned production cuts in the organic silicon industry. Industrial silicon may face a situation of "both supply and demand being weak". The cost side provides support, and in the short term, it is expected to fluctuate weakly [13]. Polysilicon - Market Quotes: The main contract (PS2601) of polysilicon closed at 52,210 yuan/ton, down 0.85% (-445). The weighted open - interest changed by +2239 lots to 236,480 lots. The average spot prices of N - type granular silicon, N - type dense material, and N - type re - feeding material remained unchanged, and the basis was 90 yuan/ton [14]. - Strategy View: Polysilicon is still caught between reality and expectations. The production in November decreased, and the supply - demand pattern may improve marginally, but the short - term de - stocking amplitude is expected to be limited. The market is still highly volatile, and attention should be paid to the progress of platform companies and price feedback in the industrial chain [15]. Glass and Soda Ash Glass - Market Quotes: The main contract of glass closed at 1017 yuan/ton on Tuesday afternoon, down 1.17% (-12). The weekly inventory of float glass sample enterprises was 63.247 million boxes, up 0.18%. The top 20 long - position holders reduced their long positions by 5546 lots, and the top 20 short - position holders reduced their short positions by 32,223 lots [17]. - Strategy View: The supply contraction is limited, and the demand is weak. The enterprise inventory is high, and the spot price is under pressure. Although there is cost support and positive policy expectations, the current supply - demand imbalance and the decline in the futures market intensify the downward pressure on prices, and the market is expected to remain weak in the short term [18]. Soda Ash - Market Quotes: The main contract of soda ash closed at 1214 yuan/ton on Tuesday afternoon, down 1.38% (-17). The weekly inventory of soda ash sample enterprises was 1.7073 million tons, down 0.69 million tons. The top 20 long - position holders increased their long positions by 858 lots, and the top 20 short - position holders increased their short positions by 16,055 lots [19]. - Strategy View: The soda ash industry supply is still at a relatively high level, and the downstream demand is mediocre. Some enterprises have a stronger willingness to support prices, and the price is expected to continue to fluctuate at a low level in the short term. Attention should be paid to the changes in plant operation and downstream procurement rhythm [20].

