Hua Xia Shi Bao

Search documents

国补+养老+消费,招联「铁粉圆梦日」探索普惠金融新路径

Hua Xia Shi Bao· 2025-10-31 03:36

Core Viewpoint - The company integrates inclusive finance with intergenerational reunion needs through the "Iron Fans Dream Day" initiative, promoting high-quality elderly care services while fostering family happiness [1][5][13] Group 1: Event Overview - The "Respect for the Elderly" special event in October invited "Iron Fans" to Chengdu, allowing them to share quality time with their parents amidst local cultural experiences [3][5] - Activities included traditional tea tasting and Sichuan opera performances, with staff providing thoughtful support for elderly participants [3][5] Group 2: Financial and Emotional Support - The company emphasizes that inclusive finance goes beyond providing quality financial services; it focuses on accompanying users and safeguarding family happiness [5][7] - Since 2023, the company has organized various events to support family reunions and has launched multiple "Iron Fans Dream Day" activities to fulfill user expectations [5][7] Group 3: Self-Service System and User Care - The company has developed a "self-confidence + self-healing" self-service system, offering benefits to trustworthy users and support for those in difficulty [7][9] - Services for trustworthy users include interest rate reductions and credit limit increases, while support for users facing repayment pressure includes installment repayment and fee reductions [7][9] Group 4: Elderly Care and Safety Solutions - The company collaborates with China Unicom to provide elderly-friendly home modifications, enhancing safety for users' parents living at home [7][9] - Modifications include installing anti-slip flooring and smart security systems, addressing users' concerns about their parents' safety from a distance [7][9] Group 5: Technological Integration in Healthcare - The company has introduced the "Zhangsi" AI diagnosis system, providing accessible medical services and health assessments for users [11][13] - The system covers various health conditions and has been implemented in over 30 medical institutions nationwide [11] Group 6: Future Plans and Expansion - The "Iron Fans Dream Day" will continue in cities like Shanghai and Guangzhou, with users able to register through various online platforms [13] - The company aims to expand its inclusive services in areas such as elderly care, consumption, and health, enhancing both convenience and emotional connection in financial services [13]

茅台为何48小时密集动作?

Hua Xia Shi Bao· 2025-10-31 02:21

Core Insights - The article highlights a series of significant events for Moutai over a 48-hour period, prompting a reevaluation of its value logic amidst slowing growth and stock price pressure [1][2][3] - The focus has shifted from short-term price fluctuations to a critical question: Can Moutai break through its bottleneck through strategic transformation and rebuild its long-term competitiveness? [1] Group 1: Key Events - On October 28, Moutai's chairman attended the inaugural Zhi Shui River Forum, which gathered major domestic and international liquor industry leaders, indicating a strong collaborative effort in the global liquor market [2] - Moutai's new management team emphasized green development and open sharing, launching a "High-Quality Development Promotion Action" with over twenty domestic and foreign liquor companies [2][3] - On October 29, Moutai celebrated the Chongyang Festival with significant events, including the unveiling of its biotechnology research company, signaling a commitment to innovation and future growth [2][3] Group 2: Financial Performance - For the first three quarters, Moutai reported total revenue of 130.9 billion yuan, a year-on-year increase of 6.32%, and a net profit of 64.63 billion yuan, also up 6.25% [3] - Despite the overall challenges in the liquor industry, Moutai's stable growth reflects its strong fundamentals and effective channel management [4][5] Group 3: Strategic Transformation - Moutai is focusing on three transformations: targeting new business demographics, expanding dining scenarios, and shifting from selling liquor to selling lifestyle experiences [4][5] - The company is gradually moving from reliance on high-end products to a diversified product matrix and expanding its global market presence [5][6] Group 4: Industry Context - The liquor industry is facing unprecedented challenges, with a reported 5.8% decline in production and a 10.93% drop in total profits in the first half of 2025 [4] - Moutai's recent actions signal a shift from a volume-price growth model to a focus on sustainable ecological value and international market participation [7][8] Group 5: Future Outlook - Moutai's new valuation logic emphasizes comprehensive ecological value over single product value, aiming for long-term growth despite current market pressures [8][9] - The company is adapting to changing consumer preferences, particularly among younger demographics, and is expected to continue evolving its marketing strategies to align with modern consumption trends [9]

