经济增长

Search documents

货币政策专题:年内还有降准降息吗?

Tianfeng Securities· 2025-10-28 09:16

1. Report's Industry Investment Rating No industry investment rating was provided in the report. 2. Core Views of the Report - The necessity of a reserve requirement ratio cut is increasing due to liquidity pressure on banks' liability side in Q4, but the possibility of an interest rate cut requires further observation of economic data and tariff game impacts [3][4] - If a reserve requirement ratio cut occurs, it may drive down short - term and certificate of deposit rates; if an interest rate cut occurs, the magnitude is crucial, and the bond market may experience a small decline in interest rates, but the downward space is limited [48][49] 3. Summary by Relevant Catalogs 3.1 History of Q4 Reserve Requirement Ratio and Interest Rate Cuts - In the past 5 years, except for 2021, policy rates were generally cut twice a year but not in Q4. In 2020, cuts were in H1; in 2024, in H2; in 2022, once each in H1 and H2, mostly by 10BP, with 20BP cuts in March 2020 and September 2024 [1][10] - In 2021, there was no interest rate cut, but the 1 - year LPR was cut by 5BP in Q4. In 2024, the policy rate was cut by 20BP in September and the LPR by 25BP in October [10] - From 2020 - 2022, reserve requirement ratio cuts were about twice a year, once each in H1 and H2, and there were cuts in Q4 of 2021 - 2022. In 2020, affected by the pandemic, comprehensive and targeted cuts were used in H1 [11] 3.2 Central Bank's Stance on Monetary Policy - After the reserve requirement ratio and interest rate cuts in early May this year, the policy focus shifted to the implementation of existing policies, with room for flexible adjustment based on the situation [2] - The "opportunistic" in "opportunistic reserve requirement ratio and interest rate cuts" has three meanings: adverse changes in the economic fundamentals, weakened effects of expansionary fiscal policies, and a sharp decline in the capital market [2][17] - Currently, the necessity for monetary policy to support expansionary fiscal policies may be decreasing, and the focus of monetary policy may be on supporting economic growth, which depends on macro - economic conditions [2][18][19] 3.3 Possibility of Reserve Requirement Ratio and Interest Rate Cuts This Year 3.3.1 Necessity of a Reserve Requirement Ratio Cut - Banks' liability side faces liquidity pressure in Q4, increasing the necessity of a cut. The high maturity scale of medium - and long - term liquidity, the need to supplement liquidity regularly under the "structural liquidity shortage" framework, and the special situation this year (large - scale high - interest time deposit maturities and a narrowing M2 - M1 gap) all contribute [20][21][24] 3.3.2 Possibility and Boundaries of an Interest Rate Cut - Since 2024, the central bank launched "policy combos" under different domestic and international macro - environments. Currently, there are similarities and differences, leading to a divergence in market expectations for loose monetary policy [28] - Although Q4 economic data is expected to slow down compared to Q3, it doesn't directly mean a window for policy intensification. It is necessary to observe economic performance from November to December and the impact of the tariff game [39][40] - To support the real economy, a cut in structural monetary policy tools may come first. And a cut may not be the only way to promote a reasonable rise in prices and reduce the real economy's financing costs. Also, a cut may put pressure on banks' net interest margins [45][46] 3.4 Impact on the Bond Market - The probability of reserve requirement ratio and interest rate cuts is increasing marginally, but it is not a high - probability event. Reserve requirement ratio cuts and cuts in structural monetary policy tools may come first [48] - If a reserve requirement ratio cut occurs, it may drive down short - term and certificate of deposit rates. If an interest rate cut occurs, the magnitude is crucial, and the bond market may experience a small decline in interest rates, but the downward space is limited by the current low - interest rate level and policy imagination space brought by the "14th Five - Year Plan" [49][50]