黑色建材日报-20251118

Wu Kuang Qi Huo· 2025-11-18 01:39

Report Industry Investment Rating No relevant information provided. Core Viewpoints of the Report - The negative feedback of the recent decline in the steel market has ended, and short - term price increases are mainly due to short - sellers taking profits. Steel demand has entered the off - season, with high inventory pressure on hot - rolled coils. In the short term, prices are likely to continue weak and volatile, but there may be a marginal inflection point in demand with policy implementation and macro - environment improvement [2]. - For iron ore, although the supply has recovered and high inventory suppresses prices, the short - term increase in hot metal production supports demand. In the macro - vacuum period, prices will operate within a shock range [5]. - For the black sector, as the time approaches December, the positive impact of macro - expectations on sentiment and prices is expected to increase. It is more cost - effective to look for positions to rebound rather than short. The future price increase depends on the introduction and strength of stimulus policies [10][11]. - Industrial silicon is expected to show a pattern of "weak supply and demand", with short - term prices likely to be weak and volatile. Polysilicon is still fluctuating between reality and expectations, and prices are in a wide - range shock [15][17]. - For glass, due to the imbalance between supply and demand, high inventory, and weak demand, the short - term market will continue to be weak. For soda ash, with high supply and weak demand, prices will continue to oscillate at a low level [20][22]. Summary by Directory Steel Market Information - The closing price of the rebar main contract was 3097 yuan/ton, up 44 yuan/ton (1.441%) from the previous trading day. The registered warehouse receipts decreased by 3655 tons, and the main contract positions decreased by 107385 lots. In the spot market, prices in Tianjin and Shanghai increased by 30 yuan/ton [1]. - The closing price of the hot - rolled coil main contract was 3302 yuan/ton, up 46 yuan/ton (1.412%) from the previous trading day. The registered warehouse receipts increased by 6484 tons, and the main contract positions decreased by 23505 lots. In the spot market, prices in Lecong and Shanghai increased by 50 yuan/ton [1]. Strategy Viewpoints - Rebar shows a pattern of both supply and demand decline and continuous inventory reduction, with a neutral overall performance. Hot - rolled coils have weak terminal demand, and inventory is accumulating against the season. In the short term, prices are likely to be weak and volatile, but there may be an inflection point in demand later [2]. Iron Ore Market Information - The main iron ore contract (I2601) closed at 788.50 yuan/ton, up 2.07% (+16.00). The positions increased by 1019 lots to 48.14 million lots. The weighted positions were 90.75 million lots. The spot price of PB powder at Qingdao Port was 792 yuan/wet ton, with a basis of 53.75 yuan/ton and a basis rate of 6.38% [4]. Strategy Viewpoints - In terms of supply, the overseas iron ore shipment volume has recovered significantly. In terms of demand, the daily average hot metal output has increased, but the steel mill profitability rate is declining. Port inventory is accumulating. In the short term, prices will operate within a shock range [5]. Manganese Silicon and Ferrosilicon Market Information - The manganese silicon main contract (SM601) closed up 0.77% at 5792 yuan/ton. The spot price in Tianjin was 5700 yuan/ton, with a premium of 98 yuan/ton over the futures. The ferrosilicon main contract (SF601) closed up 1.38% at 5566 yuan/ton. The spot price in Tianjin was 5600 yuan/ton, with a premium of 34 yuan/ton over the futures [8]. Strategy Viewpoints - As the time approaches December, the positive impact of macro - expectations on the black sector is expected to increase. For manganese silicon, pay attention to the manganese ore end. For ferrosilicon, the supply - demand fundamentals have no obvious contradictions, and the operability is low [10][11]. Industrial Silicon and Polysilicon Market Information - The main industrial silicon contract (SI2601) closed at 9080 yuan/ton, up 0.67% (+60). The weighted contract positions decreased by 2209 lots to 401179 lots. The spot price of 553 in East China was 9350 yuan/ton, unchanged from the previous day [13]. - The main polysilicon contract (PS2601) closed at 52655 yuan/ton, down 2.57% (-1390). The weighted contract positions decreased by 6818 lots to 234241 lots [16]. Strategy Viewpoints - Industrial silicon is expected to show a pattern of "weak supply and demand", with short - term prices likely to be weak and volatile. Polysilicon is still fluctuating between reality and expectations, and prices are in a wide - range shock [15][17]. Glass and Soda Ash Market Information - The glass main contract closed at 1029 yuan/ton, down 0.29% (-3). The inventory of float glass sample enterprises increased by 11.10 million cases (0.18%) [19]. - The soda ash main contract closed at 1231 yuan/ton, up 0.41% (+5). The weekly inventory of soda ash sample enterprises decreased by 0.69 million tons (0.18%) [21]. Strategy Viewpoints - For glass, due to the imbalance between supply and demand, high inventory, and weak demand, the short - term market will continue to be weak. For soda ash, with high supply and weak demand, prices will continue to oscillate at a low level [20][22].

国务院发展研究中心原副主任刘世锦:发展新质生产力要创造好的宏观环境

Shang Hai Zheng Quan Bao· 2025-11-13 10:53

上证报中国证券网讯(记者 白丽斐)国务院发展研究中心原副主任刘世锦13日在第十六届财新峰会上 表示,发展新质生产力要创造好的宏观环境。他认为,经济增长可以从高度和宽度两个维度来看,高度 是指通过创新和体制改革提升经济增长往上的空间;宽度是需求,不同的社会群体收入所得构成了全社 会的总需求。如果需求不足,特别是消费需求不足的问题不能解决的话,新质生产力发展可能会受到很 大限制。 来源:上海证券报·中国证券网 ...

