通信ETF广发

Search documents

通信板块ETF走高;恒生科技ETF近半年吸金超千亿丨ETF晚报

2 1 Shi Ji Jing Ji Bao Dao· 2026-02-26 09:09

ETF Industry News - The three major indices showed mixed performance today, with the Shanghai Composite Index down 0.01%, the Shenzhen Component Index up 0.19%, and the ChiNext Index down 0.29. Communication sector ETFs saw gains, with 5G ETF Bosera (159811.SZ) up 3.41%, Communication ETF Jiashi (159695.SZ) up 2.78%, and Communication ETF Guangfa (159507.SZ) up 2.73% [1] - In contrast, several ETFs in the power equipment sector declined, including Lithium Battery ETF (561160.SH) down 2.34%, Battery ETF Jiashi (562880.SH) down 2.30%, and Battery ETF (561910.SH) down 2.23% [1] Fund Flows - The Hang Seng Technology ETF attracted over 100 billion yuan in net subscriptions over the past six months, with a net inflow of 34.25 billion yuan in the current year, indicating a "buy the dip" trend [2] Market Overview - The A-share market and major overseas indices showed varied performance today, with the Shanghai Composite Index closing at 4146.63 points, the Shenzhen Component Index at 14503.79 points, and the ChiNext Index at 3344.98 points [3] - The top-performing sectors included communication, electronics, and defense, with daily gains of 2.84%, 1.98%, and 1.52% respectively [6] ETF Performance - Stock-style ETFs performed the best today, with an average gain of 0.48%, while cross-border ETFs had the worst performance with an average decline of 1.56% [9] - The top three stock ETFs by performance were Guozheng 2000 ETF Bosera (159505.SZ) at 5.04%, 5G ETF Bosera (159811.SZ) at 3.41%, and Sci-Tech Machinery ETF Jiashi (588850.SH) at 3.31% [12] Trading Volume - The top three stock ETFs by trading volume were A500 ETF Fund (512050.SH) with 10.705 billion yuan, A500 ETF Huatai-PB (563360.SH) with 7.747 billion yuan, and A500 ETF Southern (159352.SZ) with 7.660 billion yuan [16]

ETF市场日报 | 中韩半导体ETF暴涨9.64%,短融ETF成交破660亿

Sou Hu Cai Jing· 2026-02-26 08:15

Market Overview - A-shares showed mixed performance with the Shanghai Composite Index down 0.01%, Shenzhen Component Index up 0.19%, and ChiNext Index down 0.29% as of market close [1] - Total trading volume in Shanghai, Shenzhen, and Beijing reached 25,568 billion, an increase of 756 billion from the previous day [1] ETF Performance - The China-Korea Semiconductor ETF surged by 9.64%, leading the market, driven by the recovery in the semiconductor supply chain [2] - The National 2000 ETF rose by 5.04%, indicating a rebound in small-cap growth stocks [2] - The Electric Grid sector performed well, with the Electric Grid ETF up 3.23% and the Electric Grid Equipment ETFs rising by 3.22% and 2.91% respectively [2] Communication Sector - The communication sector also saw gains, with ETFs in this category rising between 2.73% and 2.78% [3] Declining Sectors - The pharmaceutical sector faced a broad retreat, with the Hang Seng Biotechnology ETF showing the largest decline at -3.89% [4] - Other related ETFs in the healthcare and biotechnology sectors also experienced significant drops, indicating a market shift from defensive sectors to technology growth [4] Trading Activity - The Short-term Bond ETF had a trading volume exceeding 66 billion, leading in activity among ETFs [5] - The top traded ETFs included the Short-term Bond ETF at 661.12 billion and the Silver Day Benefit ETF at 167.16 billion [5] Turnover Rates - Cross-border products showed high trading activity, with the Brazil ETF and China-Korea Semiconductor ETF having turnover rates of 171.99% and 125.76% respectively [6][7] - The National Debt ETF also maintained a strong turnover rate of 88.09%, indicating active trading in interest rate bonds and cross-border assets [7] New ETF Launch - A new Technology Growth ETF by Industrial Bank is set to launch on February 27, with a focus on hard technology and a multi-factor strategy targeting the top 50 securities in various tech sectors [8]