77115亿元!山东前三季度GDP增长5.6%

Qi Lu Wan Bao· 2025-10-28 07:36

Economic Overview - Shandong's GDP for the first three quarters reached 77,115 billion yuan, growing by 5.6% year-on-year, surpassing the national average, indicating strong economic resilience [1] - The primary industry added value was 4,825 billion yuan, growing by 3.9%; the secondary industry added value was 30,150 billion yuan, growing by 5.3%; and the tertiary industry added value was 42,140 billion yuan, growing by 6.1%, becoming the main driver of economic growth [1] Agriculture Sector - The total output value of agriculture, forestry, animal husbandry, and fishery grew by 4.3%, maintaining the same growth rate as the first half of the year [2] - Vegetable production increased by 3.1%, and fruit production grew by 2.6% [2] - Livestock production showed positive trends, with major livestock and poultry products increasing by 4.0%, and pig slaughtering up by 4.4% [2] Industrial Sector - The added value of large-scale industries in Shandong grew by 7.8%, indicating a sustained positive trend in industrial economy [3] - Equipment manufacturing saw a remarkable increase of 12.0%, significantly higher than the overall industrial growth [3] - The automotive industry grew by 17.0%, while the electronics sector increased by 16.6%, showcasing the rapid development of high-end manufacturing [3] Service Sector - The revenue of large-scale service industries grew by 5.4%, with 87.5% of industries experiencing revenue growth [4] - Consumer upgrade sectors performed well, with entertainment growing by 19.4% and business services by 16.9% [4] - Retail sales of consumer goods totaled 30,386.1 billion yuan, growing by 5.6%, with online retail sales increasing by 17.1% [4] Investment Trends - Despite a 3.7% decline in overall fixed asset investment, industrial investment grew by 7.7%, highlighting a shift towards high-quality development [6] - High-end manufacturing investment surged, with general equipment manufacturing up by 29.5% [6] Foreign Trade - Shandong's total import and export value reached 2.62 trillion yuan, growing by 5.5%, with exports at 1.60 trillion yuan and imports at 1.02 trillion yuan [7] - Private enterprises played a crucial role, with their import and export growth at 6.8%, accounting for 75.7% of total trade [7] Social Welfare - The employment situation remained stable, with 1.059 million new urban jobs created, reflecting resilience amid economic pressures [8] - Per capita disposable income reached 33,826 yuan, with urban and rural incomes growing by 4.4% and 5.1% respectively [8]

周度经济观察:尘埃暂落定,市场上涨或未完-20251028

Guotou Securities· 2025-10-28 07:06

Economic Policy Insights - The 20th Central Committee's Fourth Plenary Session emphasizes both short-term and long-term economic growth, focusing on technology innovation, manufacturing, and consumption[2] - The "15th Five-Year Plan" is expected to provide detailed industry planning, which will be crucial for future economic strategies[4] - The importance of maintaining a reasonable proportion of manufacturing is highlighted, as a decline in this sector can lead to slower economic growth and increased foreign dependency[5] Market Trends and Predictions - Recent easing of US-China trade tensions is expected to enhance market risk appetite, contributing to a bullish market outlook[2] - The US inflation rate has decreased, with the September CPI at 3%, alleviating concerns about stagflation and paving the way for potential interest rate cuts by the Federal Reserve[16][17] - The A-share market has seen a rise, with the Shanghai Composite Index reaching 4000 points, indicating a potential upward trend in equity markets[9] Bond Market Analysis - The People's Bank of China has resumed government bond trading, signaling a move to guide interest rates lower, which is favorable for the bond market in the short term[12][13] - However, the bond yield may not return to previous lows due to earlier market adjustments and ongoing risk factors[14] - Mid-term adjustments in the bond market are anticipated, influenced by changes in market risk appetite and inflation trends[14] Consumption and Domestic Demand - The focus on expanding domestic demand and boosting consumption is evident, with policies expected to target healthcare, education, and elderly care sectors[6] - The government aims to stabilize employment and market expectations to support economic recovery, especially in light of declining real estate sales and consumer spending[6][7]

中美经贸磋商成果提振国际市场

Huan Qiu Shi Bao· 2025-10-28 02:49

Group 1 - The easing of China-US trade tensions has led to a surge in market optimism, with global stock markets, oil prices, and copper prices rising in response to the positive developments from trade talks in Kuala Lumpur [1][2] - Asian stock markets experienced significant gains, with the KOSPI index surpassing 4000 points and the Nikkei index reaching a historic high of 50,000 points, reflecting investor confidence in improved trade relations [2] - The progress in China-US trade negotiations has alleviated concerns about economic weakness, contributing to a rise in US stock futures and commodity prices, particularly for agricultural products [3][4] Group 2 - Investors are looking for sustained signals of trade conflict resolution and effective economic stimulus measures from China, which could translate into tangible growth [4][5] - China's industrial profits showed a year-on-year increase of 3.2% for the first nine months of the year, with a notable 21.6% growth in September, exceeding Bloomberg's expectations [4] - The stability and cooperation between China and the US are crucial for global market confidence, as their trade relationship accounts for nearly one-fifth of global trade [5]

冲刺在即,宁波能否再进位?