黑色建材日报-20251112

Wu Kuang Qi Huo· 2025-11-12 02:03

Report Industry Investment Rating No relevant content provided. Core Viewpoints of the Report - The steel demand has officially entered the off - season, and there is still a risk of hot - rolled coil inventory. Future attention should be paid to the production reduction rhythm. With the implementation of the Fed's easing expectations and positive signals from the China - US meeting, the market sentiment and capital environment are expected to improve, and the steel consumption end may gradually recover. In the short term, due to the impact of the cost side, the price center of finished products has slightly declined, and the demand is still weak, so the price will continue the weak shock trend. However, with the implementation of policies and changes in the macro - environment, future demand is expected to turn around [2]. - From the fundamental perspective of iron ore, affected by environmental protection restrictions and the decline in steel mill profits, the trend of declining hot - metal production continues, the demand side of iron ore continues to weaken, and the inventory pressure remains. In the short term, the ore price will run weakly, and attention should be paid to the support level of 750 - 760 yuan/ton [5]. - The black - sector pricing has recently returned to the fundamentals. The market is "attempting" a "negative feedback" transaction in the black sector, but this is considered a phased shock and emotional release with limited downside space. It is more cost - effective to look for callback positions to do long rather than short. The height after the callback depends on whether stimulus policies are introduced and their intensity [9][10]. - For industrial silicon, the supply and demand sides are weak, and the cost support is temporarily stable. It is expected that the price will consolidate and wait for new drivers. For polysilicon, the supply - demand pattern may improve marginally, but the short - term de - stocking range is expected to be limited. Attention should be paid to whether the upstream spot and futures prices can remain firm [14][16]. - For glass, the market lacks strong support from the supply - demand fundamentals, and the cost support for prices continues to weaken. It is expected that the price will continue to run weakly in the short term. For soda ash, the market has both long and short factors, and the price may continue the shock trend [19][21]. Summary by Related Catalogs Steel Products Market Quotes - The closing price of the rebar main contract was 3025 yuan/ton, down 19 yuan/ton (- 0.62%) from the previous trading day. The registered warehouse receipts decreased by 6380 tons to 100,612 tons, and the main contract positions decreased by 32 lots to 1.923701 million lots. The Tianjin aggregated price of rebar was 3210 yuan/ton, up 10 yuan/ton, and the Shanghai aggregated price was 3190 yuan/ton, unchanged [1]. - The closing price of the hot - rolled coil main contract was 3242 yuan/ton, down 10 yuan/ton (- 0.30%) from the previous trading day. The registered warehouse receipts remained unchanged at 97,028 tons, and the main contract positions decreased by 19,179 lots to 1.326892 million lots. The Lecong aggregated price of hot - rolled coil was 3270 yuan/ton, up 10 yuan/ton, and the Shanghai aggregated price was 3260 yuan/ton, down 10 yuan/ton [1]. Strategy Views - Rebar supply and demand both declined, and inventory continued to decline, showing a neutral performance overall. Hot - rolled coil demand declined significantly, with inventory accumulating against the season. Steel demand has entered the off - season, and the hot - rolled coil inventory risk remains. Future attention should be paid to the production reduction rhythm [2]. Iron Ore Market Quotes - The main contract of iron ore (I2601) closed at 763.00 yuan/ton, with a change of - 0.26% (- 2.00), and the positions decreased by 11,250 lots to 530,400 lots. The weighted positions were 963,000 lots. The spot price of PB fines at Qingdao Port was 775 yuan/wet ton, with a basis of 60.52 yuan/ton and a basis rate of 7.35% [4]. Strategy Views - On the supply side, the