暴跌超11%!全球科技巨头业绩爆雷 市值一夜蒸发超2000亿美元 扎克伯格回应市场质疑

Hua Xia Shi Bao· 2025-10-31 00:34

Market Overview - On October 30, US stock indices collectively declined, with the Dow Jones down 0.23% to 47,522.12 points, the S&P 500 down 0.99% to 6,822.34 points, and the Nasdaq Composite down 1.57% to 23,581.14 points, ending a streak of record highs [2][3] Company Performance - Meta Platforms reported a significant drop in stock price, falling 11.33% after its quarterly earnings announcement, while Microsoft also saw a decline of 2.92%. Investor concerns were raised regarding the increasing expenditures in the AI sector for both companies [4] - Meta's Q3 revenue reached $51.24 billion, a 26% year-over-year increase, but net profit plummeted 83% to $2.71 billion, with earnings per share at $1.05, significantly below the market expectation of $6.68 [4] - The drastic decline in Meta's profits was primarily attributed to a one-time non-cash tax expense of $15.93 billion resulting from the "One Big Beautiful Bill Act," which raised the effective tax rate from 12% to 87% compared to the previous year [4][5] - Meta's total costs and expenses for Q3 were $30.7 billion, a 32% increase year-over-year, outpacing the revenue growth and leading to a contraction in operating profit margin from 43% to 40% [4] Adjusted Financials - Excluding the tax impact, Meta's Q3 net profit would have been $18.64 billion, with diluted earnings per share of $7.25, reflecting a 20% year-over-year growth and surpassing market expectations of $6.69 [5] Workforce Adjustments - Meta plans to lay off approximately 600 employees in its AI division as part of efforts to streamline operations and enhance efficiency following a period of significant expansion [5] Semiconductor Sector - The semiconductor sector faced pressure, with the Philadelphia Semiconductor Index declining by 1.53%, and 22 out of 30 component stocks falling. Notable declines included AMD down 3.59%, Broadcom down 2.46%, and Nvidia down 2%, with its market capitalization dropping below $500 billion [7][8] Other Tech Stocks - Other major tech stocks also experienced declines, with Tesla down 4.63%, Oracle down 6.69%, and Palantir down 2.14%. However, Apple saw a slight increase of 0.63%, with a post-market surge of nearly 4% following a 6.1% year-over-year growth in iPhone revenue [8]

东航前三季度盈利显著改善,旅客运输量及客座率全面提升

Hua Xia Shi Bao· 2025-10-31 00:13

Core Viewpoint - China Eastern Airlines (CEA) has significantly improved its profitability in Q3 2025, reporting a net profit of 2.103 billion yuan, marking a turnaround from losses in the previous year [2] Financial Performance - For the first three quarters of 2025, CEA achieved operating revenue of 106.414 billion yuan, a year-on-year increase of 3.73% [2] - The net profit attributable to shareholders was 2.103 billion yuan, indicating a successful recovery from previous losses [2] Market Opportunities - The summer travel season in 2025 saw a robust increase in passenger transport, with CEA capitalizing on this trend by executing 194,000 flights and serving 28.06 million passengers during the peak period [3] - CEA's international flights reached new heights, with 27,000 international and regional flights executed, transporting 4.492 million passengers, representing year-on-year growth of 9.8% and 13.6% respectively [3] International Route Expansion - CEA has become the leading airline in China for international routes, having opened 23 new medium to long-haul international routes since 2024, connecting to 36 destinations in 21 countries along the Belt and Road Initiative [4] - In the first three quarters, CEA's international passenger volume reached 15.4965 million, a year-on-year increase of 23.61%, surpassing its competitors [5] Hub Development - CEA plays a crucial role in the construction of the Shanghai international aviation hub, with 4.795 million international transfer passengers recorded in the first half of 2025, a 26.8% increase [6] - The company has introduced various intermodal transport services to enhance passenger transfer efficiency, including a service center at Hongqiao Station and a "Airport Express" service for seamless transfers [6]

广东两家拟上市银行三季度业绩承压,IPO进程再度受阻

Hua Xia Shi Bao· 2025-10-30 14:36

Core Viewpoint - Both Dongguan Bank and Nanhai Rural Commercial Bank have reported a decline in operating income and net profit for the first three quarters of the year, indicating ongoing financial challenges as they pursue their IPOs [2][3]. Financial Performance - Dongguan Bank achieved operating income of 6.918 billion yuan, a year-on-year decrease of 9.39%, and net profit of 2.544 billion yuan, down 20.66% from the previous year [3][4]. - Nanhai Rural Commercial Bank reported operating income of 4.277 billion yuan, a decline of 8.73%, and net profit of 1.865 billion yuan, down 17.08% year-on-year [4][5]. Revenue Structure - Dongguan Bank's net interest income remained relatively stable at 5.24 billion yuan, a slight decrease of 0.43%, but investment income fell significantly from 1.733 billion yuan to 1.343 billion yuan, a drop of 22.54% [4]. - Nanhai Rural Commercial Bank's net interest income decreased from 2.708 billion yuan to 2.528 billion yuan, a decline of 6.64%, while investment income increased from 1.329 billion yuan to 2.003 billion yuan, a growth of 50.75% [5]. IPO Status - Both banks' IPO applications have been repeatedly halted due to outdated financial information, marking the fourth time since March 2024 that their review status has changed to "suspended" [2][7]. - As of September 30, Dongguan Bank's core Tier 1 capital adequacy ratio was 9.13%, while Nanhai Rural Commercial Bank's was 12.51%, both showing a decline from the previous year [7]. Capital Supplementation - The banks are primarily relying on profit retention and the issuance of capital bonds for capital supplementation, but declining profitability is limiting their internal capital generation capabilities [8]. - Dongguan Bank issued 4 billion yuan in subordinated capital bonds, while Nanhai Rural Commercial Bank issued 3 billion yuan, providing some capital relief [8].

