Three Squirrels(300783)

Search documents

三只松鼠(300783):流量费率提升,压制利润表现

GOLDEN SUN SECURITIES· 2025-10-28 07:05

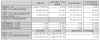

Investment Rating - The investment rating for the company is "Buy" [3][5]. Core Views - The company reported a revenue of 22.8 billion yuan in Q3 2025, reflecting an 8.9% year-on-year increase, while the net profit attributable to shareholders decreased by 56.8% to 0.2 billion yuan due to rising online traffic costs [1][2]. - The gross margin improved by 1.3 percentage points to 25.7% in Q3 2025, primarily driven by an increase in self-produced products and adjustments in channel structure [2]. - The company is actively exploring new business models, including offline distribution and lifestyle stores, to mitigate the pressure from rising online traffic costs [2][3]. Financial Summary - For the fiscal year 2025, the company is projected to achieve revenues of 116.2 billion yuan, 136.5 billion yuan, and 156.5 billion yuan for 2025, 2026, and 2027 respectively, with year-on-year growth rates of 9.4%, 17.5%, and 14.6% [3][4]. - The net profit attributable to shareholders is expected to be 2.2 billion yuan, 3.3 billion yuan, and 4.1 billion yuan for 2025, 2026, and 2027 respectively, with a significant decrease of 47.1% in 2025 followed by growth of 53.4% and 23.9% in the subsequent years [3][4]. - The company’s earnings per share (EPS) for 2025 is estimated at 0.54 yuan, with a projected price-to-earnings (P/E) ratio of 43.5 [4][5].

三只松鼠(300783):收入增长稳健 盈利能力短期承压

Xin Lang Cai Jing· 2025-10-28 02:43

Core Viewpoint - The company reported its Q3 2025 results, showing an increase in revenue but a significant decline in net profit, indicating challenges in profitability despite revenue growth [1][2]. Financial Performance - Q3 2025 revenue reached 2.281 billion yuan, a year-on-year increase of 8.91% [1] - Net profit attributable to shareholders was 22 million yuan, down 56.79% year-on-year [1] - Non-recurring net profit was 6 million yuan, a decrease of 83.45% year-on-year [1] - Gross margin improved to 25.71%, up 1.25 percentage points year-on-year [2] - The net profit margin was 0.98%, down 1.48 percentage points year-on-year [2] - The non-recurring net profit margin was 0.28%, down 1.54 percentage points year-on-year [2] Expense Analysis - Total expense ratio for Q3 2025 was 25.24%, an increase of 3.29 percentage points year-on-year [2] - Sales expense ratio was 21.33%, up 2.24 percentage points year-on-year [2] - Management expense ratio was 3.17%, an increase of 0.66 percentage points year-on-year [2] - R&D expense ratio was 0.60%, up 0.32 percentage points year-on-year [2] - Financial expense ratio was 0.14%, an increase of 0.07 percentage points year-on-year [2] Strategic Initiatives - The company is actively promoting its "D+N" omnichannel model, enhancing supply chain efficiency [2] - Online operations are being refined, while offline distribution is accelerating to adapt to a full range of products and channels [2] - The production capacity of the snack and nut supply chain is increasing, which is expected to lower costs and strengthen key products [2] Future Projections - Revenue forecasts for 2025, 2026, and 2027 are 11.262 billion, 12.872 billion, and 14.563 billion yuan, with year-on-year growth rates of 6.03%, 14.30%, and 13.14% respectively [3] - Expected net profits for 2025, 2026, and 2027 are 205 million, 437 million, and 531 million yuan, with year-on-year growth rates of -49.80%, 113.35%, and 21.63% respectively [3] - Corresponding P/E ratios for 2025, 2026, and 2027 are projected to be 45.8, 21.5, and 17.7 times [3] - The company is given a "recommend" rating based on these projections [3]