overseas iron ore shipment volume continued to decline. On the demand side, the daily average hot - metal production decreased, affected by environmental protection restrictions in Hebei and the decline in steel mill profits. The port inventory accumulation increased, and the steel mill inventory increased. Fundamentally, the demand for iron ore continues to weaken, and the inventory pressure remains. In the short term, the ore price will run weakly, and attention should be paid to the support level of 750 - 760 yuan/ton [5]. Manganese Silicon and Ferrosilicon Market Quotes - The main contract of manganese silicon (SM601) closed down 0.96% at 5764 yuan/ton. The spot price of 6517 manganese silicon in Tianjin was 5700 yuan/ton, with a conversion to the futures price of 5890 yuan/ton, unchanged from the previous day, and a premium of 126 yuan/ton over the futures price. The main contract of ferrosilicon (SF601) closed down 1.79% at 5588 yuan/ton. The spot price of 72 ferrosilicon in Tianjin was 5550 yuan/ton, down 50 yuan/ton from the previous day, and a discount of 12 yuan/ton to the futures price [8]. Strategy Views - In November, the black - sector pricing has returned to the fundamentals. The market is "attempting" a "negative feedback" transaction in the black sector, but this is considered a phased shock and emotional release with limited downside space. For manganese silicon, its fundamentals are still not ideal, and attention should be paid to the manganese ore end. For ferrosilicon, its supply - demand fundamentals have no obvious contradictions, and its operability is relatively low [9][10]. Industrial Silicon and Polysilicon Market Quotes - The main contract of industrial silicon (SI2601) closed at 9180 yuan/ton, down 1.18% (- 110). The weighted positions decreased by 13,304 lots to 426,734 lots. The spot price of 553 industrial silicon in East China was 9350 yuan/ton, unchanged, with a basis of 170 yuan/ton. The spot price of 421 was 9750 yuan/ton, unchanged, with a basis of - 230 yuan/ton [12]. - The main contract of polysilicon (PS2601) closed at 51,930 yuan/ton, down 3.33% (- 1790). The weighted positions increased by 11,791 lots to 234,183 lots. The average price of N - type granular silicon was 50.5 yuan/kg, the average price of N - type dense material was 51 yuan/kg, and the average price of N - type re - feeding material was 52.2 yuan/kg, all unchanged, with a basis of 270 yuan/ton [15]. Strategy Views - For industrial silicon, the supply and demand sides are weak, and the cost support is temporarily stable. It is expected that the price will consolidate and wait for new drivers. For polysilicon, the supply - demand pattern may improve marginally, but the short - term de - stocking range is expected to be limited. Attention should be paid to whether the upstream spot and futures prices can remain firm [14][16]. Glass and Soda Ash Market Quotes - The glass main contract closed at 1053 yuan/ton, down 1.50% (- 16). The North China large - plate price was 1110 yuan, unchanged, and the Central China price was 1140 yuan, unchanged. The weekly inventory of float glass sample enterprises was 63.136 million cases, down 2.654 million cases (- 4.03%). The top 20 long - position holders increased 55,903 long positions, and the top 20 short - position holders increased 66,853 short positions [18]. - The soda ash main contract closed at 1215 yuan/ton, down 0.90% (- 11). The heavy - soda price in Shahe was 1176 yuan, unchanged. The weekly inventory of soda ash sample enterprises was 1.7142 million tons, up 12,200 tons. The heavy - soda inventory was 899,600 tons, up 13,200 tons, and the light - soda inventory was 814,600 tons, down 1000 tons. The top 20 long - position holders reduced 31,273 long positions, and the top 20 short - position holders reduced 11,482 short positions [20]. Strategy Views - For glass, the market lacks strong support from the supply - demand fundamentals, and the cost support for prices continues to weaken. It is expected that the price will continue to run weakly in the short term. For soda ash, the market has both long and short factors, and the price may continue the shock trend [19][21].