上市首日大涨86.7%!八马茶业圆梦港交所:能否破解加盟模式隐忧?

Hua Xia Shi Bao· 2025-10-30 13:56

Core Viewpoint - Baima Tea has successfully listed on the Hong Kong Stock Exchange after years of attempts, achieving a closing price of HKD 93.35 per share, an increase of 86.7%, with a market capitalization of HKD 7.935 billion [2][8]. Financial Performance - Baima Tea's revenue and net profit for the years 2022 to 2024 are approximately RMB 1.818 billion, RMB 2.122 billion, and RMB 2.143 billion, with corresponding net profits of RMB 166 million, RMB 206 million, and RMB 224 million [3]. - In the first half of 2025, Baima Tea reported revenue of RMB 1.063 billion, a decrease of approximately RMB 57 million compared to the same period last year, and a net profit of RMB 120 million, down RMB 26 million year-on-year [3]. Marketing and Expansion - The company has increased its marketing expenditures significantly, with sales and marketing expenses from 2022 to the first half of 2025 being RMB 617 million, RMB 681 million, RMB 692 million, and RMB 332 million, representing 33.9%, 32.1%, 32.3%, and 31.2% of revenue respectively [4]. - As of June 30, 2023, Baima Tea has expanded its number of stores to 3,585, up from 2,613 in 2022, adding nearly 1,000 stores in three years [4]. Business Model and Challenges - Baima Tea relies heavily on a franchise model, with 3,341 of its 3,585 stores being franchise outlets, accounting for over 50% of total revenue [6]. - The number of franchisees has slightly decreased in the first half of 2025, indicating potential challenges in maintaining franchise relationships and revenue stability [6]. Market Position and Growth Potential - Baima Tea positions itself as a leader in the high-end tea market, targeting high-income consumers, with an average transaction value between RMB 2,300 and RMB 3,000 [4]. - The company holds a market share of 1.7% in the high-end tea segment, suggesting significant room for growth as the top five brands collectively hold only 5.6% of the market [4]. Industry Insights - The Chinese tea market is characterized by a fragmented structure with intense competition, lacking strong brand identities [5]. - Experts suggest that Baima Tea can leverage its brand and marketing strategies to create emotional connections with consumers and enhance its market position [5][9]. Investor Sentiment - The public offering prior to Baima Tea's listing attracted 169,000 applications, with an oversubscription rate of 2,684 times, setting a record for new stock oversubscription in Hong Kong this year [7]. - The market's positive response reflects a renewed interest in traditional tea companies with strong brand influence and market channels [8].

石药系“左手倒右手”?新诺威携“高溢价并购”与“增收不增利”困局赴港

Hua Xia Shi Bao· 2025-10-30 13:36

Core Viewpoint - The company is actively seeking to expand beyond its traditional functional ingredients and health food business, facing significant pressure on profitability despite a slight increase in revenue in the first three quarters of the year [1][2]. Group 1: Business Performance - The company's core business includes functional ingredients, health foods, and specialized medical foods, with nearly all revenue derived from these segments [2]. - In 2024, the company experienced a substantial decline in revenue and net profit, with revenue dropping by 21.98% to 1.98 billion yuan and net profit falling by 87.63% to 53.73 million yuan [2][5]. - The decline in revenue is attributed to market factors affecting the price of caffeine products and increased R&D investment, which rose by 25.44% compared to the previous year [3][4]. Group 2: Strategic Moves - The company has initiated a series of acquisitions to enter the biopharmaceutical sector, including a 51% stake in Giant Stone Biotech for 1.871 billion yuan and a planned acquisition of 100% of Shiyao Baike for 7.6 billion yuan [4][7]. - The stock price surged over 500% following these announcements but has since declined to 34.57 yuan as of October 29, 2025 [4]. - The company is also planning an IPO in Hong Kong to enhance its global strategy and improve cash flow [9][10]. Group 3: Financial Challenges - The company reported a significant increase in R&D expenses, which accounted for 43.39% of revenue, leading to a net loss of 24.05 million yuan in the first three quarters of the year [3][6]. - The financial data indicates a concerning trend of "increased revenue without increased profit," with a net profit loss of 240.49 million yuan in the first three quarters, compared to profits exceeding 137 million yuan in the same period last year [3][9]. - The company faces risks related to cash flow and potential debt default if the IPO is delayed or if the biopharmaceutical pipeline does not progress as planned [9][10].