英伟达Q4业绩超预期,通信ETF、通信设备ETF涨超2%

Ge Long Hui· 2026-02-26 06:10

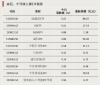

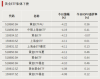

人工智能算力方向延续强势,通信ETF华夏、通信ETF广发、通信ETF银华、通信ETF嘉实、通信ETF、 通信设备ETF涨超2%。 | 证券代码 | 证券简称 | 跟踪指数 | 当日涨幅% | 年内涨幅% | 管理人 | | --- | --- | --- | --- | --- | --- | | 515050.SH | 通信ETF华夏 | 5G通信 | 2.87% | 8.57% | 华夏星美 | | 159507.SZ | 通信ETF广发 | 国证通信 | 2.87% | 10.03% | 广发基金 | | 159994.SZ | 通信ETF银华 | 5G通信 | 2.65% | 8.39% | 银华基金 | | 159695.SZ | 通信ETF嘉实 | 国证通信 | 2.49% | 10.12% | 嘉实基金 | | 515880.SH | 通信ETF | 通信设备 | 2.49% | 8.25% | 国泰基金 | | 159583.SZ | 通信设备ETF | 通信设备主题 40 40 mix, ... J 14 11 10, 30 0 0 0 0 0 0 0 10 10 10 10 10 10 | ...

多只ETF、LOF罕见跌停

Xin Lang Cai Jing· 2026-01-30 12:51

Group 1 - The precious metals, industrial metals, and minor metals sectors experienced a significant decline, with multiple gold and colored ETFs hitting the limit down [1][2][9] - Several LOF funds that had previously hit the limit up faced a limit down after resuming trading, indicating market volatility [10][18] - On January 29, gold and colored ETFs attracted substantial net inflows, while semiconductor-related ETFs also saw reverse positioning [11][15] Group 2 - The communication ETF sector showed a general increase, with several ETFs related to communication and artificial intelligence rising significantly [12][13] - Low-valuation sectors such as agriculture, forestry, and paper-making led the market gains, contrasting with the overall decline in precious metals [12] - The trading volume for gold ETFs surged, with the gold ETF reaching a transaction volume of 257.78 billion, significantly higher than the previous week's average of 71.07 billion [4][14] Group 3 - On January 29, various ETFs related to colored metals and gold saw net inflows exceeding 10 billion, indicating strong investor interest [15][17] - The semiconductor sector, despite its recent declines, attracted significant reverse investments, with notable inflows into semiconductor equipment ETFs [16][17] - The core logic supporting gold prices remains unchanged, driven by high geopolitical risks and the weakening of the dollar's credibility due to high U.S. government deficits [8][19]

ETF午评 | 贵金属深度回调,黄金股票ETF、黄金股ETF跌停

Ge Long Hui· 2026-01-30 07:37

上证指数午盘跌1.19%,创业板指涨0.8%。沪深京三市半日成交额19514亿元,较上日缩量836亿 元。全市场超3800只个股下跌。 贵金属、基本金属板块深度回调,个股现跌停潮;钢铁、地产、白 酒、化工行业跌幅靠前;商业航天、光伏、AI应用题材走弱;CPO概念股盘中拉升,农业股逆势走强。 ETF方面,华泰柏瑞基金中韩半导体ETF涨3%。AI硬件走强,CPO概念股盘中拉升,通信ETF广 发、通信ETF嘉实分别涨2.9%和2.57%。农业板块走强,粮食ETF广发、鹏华基金粮食ETF分别涨2.32% 和2.19%。 (责任编辑:刘静 HZ010) 金属板块深度回调,黄金股票ETF、黄金股ETF、黄金股票ETF跌停。稀有金属同步下跌,稀有金 属ETF跌8%。 【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com ...