黑色建材日报-20251107

Wu Kuang Qi Huo· 2025-11-07 02:27

Report Industry Investment Rating No information provided. Core Viewpoints of the Report - The overall atmosphere in the commodity market was good yesterday, but the prices of finished steel products showed a weak and volatile trend. The demand for steel has officially entered the off - season, and there are still inventory risks for hot - rolled coils. Future attention should be paid to the pace of production cuts. With the implementation of the Fed's easing expectations and positive signals from the China - US meeting, the market sentiment and capital environment are expected to improve, and the consumption side of steel may gradually recover. In the short term, demand is still weak, but there may be an inflection point in the future [2]. - For iron ore, due to environmental protection restrictions and the decline in steel mill profits, the demand side continues to weaken, and the inventory pressure remains high. After the macro - events are realized, the fundamentals of iron ore are weak, and the price is expected to run weakly in the short term [5]. - Regarding manganese silicon and silicon iron, the fundamentals of manganese silicon are not ideal, and potential drivers may come from the manganese ore end. Silicon iron's supply - demand fundamentals have no obvious contradictions, and both are likely to follow the black - sector market [10]. - For industrial silicon, the supply - side pressure persists, and the demand support is weakening. It is expected to fluctuate in the short term. For polysilicon, the supply - demand pattern may improve marginally, but the short - term de - stocking range is limited [13][16]. - In the glass market, the short - term market may continue to fluctuate narrowly, and future attention should be paid to downstream orders and capacity changes. For soda ash, the price is expected to continue the weak and volatile pattern in the short term [19][21]. Summary by Related Catalogs Steel Market Conditions - The closing price of the rebar main contract was 3037 yuan/ton, up 13 yuan/ton (0.429%) from the previous trading day. The registered warehouse receipts were 118,534 tons, with no change. The main - contract open interest decreased by 11,428 lots to 2.020353 million lots. The spot prices in Tianjin and Shanghai increased by 10 yuan/ton to 3190 yuan/ton [1]. - The closing price of the hot - rolled coil main contract was 3256 yuan/ton, up 3 yuan/ton (0.092%) from the previous trading day. The registered warehouse receipts decreased by 889 tons to 99,412 tons. The main - contract open interest decreased by 7743 lots to 1.365348 million lots. The spot prices in Lecong and Shanghai remained unchanged at 3270 yuan/ton [1]. Strategy Views - The supply and demand of rebar both decreased, and the inventory continued to decline, showing a neutral performance. The demand for hot - rolled coils declined significantly, and the inventory showed reverse - seasonal accumulation. The steel demand has entered the off - season, and the risk of hot - rolled coil inventory still exists. Future attention should be paid to the production - cut rhythm. With the improvement of the macro - environment, the demand may recover in the future [2]. Iron Ore Market Conditions - The main contract (I2601) of iron ore closed at 777.50 yuan/ton, with a change of +0.19% (+1.50). The open interest decreased by 7164 lots to 537,500 lots. The weighted open interest was 937,000 lots. The spot price of PB powder at Qingdao Port was 785 yuan/wet ton, with a basis of 57.04 yuan/ton and a basis rate of 6.83% [4]. Strategy Views - The overseas iron - ore shipment volume decreased, but it was still at a high level in the same period. The demand for iron ore weakened, and the port inventory and steel - mill inventory increased. Affected by environmental protection restrictions and the decline in steel - mill profits, the iron - ore demand continued to weaken, and the price was expected to run weakly in the short term [5]. Manganese Silicon and Silicon Iron Market Conditions - On November 6, the main contract of manganese silicon (SM601) closed up 0.38% at 5798 yuan/ton. The spot price in Tianjin was 5680 yuan/ton, with a basis of 72 yuan/ton. The main contract of silicon iron (SF601) closed up 0.47% at 5586 yuan/ton. The spot price in Tianjin was 5600 yuan/ton, with a basis of 14 yuan/ton [7][8]. Strategy Views - The fundamentals of manganese silicon were not ideal, and potential drivers might come from the manganese ore end. Silicon iron's supply - demand fundamentals had no obvious contradictions, and both were likely to follow the black - sector market [10]. Industrial Silicon and Polysilicon Market Conditions - The closing price of the main contract of industrial silicon (SI2601) was 9065 yuan/ton, up 0.50% (+45). The open interest increased by 1917 lots to 400,305 lots. The spot price of 553 in East China remained unchanged at 9300 yuan/ton, with a basis of 235 yuan/ton; the spot price of 421 remained unchanged at 9700 yuan/ton, with a basis of - 165 yuan/ton [12]. - The closing price of the main contract of polysilicon (PS2601) was 53,395 yuan/ton, up 0.07% (+40). The open interest decreased by 4850 lots to 225,552 lots. The average spot prices of N - type granular silicon, N - type dense material, and N - type re - feeding material remained unchanged, with a basis of - 1195 yuan/ton [15]. Strategy Views - For industrial silicon, the supply - side pressure persisted, and the demand support was weakening. It was expected to fluctuate in the short term. For polysilicon, the supply - demand pattern might improve marginally, but the short - term de - stocking range was limited [13][16]. Glass and Soda Ash Market Conditions - The glass main contract closed at 1101 yuan/ton on Thursday afternoon, up 0.36% (+4). The price of large - size glass in North China remained unchanged at 1130 yuan, and the price in Central China increased by 20 yuan to 1140 yuan. The weekly inventory of float - glass sample enterprises decreased by 2.654 million boxes (-4.03%) to 63.136 million boxes. The top 20 long - position holders reduced 9576 lots, and the top 20 short - position holders increased 10,400 lots [18]. - The soda - ash main contract closed at 1207 yuan/ton on Thursday afternoon, up 1.00% (+12). The price of heavy - ash in Shahe increased by 12 yuan to 1157 yuan. The weekly inventory of soda - ash sample enterprises increased by 12,200 tons to 1.7142 million tons. The top 20 long - position holders reduced 5605 lots, and the top 20 short - position holders reduced 22,126 lots [20]. Strategy Views - In the glass market, the short - term market may continue to fluctuate narrowly, and future attention should be paid to downstream orders and capacity changes. For soda ash, the price is expected to continue the weak and volatile pattern in the short term [19][21].