3 6 Ke· 2025-10-28 02:07

Economic Overview - Ningbo's GDP for the first three quarters of 2025 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's GDP growth rate of 5.0% is lower than the national average of 5.2% and the provincial average of 5.7% [2] - The secondary industry's added value growth of 4.3% is also below the national and provincial levels by 0.6 and 0.9 percentage points, respectively [2] - The city's fixed asset investment saw a significant decline of 18.1%, contrasting with a national decrease of 0.5% and a provincial decrease of 3.8% [2] Foreign Trade Performance - Ningbo's total import and export volume exceeded 1 trillion yuan, reaching 1,092.26 billion yuan, with a year-on-year growth of 3.7%, which is below the national growth of 4.0% and provincial growth of 6.2% [3] - The city's foreign trade dependency is notably high at 78.3%, significantly above the national average of 32.5% and the provincial average of 58.4%, indicating greater vulnerability to external shocks [3] Future Outlook - Ningbo aims to achieve a GDP of over 2 trillion yuan by 2025, with a current GDP of 1,814.77 billion yuan in 2024, indicating a close competition with Nanjing [1] - The city faces challenges in maintaining economic momentum and is urged to enhance efforts in stabilizing and improving economic conditions [3]

创逾一年最快增速!出口驱动韩国经济超预期增长 三季度GDP同比增1.7%

Zhi Tong Cai Jing· 2025-10-28 01:29

周二公布的数据显示,韩国经济实现了逾一年来的最快增速,其第三季度GDP的增长幅度超过了分析师 的预期。据韩国央行的初步估计,三季度GDP同比增长1.7%,而经济学家们预计的增长率为1.5%。该 国经济在第二季度增长了0.6%。韩国银行的数据表明,经济增长主要得益于出口以及制造业。其中, 出口同比增长了6%,制造业同比增长了3.3%。 建筑业是经济发展的最大拖累因素,在报告所涵盖的季度中,其规模较上年同期萎缩了8.1%。 商品和服务出口的增长得益于半导体和汽车出货量的增加,这是自2024年第三季度以来增长速度最快的 一次。 李在明采访中表示:"美国当然会尽力维护自身利益,但绝不能达到会导致韩国遭受灾难性后果的程 度。" 7 月,韩国与特朗普达成了一项贸易协议,该协议规定韩国对美国出口商品一律征收15%的关税——这 是特朗普此前宣布的25%税率的下调版本。作为回报,首尔方面承诺向美国投资3500亿美元。 李在明将于本周晚些时候在韩国举行的亚太经济合作组织峰会的间隙与特朗普会面。 韩国央行在上周四的声明中表示,得益于消费的持续复苏以及出口的强劲增长,经济状况持续向好。韩 国央行预测,2025年全年的经济增长率为0. ...

日韩股指创下纪录,油价铜价同步上扬,中美经贸磋商成果提振国际市场

Huan Qiu Shi Bao· 2025-10-27 22:47

Group 1 - The easing of China-US trade tensions has led to a significant increase in market optimism, resulting in a rebound across global markets, including stock prices, oil, and copper [1][2][3] - Asian stock markets saw substantial gains, with the KOSPI index surpassing 4000 points and the Nikkei index reaching a historical high of 50,000 points, reflecting investor confidence in improved trade relations [2] - The positive sentiment from the China-US trade discussions has also influenced commodity prices, with agricultural products like soybeans and corn expected to benefit from a potential trade agreement [3][4] Group 2 - The progress in China-US trade negotiations has alleviated concerns about economic weakness, leading to a rise in US stock futures and European stock index futures [3][5] - China's industrial profits showed a year-on-year increase of 3.2% for the first nine months of the year, with a notable 21.6% growth in September, exceeding market expectations [4] - The stability and cooperation between China and the US are crucial for global market confidence, as their trade accounts for nearly one-fifth of the global total, highlighting the interconnectedness of supply chains [5]

u200b塞浦路斯2024年经济增长3.9%,GDP总额294.2亿欧元

Shang Wu Bu Wang Zhan· 2025-10-27 16:28

Core Viewpoint - Cyprus is projected to achieve a real GDP of €29.42 billion in 2024, reflecting a year-on-year growth of 3.9% driven by strong performances in information and communication, hospitality and catering, construction, and wholesale and retail trade including motor vehicle repairs [1] Economic Growth - The International Monetary Fund (IMF) has revised its growth forecasts for Cyprus, predicting a growth rate of 2.9% in 2025 and 2.8% in 2026 [1] - The strong economic growth in Cyprus is attributed to key sectors such as information and communication, hospitality, construction, and retail trade [1] Inflation and Unemployment - The inflation rate in Cyprus is expected to significantly decrease to 0.7% in 2025 and 1.3% in 2026, which are the lowest levels in the Eurozone [1] - The unemployment rate is projected to be 4.5% in 2025 and 4.7% in 2026, indicating a relatively low level of unemployment [1] Global Economic Context - The IMF forecasts a global economic growth rate of 3.2% in 2025 and 3.1% in 2026, with developed economies expected to grow at a rate of 1.6% [1] - Ongoing trade tensions and uncertainties are anticipated to continue impacting the global economic outlook [1]