净利腰折!三只松鼠陷现金流困局

Shen Zhen Shang Bao· 2025-10-28 01:03

Core Viewpoint - The company, Three Squirrels, reported an increase in revenue but a significant decline in profit for the first three quarters of 2025, indicating challenges in profitability despite revenue growth [2][3]. Financial Performance - For the first three quarters of 2025, the company's operating revenue reached 7.76 billion yuan, a year-on-year increase of 8.22% [3]. - The net profit attributable to shareholders was 161 million yuan, down 52.9% year-on-year [3]. - The net profit after deducting non-recurring gains and losses was 57.14 million yuan, a decrease of 78.57% year-on-year [3]. - In Q3 alone, operating revenue was 2.28 billion yuan, up 8.91% year-on-year [3]. - The net profit for Q3 was 22.27 million yuan, down 56.79% year-on-year [3]. - The net profit after deducting non-recurring gains and losses for Q3 was 6.31 million yuan, a decline of 83.45% year-on-year [3]. Cash Flow and Financial Health - The company faced a cash flow crisis, with a net cash flow from operating activities of -505 million yuan, a year-on-year decline of 1690.52% [4]. - Cash and cash equivalents dropped from 866 million yuan at the beginning of the year to 242 million yuan, a decrease of 72.06% [4]. - Short-term borrowings surged by 59.87% compared to the end of the previous year due to new borrowings [4]. - Sales expenses reached 1.61 billion yuan, an increase of 24% compared to the beginning of the year, primarily due to higher platform and promotional costs [4]. - Investment income decreased by approximately 30% compared to the previous period, impacting overall profitability [4]. Dependency on Non-Recurring Gains - The company's reliance on non-recurring gains has exceeded 60%, with government subsidies amounting to 98.82 million yuan included in the current period's profit [3].

8点1氪:春秋航空招聘已婚已育“空嫂”;市监局称“酸菜池里抽烟乱吐”生产乱象属实;姚润昊卸任上海叠纸法人、执行董事

36氪· 2025-10-28 00:10

Group 1 - Spring Airlines has launched a special recruitment initiative for "air sisters," targeting married women with children, and has raised the age limit to 40 years [3][4] - The educational requirement for the cabin crew positions is a full-time bachelor's degree or higher, with height requirements set between 162cm and 174cm, and no prior work experience is necessary [4] - The recruitment head emphasized that the "air sisters" possess strong affinity and adaptability, which are advantageous in serving children and handling emergencies [4] Group 2 - The Indian and Chinese governments have officially resumed direct flights after a five-year hiatus, marking a significant step towards rebuilding relations between the two populous nations [6] - The first flight was operated by India's largest airline, Indigo, from Kolkata to Guangzhou, with additional flights from New Delhi to Shanghai and Guangzhou set to commence in November [6] Group 3 - Ford's CEO stated that the tariffs imposed by former President Trump have resulted in over $2 billion in additional costs for the company, equating to a loss of approximately 20% of its global profits [17] - The tariffs have significantly impacted Ford's production activities, particularly concerning parts sourced from other countries [17] Group 4 - Meituan has announced that its social security subsidy for delivery riders will now cover the entire country, marking the first such initiative in the industry [13] - The subsidy program includes various benefits such as pension insurance, accident insurance, and additional support for riders and their families [13] Group 5 - Three squirrels reported a net profit of 22.27 million yuan for the third quarter, reflecting a year-on-year decline of 56.79%, despite achieving a revenue of 2.281 billion yuan, which is an 8.91% increase [27] - Sichuan Gold reported a net profit of 160 million yuan for the third quarter, a significant year-on-year increase of 184.38%, with revenues reaching 346 million yuan, up 161.19% [28] - Kangtai Biotech's third-quarter net profit fell by 93.74% to 11.62 million yuan, with revenues declining by 17.74% to 671 million yuan [29] - Heng Rui Pharmaceutical reported a net profit of 1.301 billion yuan for the third quarter, marking a year-on-year increase of 9.53%, with revenues of 7.427 billion yuan, up 12.72% [30]

氪星晚报|青岛啤酒:第三季度净利润13.7亿,同比增长1.62%;宋旸已接替邵京平(James)出任京东零售平台营销中心负责人;安踏体育:三季度安踏和F...