黑色建材日报-20251024

Wu Kuang Qi Huo· 2025-10-24 01:11

Group 1: Report Industry Investment Rating - No relevant information provided Group 2: Core Viewpoints of the Report - In the long - term, under the background of the gradually loosening macro - environment, the logic of steel price trends remains unchanged; in the short - term, the weak real demand for steel is difficult to improve significantly [3] - For iron ore, the demand weakens after the decline of hot metal production, and the continuous accumulation of port inventory puts pressure on prices. The market is in a state of weak reality and macro - expectation tug - of - war, with prices oscillating [6] - For the black sector, it is not pessimistic about the future. It is considered that the cost - performance of finding callback positions to do rebounds may be higher than short - selling [11] - For industrial silicon, it is expected to oscillate in the short - term, following the commodity environment, and the trend of coking coal futures has a certain driving effect on its price [14] - For polysilicon, the current price fluctuation is regarded as a phased correction within the oscillation range, and attention should be paid to the progress of platform companies [16] - For glass, in the short - term, without external factors, the market is expected to remain weak [19] - For soda ash, the market is expected to continue to oscillate weakly in the short - term [21] Group 3: Summary by Related Catalogs Steel Market Quotes - The closing price of the rebar main contract was 3047 yuan/ton, up 2 yuan/ton (0.065%) from the previous trading day. The registered warehouse receipts were 129,796 tons, with no change. The main contract position was 1.995833 million lots, down 10,093 lots. The Tianjin aggregated price of rebar was 3110 yuan/ton, and the Shanghai aggregated price was 3200 yuan/ton, both with no change [2] - The closing price of the hot - rolled coil main contract was 3219 yuan/ton, up 4 yuan/ton (0.124%) from the previous trading day. The registered warehouse receipts were 113,657 tons, down 2375 tons. The main contract position was 1.509998 million lots, up 6767 lots. The Lecong aggregated price of hot - rolled coil was 3230 yuan/ton, down 10 yuan/ton; the Shanghai aggregated price was 3270 yuan/ton, with no change [2] Strategy Views - Rebar supply and demand both increased, and inventory decreased, showing a neutral performance; hot - rolled coil production decreased slightly, demand rebounded, inventory decreased marginally but remained at a relatively high level, and the inventory contradiction was slightly relieved. The steel mill profitability rate declined significantly recently, and the hot metal production decreased significantly, reducing the supply - side pressure marginally [3] Iron Ore Market Quotes - The main contract of iron ore (I2601) closed at 777.00 yuan/ton, with a change of +0.39% (+3.00), and the position changed by +2978 lots to 561,100 lots. The weighted position of iron ore was 941,900 lots. The spot price of PB powder at Qingdao Port was 783 yuan/wet ton, with a basis of 55.33 yuan/ton and a basis rate of 6.65% [5] Strategy Views - Supply: The overseas iron ore shipment volume rebounded in the latest period and was at a high level in the same period. The shipments from Australia and Brazil both increased, the shipment of FMG was strong, and the shipment from non - mainstream countries rebounded slightly. The near - end arrival volume decreased month - on - month [6] - Demand: The average daily hot metal production in the latest period was 239.9 tons, falling below 240 tons, mainly affected by the weak steel price, the decline of steel mill profitability to the lowest level of the year, and the environmental protection issues in Hebei affecting blast furnace production [6] - Inventory: Port inventory continued to increase, and steel mill inventory increased slightly [6] Manganese Silicon and Ferrosilicon Market Quotes - On October 23, the main contract of manganese silicon (SM601) closed up 0.14% at 5818 yuan/ton. The spot price of 6517 manganese silicon in Tianjin was 5720 yuan/ton, converted to the futures price of 5910 yuan/ton, with no change from the previous day, and the premium to the futures price was 92 yuan/ton [9] - The main contract of ferrosilicon (SF601) closed up 0.65% at 5574 yuan/ton. The spot price of 72 ferrosilicon in Tianjin was 5650 yuan/ton, with no change from the previous day, and the premium to the futures price was 76 yuan/ton [9] Strategy Views - The uncertainty of Sino - US trade friction has put pressure on commodities. Most of the current situation has been priced in, and subsequent macro - level factors may be more important [10] - For the black sector, it is not pessimistic. It is considered that the cost - performance of finding callback positions to do rebounds may be higher. Manganese silicon and ferrosilicon are likely to follow the black sector's trend [11] Industrial Silicon and Polysilicon Market Quotes - Industrial silicon: The main contract of industrial silicon futures (SI2511) closed at 8705 yuan/ton, with a change of +2.59% (+220). The weighted contract position changed by +103 lots to 438,582 lots. The spot price of non - oxygen - blown 553 in East China was 9300 yuan/ton, with no change, and the basis of the main contract was 595 yuan/ton; the price of 421 was 9650 yuan/ton, with no change, and the basis of the main contract was 145 yuan/ton [13] - Polysilicon: The main contract of polysilicon futures (PS2511) closed at 50760 yuan/ton, with a change of +0.89% (+450). The weighted contract position changed by - 3824 lots to 243,675 lots. The average price of N - type granular silicon was 50.5 yuan/kg, with no change; the average price of N - type dense material was 51.5 yuan/kg, with no change; the average price of N - type re - feeding material was 52.98 yuan/kg, down 0.02 yuan/kg, and the basis of the main contract was 2220 yuan/ton [15] Strategy Views - Industrial silicon: The supply shows a pattern of "increasing in the north and decreasing in the south", and the supply pressure still exists. The demand is mainly restricted by supply. The cost provides support for the price, and it is expected to oscillate in the short - term [14] - Polysilicon: The over - expected increase in silicon material production in October and the decrease in downstream silicon wafer production lead to continuous inventory accumulation pressure. The supply pressure will be relieved if the leading enterprises start maintenance at the end of the month. The current price fluctuation is a phased correction [16] Glass and Soda Ash Market Quotes - Glass: On Thursday at 15:00, the main contract of glass closed at 1108 yuan/ton, up 1.28% (+14). The price of large - size glass in North China was 1140 yuan, with no change; the price in Central China was 1150 yuan, with no change. The weekly inventory of float glass sample enterprises was 66.613 million boxes, up 2.3374 million boxes (+3.64%). The top 20 long - position holders increased their positions by 12,367 lots, and the top 20 short - position holders decreased their positions by 6711 lots [18] - Soda ash: On Thursday at 15:00, the main contract of soda ash closed at 1235 yuan/ton, up 0.98% (+12). The price of heavy soda ash in Shahe was 1185 yuan, up 12 yuan. The weekly inventory of soda ash sample enterprises was 1.7021 million tons, up 0.16 million tons (+3.64%), among which the inventory of heavy soda ash was 934,500 tons, down 62,000 tons, and the inventory of light soda ash was 767,600 tons, up 78,000 tons. The top 20 long - position holders increased their positions by 3131 lots, and the top 20 short - position holders increased their positions by 4848 lots [20] Strategy Views - Glass: Entering the end of the traditional peak season, the downstream procurement rhythm slows down further, and the supply rebounds. The supply - demand contradiction is difficult to resolve in the short - term, and the market is expected to remain weak [19] - Soda ash: The industry shows a pattern of strong supply and weak demand. The inventory is at a high level in the same period, and the market is expected to continue to oscillate weakly in the short - term [21]