ETF收评 | AI硬件走强,通信ETF、通信ETF广发涨3%

Ge Long Hui· 2026-01-30 07:14

Market Performance - The Shanghai Composite Index fell by 0.96%, while the ChiNext Index rose by 1.38% [1] - There was a significant decline in gold and base metal stocks, with several hitting the daily limit down [1] - Sectors such as liquor, real estate, brokerage, and oil & gas experienced notable declines [1] Sector Highlights - Commercial aerospace, fintech, photovoltaic, and AI application sectors underwent adjustments [1] - CPO and Yushu robotics concept stocks were active, while agricultural stocks strengthened [1] ETF Movements - The A500 ETF saw a notable increase of 5.6% [1] - AI hardware showed strength, with CPO concept stocks rising during the session [1] - The Guotai Fund's communication ETF and Guangfa communication ETF both increased by 3% [1] - The chip design sector was active, with the Guolianan Fund's Sci-Tech chip design ETF rising by 2.3% [1] Commodity and Metal Sector - The metal sector experienced a deep correction, with gold stock ETFs and related stocks hitting the daily limit down [1] - The non-ferrous metal sector also saw a decline, with the industrial non-ferrous ETF from Wanji hitting the daily limit down [1]

星座部署进入常态化发射新时代,卫星通信+光模块双轮驱动的通信ETF广发(159507)盘中最高涨超3%

Xin Lang Cai Jing· 2025-12-22 02:31

场内ETF方面,截至2025年12月22日 09:46,国证通信指数强势上涨2.79%,通信ETF广发(159507)上涨 2.84%,盘中最高涨超3%。拉长时间看,截至2025年12月19日,通信ETF广发近2周累计上涨5.86%。成 分股万集科技上涨16.56%,长芯博创上涨12.85%,北斗星通10cm涨停。前十大权重股合计占比 67.58%,其中权重股亨通光电10cm涨停,中天科技上涨5.72%,第一大权重股中际旭创上涨4.93%,新 易盛、天孚通信等跟涨。 规模方面,截至2025年12月19日,通信ETF广发最新规模达1.30亿元,创近3月新高。份额方面,通信 ETF广发本月以来份额增长300.00万份。 通信ETF广发(159507):紧密跟踪国证通信指数,选取沪深北交易所通信产业相关上市公司,用以反映 中国证券市场上通信行业证券价格变动的趋势,标的指数一键覆盖中际旭创、新易盛、天孚通信三大光 模块龙头,权重占比超40%!场外联接(A:019236;C:019237)。 12月20日20时30分,我国在文昌航天发射场使用长征五号运载火箭,成功将通信技术试验卫星二十三号 发射升空,卫星顺利进入预定轨 ...

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

资金逆势加码这一方向,什么信号?

Zhong Guo Zheng Quan Bao· 2025-10-22 12:53

Group 1: Gold ETF Performance - On October 22, gold ETFs collectively declined due to falling international gold prices, with the top ten decliners all being gold ETFs [4][5] - Despite the significant drop in gold ETFs this week, there is a trend of "buying on dips," with multiple gold ETFs receiving increased capital inflows [2][6] - The specific declines in gold ETFs include: - Gold ETF AU (518860.SH): -4.22% - Bank of China Shanghai Gold ETF (518890.SH): -4.19% - Gold ETF (159934.SZ): -4.13% [5] Group 2: Bond ETF Activity - Several bond ETFs are actively traded, with the Short-term Bond ETF (511360) achieving a transaction volume of 38.747 billion yuan, the highest in the market [10][11] - The turnover rates for the Sci-Tech Bond ETFs from Huatai and Guotai both exceeded 100% [10] Group 3: Market Outlook - Companies are optimistic about the market direction over the next 6 to 12 months, driven by the expansion of profit effects since last year's "9.24" event and the acceleration of medium to long-term capital inflows [12] - Key investment opportunities include the AI industry chain, resilient external demand, and financial sectors amid active capital markets [12][9]

四点半观市 | 机构:中国股市将进入更为持久的上涨阶段 成长风格有望继续跑赢价值风格

Shang Hai Zheng Quan Bao· 2025-10-22 10:37

Group 1 - The core viewpoint of the news indicates that the A-share market is expected to enter a more sustainable upward trend, with major indices projected to rise by approximately 30% by the end of 2027, driven by corporate earnings growth and valuation recovery [1] - Goldman Sachs' research team suggests that the current market leverage levels are generally controllable, with no signs of overheating, and despite recent market pullbacks, the medium-term outlook remains positive [1] - UBS Securities highlights a shift in market style since October, with a consensus likely to form around the technology growth sector, supported by easing risk sentiment and the verification of third-quarter earnings [1] Group 2 - The micro-cap stock index has shown impressive performance, with a year-to-date increase of nearly 64% as of October 21, 2023, reaching a historical high, which may be attributed to its "reverse stock selection" characteristic [2]