3 6 Ke· 2025-10-27 15:08

Group 1: Meituan's Health Initiative - Meituan has launched a "Health Double Eleven" campaign featuring special medical foods and health supplements, responding to a nearly 40% increase in related search volume on its platform [1] - The campaign includes products like Ejiao and bird's nest, along with special medical foods such as Ai Er Shu and Tai Min Shu, and offers significant discount coupons to users [1] - Users purchasing special medical foods can join a community for exclusive nutritionist consultations and additional discounts [1] Group 2: Qingdao Beer Financial Performance - Qingdao Beer reported a third-quarter net profit of 1.37 billion yuan, representing a year-on-year increase of 1.62% [2] - The company's revenue for the third quarter was 8.876 billion yuan, showing a slight decline of 0.17% compared to the previous year [2] Group 3: Changchun High-tech's Clinical Trial Approval - Changchun High-tech's subsidiary, GenSci, received approval for the clinical trial application of GenSci098 injection, which has potential for treating diffuse toxic goiter [3] - This approval is expected to facilitate the clinical development of the product for the target population [3] Group 4: Kingsoft Office Financial Performance - Kingsoft Office reported a third-quarter net profit of 431 million yuan, marking a year-on-year increase of 35.42% [4] - The company's revenue for the third quarter was 1.521 billion yuan, reflecting a growth of 25.33% year-on-year [4] Group 5: Foreign Exchange and Trade Statistics - In the first three quarters, China's foreign exchange receipts and payments reached 11.6 trillion USD, setting a record for the same period [5] - The foreign exchange market transaction volume is projected to grow by 37% in 2024 compared to 2020, with foreign exchange receipts increasing by 64% over the same period [5] Group 6: Three Squirrels Financial Performance - Three Squirrels reported a third-quarter net profit of 22.27 million yuan, which is a significant decline of 56.79% year-on-year [6] - The company's revenue for the third quarter was 2.281 billion yuan, showing an increase of 8.91% compared to the previous year [6] Group 7: Hengrui Medicine Financial Performance - Hengrui Medicine's third-quarter revenue was 7.427 billion yuan, reflecting a year-on-year growth of 12.72% [6] - The net profit for the third quarter was 1.301 billion yuan, which is a 9.53% increase year-on-year [6] Group 8: Anta Sports Retail Performance - Anta Sports reported low single-digit growth in retail sales for its Anta and FILA brands in the third quarter [9] - Other brands under the company achieved a significant retail sales growth of 45-50% year-on-year [9] Group 9: National Airlines Aircraft Purchase - National Airlines announced plans to purchase six A350F cargo aircraft from Airbus, with an option for four additional aircraft [10] - The total value of the aircraft, based on the January 2024 catalog price, is approximately 4.65 billion USD per unit, with potential discounts negotiated [10] Group 10: Investment and Financing Activities - Guoyi Quantum has completed a new round of strategic financing led by Hefei Xingtai Capital, aimed at enhancing its R&D capabilities in quantum computing and related fields [10] - Song Yang has replaced Shao Jingping as the head of JD Retail's marketing center, following Shao's departure for personal reasons [7] Group 11: New Product Launch by Meituan - Meituan's LongCat team has released and open-sourced the LongCat-Video video generation model, achieving state-of-the-art results in video generation tasks [10] - The model aims to enhance capabilities in various applications, including autonomous driving and interactive business scenarios [10] Group 12: Regulatory Changes in Foreign Investment - The China Securities Regulatory Commission has introduced a green channel and simplified processes for foreign institutional investors, including sovereign funds and pension funds [11]

氪星晚报|青岛啤酒:第三季度净利润13.7亿,同比增长1.62%;宋旸已接替邵京平(James)出任京东零售平台营销中心负责人;安踏体育:三季度安踏和FILA品牌零售额同比低单位数增长