如何抓住美股“十倍股”,必读

3 6 Ke· 2025-10-22 03:18

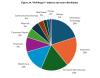

Core Insights - The article discusses the characteristics of "tenbagger" stocks, which have increased in value by ten times or more over a period from 2000 to 2024, highlighting the importance of identifying these stocks before they soar [1][2]. Group 1: Characteristics of Tenbagger Stocks - Market capitalization is a decisive factor for tenbagger potential, with most tenbagger stocks starting as small-cap stocks, benefiting from a "low base effect" [3][6]. - Many tenbagger stocks exhibit undervaluation at their inception, where the book value significantly mismatches the stock price, leading to price appreciation as earnings grow and market sentiment improves [3][6]. - A combination of value and profitability is crucial, with companies showing high book-to-market ratios and stable profitability metrics (ROE, net profit margin) outperforming the market [6][8]. Group 2: Investment Signals and Patterns - High free cash flow yield is a hidden signal for potential tenbagger stocks, indicating the ability to reinvest or return capital to shareholders without relying on financing [8]. - Tenbagger stocks often exhibit rapid price increases followed by sharp declines, indicating a "complex momentum effect" that requires careful timing for entry and exit [8][10]. - The macroeconomic environment, particularly the Federal Reserve's interest rate policies, significantly influences the emergence of tenbagger stocks, with low rates favoring growth stock valuations [10][12]. Group 3: Investment Strategy - Investors should focus on small-cap companies with value advantages and profitability, while also considering high free cash flow and reasonable capital expenditure patterns [14]. - Patience is essential, as short-term volatility can lead to premature exits from promising investments [14]. - The research challenges the notion that high EPS growth is a necessary condition for tenbagger status, suggesting a multi-dimensional approach to investment analysis [13][14].