政策驱动风电设备走强!新强联前三季净利大增1939%,价值重估窗口已打开?|掘金百分百

Hua Xia Shi Bao· 2025-10-30 13:31

Core Viewpoint - The wind power equipment leader, Xin Qiang Lian, has attracted significant market attention due to its outstanding performance in the first three quarters of 2025, with revenue and net profit showing substantial year-on-year growth [3][4]. Financial Performance - Xin Qiang Lian reported a revenue of 3.618 billion yuan and a net profit of 664 million yuan for the first three quarters of 2025, representing year-on-year increases of 84.10% and 1939.50%, respectively [3][4]. - The company's gross margin was 28.88% and net margin was 18.94%, both showing improvements compared to the previous year [4]. Stock Performance - As of October 30, 2025, Xin Qiang Lian's stock price closed at 53.89 yuan per share, with a monthly increase of approximately 24% and an annual increase exceeding 180% [3][6]. - The stock experienced a notable rise of nearly 30% from October 20 to 24, 2025, following a five-day consecutive increase [6]. Market Dynamics - The growth of Xin Qiang Lian's stock is supported by favorable policies in the wind power sector, such as the "Wind Energy Beijing Declaration 2.0," which sets ambitious installation targets for wind power during the 14th Five-Year Plan [6][8]. - The wind power equipment sector has seen multiple stocks doubling in value this year, reflecting a broader market trend driven by policy incentives [7][8]. Operational Insights - Xin Qiang Lian has a robust order book for wind power bearings and is progressing with its production plans while remaining flexible to market changes [5]. - The company is enhancing its production capacity through equipment upgrades and process optimizations, aiming to improve delivery capabilities [5]. Research and Development - Xin Qiang Lian's R&D expenditures have been increasing, with 130 million yuan spent in the first three quarters of 2025, contributing to its technological advancements and patent portfolio [10]. - The company has achieved significant milestones in developing large-scale bearings for shield tunneling machines, filling domestic gaps and reaching international standards [10].

比亚迪前三季度营收5663亿,花旗看好其发展后劲

Hua Xia Shi Bao· 2025-10-30 13:23

Core Insights - BYD reported strong financial performance in Q3 2023, with revenue of 194.99 billion yuan and net profit of 7.82 billion yuan, reflecting a 23% quarter-on-quarter growth and a 1.6 percentage point increase in gross margin [1] - For the first three quarters of 2023, BYD achieved a revenue of 566.27 billion yuan, a year-on-year increase of 13%, while R&D expenses surged by 31% to 43.75 billion yuan, highlighting the company's commitment to innovation [1] - BYD's global sales reached 3.26 million units from January to September 2023, marking an 18.64% year-on-year growth, with a significant contribution from intelligent models equipped with the Tian Shen Zhi Yan driver assistance system [2] Financial Performance - In Q3 2023, BYD's revenue was 194.99 billion yuan, with a net profit of 7.82 billion yuan, indicating a positive trend despite increased industry competition [1] - The company's R&D investment for the first three quarters reached 43.75 billion yuan, significantly exceeding its net profit of 23.33 billion yuan during the same period [1] Sales and Market Expansion - BYD's global sales for the first nine months of 2023 reached 3.26 million units, achieving 70.87% of its annual target of 4.6 million units [2] - The overseas sales of BYD surged by 132% to 701,600 units, with products now available in 117 countries and regions [2] Technological Advancements - BYD's commitment to R&D is evident as it has invested over 220 billion yuan cumulatively, surpassing Tesla's R&D spending by 10.9 billion yuan this year [1] - The introduction of innovative technologies such as the Tian Shen Zhi Yan driver assistance system and the Super e-platform has contributed to stable sales growth [1] Strategic Initiatives - BYD is actively responding to national policies to support the healthy development of small and medium-sized enterprises, as indicated by a decrease in accounts payable and a shorter payment cycle to suppliers [6] - The company is expanding its market presence in Japan with the launch of the K-EV BYD RACCO and the Sea Lion 06DM-i plug-in hybrid model [4] Future Outlook - International investment banks, including Citigroup, project BYD's sales to reach 4.67 million units in 2024 and 5.39 million units in 2025, driven by high-end brand growth and technological advantages in the plug-in hybrid sector [6] - With ongoing technological innovations and an expanding product matrix, BYD is expected to continue leading the global electric vehicle industry transformation [6]

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

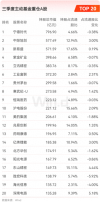

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].