3 6 Ke· 2025-10-27 14:56

Group 1: Company Performance - Meituan's special medical food activity section launched for Double Eleven, with a nearly 40% week-on-week increase in related search volume [1] - Qingdao Beer reported a third-quarter net profit of 1.37 billion, a year-on-year increase of 1.62%, with revenue of 8.876 billion, a slight decline of 0.17% [2] - Changchun High-tech's subsidiary received approval for clinical trials of GenSci098 injection, which has potential for treating diffuse toxic goiter [3] - Kingsoft Office reported a third-quarter net profit of 431 million, a year-on-year increase of 35.42%, with revenue of 1.521 billion, up 25.33% [4] - Anta Sports reported low single-digit growth in retail sales for Anta and FILA brands in the third quarter, while other brands saw a 45-50% increase [9] - Heng Rui Pharmaceutical reported a third-quarter net profit of 1.301 billion, a year-on-year increase of 9.53%, with revenue of 7.427 billion, up 12.72% [6] - Three Squirrels reported a third-quarter net profit of 22.27 million, a year-on-year decrease of 56.79%, with revenue of 2.281 billion, up 8.91% [5] - Kangtai Biological reported a third-quarter net profit of 11.62 million, a year-on-year decrease of 93.74%, with revenue of 671 million, down 17.74% [8] Group 2: Investment and Financing - Guoyi Quantum received strategic investment from Hefei Xingtai Capital, which will enhance its R&D capabilities in quantum computing and related fields [10] - Song Yang has replaced Shao Jingping as the head of JD Retail Platform Marketing Center due to personal reasons [7] - Song Yan Power completed nearly 300 million Pre-B round financing led by Fanggu Capital, with participation from several other investors [11] Group 3: Market Trends and Economic Indicators - China's foreign exchange revenue and expenditure scale reached 11.6 trillion in the first three quarters, a historical high, with a 37% increase in trading volume compared to 2020 [5] - The China Securities Regulatory Commission has implemented a green channel and simplified processes for foreign investment from sovereign funds, international organizations, and pension charitable funds [12] Group 4: New Products - Meituan LongCat-Video was officially released and open-sourced, achieving state-of-the-art performance in video generation tasks [11]

三只松鼠:2025年第三季度营业收入同比增长8.91%

Zheng Quan Ri Bao Zhi Sheng· 2025-10-27 11:37

Core Insights - The company reported a revenue of 2,281,114,649.91 yuan for the third quarter of 2025, representing a year-on-year growth of 8.91% [1] - The net profit attributable to shareholders of the listed company was 22,268,914.36 yuan, showing a significant decline of 56.79% compared to the same period last year [1] Financial Performance - Revenue for Q3 2025: 2,281,114,649.91 yuan, up 8.91% year-on-year [1] - Net profit for Q3 2025: 22,268,914.36 yuan, down 56.79% year-on-year [1]

三只松鼠:前三季度归母净利润为1.61亿元,同比下降52.91%

Bei Jing Shang Bao· 2025-10-27 10:43

Core Insights - The company reported a third-quarter revenue of 2.281 billion yuan, representing a year-on-year growth of 8.91% [2] - The net profit attributable to the parent company for the third quarter was 22.2689 million yuan, showing a significant decline of 56.79% year-on-year [2] - For the first three quarters, the company achieved a total revenue of 7.759 billion yuan, with a year-on-year increase of 8.22% [2] - The net profit attributable to the parent company for the first three quarters was 161 million yuan, which is a decrease of 52.91% compared to the previous year [2]

三只松鼠:第三季度净利润2226.89万元,同比下降56.79%

Zheng Quan Shi Bao Wang· 2025-10-27 10:00

Core Insights - The company, Three Squirrels, reported a revenue of 2.281 billion yuan for Q3 2025, reflecting a year-on-year growth of 8.91% [1] - The net profit for Q3 2025 was 22.2689 million yuan, showing a significant decline of 56.79% compared to the previous year [1] - For the first three quarters of 2025, the net profit totaled 161 million yuan, which is a decrease of 52.91% year-on-year [1]

三只松鼠(300783.SZ):前三季净利润1.6亿元 同比下降52.91%

Ge Long Hui A P P· 2025-10-27 08:53

Core Insights - The company reported a revenue of 7.759 billion yuan for the first three quarters, representing a year-on-year increase of 8.22% [1] - The net profit attributable to shareholders decreased to 160 million yuan, a decline of 52.91% year-on-year [1] - The net profit excluding non-recurring gains and losses was 57.137 million yuan, down 78.57% compared to the previous year [1]