如何解读三季度经济数据︱重阳问答

Jing Ji Guan Cha Bao· 2025-10-25 07:12

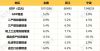

Economic Growth - The GDP growth for the first three quarters of 2023 is 5.2% year-on-year, with a 4.8% growth in the third quarter, indicating resilience in economic growth [1] - Industrial production showed a strong performance, with the industrial added value increasing by 6.5% year-on-year in September, up 1.3% from the previous month [1] Demand Side - Fixed asset investment has decreased by 0.5% year-on-year, primarily due to a decline in real estate and infrastructure investments, while manufacturing investment grew by 4% [2] - Retail sales of consumer goods increased by 3% year-on-year in September, but this marks a 0.4 percentage point decline from the previous month, continuing a four-month downward trend [2] - Service consumption remains a bright spot, with total service consumption growth rising to 5.2%, contributing 2.7 percentage points to GDP growth in the third quarter [2] Structural Issues - There are evident signs of weakness in housing prices, with all 70 major cities reporting declines in second-hand housing prices in September, and real estate investment down by 13.9% year-on-year [3] - The GDP deflator index is at -1.07%, remaining negative for over ten consecutive quarters, indicating ongoing structural issues that require further policy support [3] - To ensure a strong start for economic growth in the following year, it is necessary to enhance growth-stabilizing policies [3]

山东经济总量将跨上十万亿大台阶

Da Zhong Ri Bao· 2025-10-25 01:06

Core Insights - Shandong's economic total is set to surpass 10 trillion yuan, reflecting significant growth and development in the province's economic capabilities [2] Economic Growth - Shandong's GDP increased from 7.44 trillion yuan in 2020 to 9.86 trillion yuan in 2024, raising its share of the national economy from 7.19% to 7.31% [2] - Per capita GDP rose from 73,400 yuan in 2020 to 97,600 yuan in 2024, with the urban-rural income ratio decreasing from 2.33 to 2.14 [2] - Life expectancy increased from 79.1 years to 80.5 years over four years [2] Clean Energy Development - Shandong has accelerated the construction of large-scale clean energy bases, with non-fossil energy generation capacity reaching 134 million kilowatts, accounting for 53.4% of total capacity, a 22.6 percentage point increase since 2020 [2] - Non-fossil energy generation is expected to exceed 210 billion kWh this year, equating to a reduction of 160 million tons of CO2 emissions and saving approximately 60 million tons of standard coal [2] Environmental and Resource Management - Energy consumption per unit of GDP decreased by 18.5% over four years, with energy consumption growth at 3.9% supporting a 6.1% economic growth [3] - Water usage per unit of GDP dropped by 21.3% compared to 2020, achieving early completion of planned targets [3] - The quality of the Yellow River's water has maintained a Class II standard for nine consecutive years [3] Agricultural and Rural Development - Shandong's total grain production has remained stable at over 110 billion jin for four consecutive years, with agricultural output reaching 1.28 trillion yuan [3] - The province leads the nation in agricultural product exports for 26 years, with 2,070 rural revitalization areas cultivated [3] Economic Reforms and Business Environment - Shandong has implemented significant reforms in state-owned enterprises, finance, and taxation, enhancing the business environment [4] - The province has achieved a 90% online service rate for government affairs, promoting efficiency in administrative processes [4] - Shandong is home to 52 companies in the "China Top 500 Enterprises" list and 71 in the "China Top 500 Manufacturing Enterprises" list, with a 33% increase in listed companies since 2020 [4] Employment and Social Services - A total of 5.994 million new urban jobs were created, with 1.568 million positions filled through public welfare programs [5] - Shandong has been designated as a pilot area for rural education revitalization, leading the nation in the number of quality balanced counties for compulsory education [6] - The province has achieved a 90% rate for direct settlement of medical expenses across regions, enhancing healthcare accessibility [6]