信息技术ETF

Search documents

202602保险客户资产配置月报:A股关注中盘蓝筹,中债阶段性对冲配置-20260210

Orient Securities· 2026-02-10 06:52

Market Outlook - A-shares are focusing on mid-cap blue chips, with a neutral stance on bonds and US stocks, and a cautious outlook on gold in the short term[2] - Risk appetite in A-shares is shifting, with structural opportunities being the main focus amid overall market fluctuations[2] - The bond market is expected to continue following risk appetite trends, serving as a hedge against risk assets[2] Investment Strategy - The report recommends increasing allocations to mid-cap blue chips and sectors such as non-ferrous metals, chemicals, new energy, military, communication, and electronics[5] - A dual strategy of passive and active enhancement is suggested for stock-bond allocation, with a focus on increasing positions in mid-term bonds[48] Industry Insights - Price increases in cyclical goods are highlighted as key investment clues, particularly in the chemical, agricultural, and non-ferrous sectors[30] - Geopolitical tensions are raising global economic risk assessments, which is a fundamental driver for commodity price increases[30] Performance Metrics - The low-volatility strategy has achieved an annualized return of 11.8%, while the high-volatility strategy has reached 18.1% since 2025[9] - The industry rotation strategy has outperformed benchmarks with an annualized return of 44.8% since 2025[9] Risk Considerations - Extreme risk events could disrupt market expectations, and there is a risk of quantitative models failing to predict future trends[6]

金融市场流动性与监管动态周报:规模指数ETF净流出,融资买入额占两市交易额比例回落-20260120

CMS· 2026-01-20 13:34

Group 1: Market Liquidity and ETF Flows - Recent outflows from stock ETFs indicate a cooling market, with broad-based index ETFs being the main contributors to these outflows, while thematic and sector-specific ETFs continue to attract net inflows [1][3][8] - The CSI 300 ETF experienced significant net outflows, while the CSI 2000 ETF, representing small-cap stocks, saw net inflows, indicating a shift in investor preference towards less pressured assets [11][12] - On January 19, financing funds recorded a net outflow of 8.5 billion yuan, marking the first net outflow of the year, as uncertainty around annual performance forecasts increases [3][11] Group 2: Monetary Policy and Interest Rates - The central bank conducted a net injection of 1,112.8 billion yuan in the open market during the week of January 12-16, with a focus on maintaining reasonable liquidity in the banking system [15] - Money market rates have declined, with the R007 and DR007 rates decreasing by 0.2 basis points and 3.0 basis points respectively, while the yield on 1-year and 10-year government bonds also fell [15][16] Group 3: Sector Preferences and Fund Flows - In terms of sector preferences, the computer, non-ferrous metals, and media sectors attracted significant net inflows, while sectors like electronics, power equipment, and banking faced substantial outflows [46][47] - The net inflow for the computer sector was 87.9 billion yuan, while the non-ferrous metals sector saw 61.7 billion yuan, indicating strong investor interest in these areas [47] Group 4: Market Sentiment and Trading Activity - Market sentiment has weakened, with the financing buy amount for the week of January 12-16 being 1,934.3 billion yuan, accounting for 12.6% of the total A-share trading volume, a decrease from previous levels [37] - The VIX index increased, reflecting a decline in market risk appetite, as the Nasdaq and S&P 500 indices also experienced slight declines [39]

科技股开启“春季躁动”行情,5G通信ETF(515050)、信息技术ETF(562560)盘中涨超2%,中微公司涨超10%

Mei Ri Jing Ji Xin Wen· 2026-01-05 02:22

Group 1 - The A-share market opened higher on January 5, 2026, with the technology sector, particularly communications, leading the gains, as evidenced by the Information Technology ETF (562560) and 5G Communication ETF (515050) both rising over 2% [1] - Notable stocks such as Zhongwei Company surged over 10%, while other companies like Jiangbolong, Baiwei Storage, Blue Technology, Zhaoyi Innovation, Huagong Technology, and Luxshare Precision also showed strong performance [1] - The market is expected to enter a "spring rally" phase, driven by the end of the observation adjustment period in late 2025, alongside new capital inflows from insurance funds and a clear overseas interest rate cut cycle [1] Group 2 - The macroeconomic environment is currently in a marginal recovery phase, with a neutral to loose financial environment, which supports the ongoing trend in the technology industry [1] - The upcoming spring rally is anticipated to focus on structural opportunities within high-growth sectors, as indicated by analysts from Zhongtai Securities [1]

招商证券:岁末年初市场风格特征如何?

智通财经网· 2025-12-23 22:29

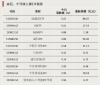

Group 1: Market Trends and Investor Behavior - The market style tends to exhibit defensive characteristics at the end of the year, with large-cap value stocks outperforming, while the small-cap style represented by the CSI 1000 faces pressure [1] - Institutional investors are likely to adopt a conservative investment approach due to year-end performance assessments, leading to a decrease in risk appetite [1] - As the market enters the dense disclosure period for annual earnings forecasts in January, earnings uncertainty becomes a key concern, prompting funds to flow towards more stable large-cap blue-chip stocks [1] Group 2: Monetary Policy and Market Liquidity - The central bank's net injection in the open market was 219 billion yuan last week, with upcoming maturities including 4.575 billion yuan in reverse repos and 3 billion yuan in MLF [2] - Money market rates are declining, with short and long-term government bond yields also decreasing, while the issuance scale of interbank certificates of deposit has expanded [2] - The net inflow of funds in the secondary market has increased, with a rise in financing balances and net purchases of financing funds amounting to 3.42 billion yuan [2] Group 3: Sector Preferences and Fund Flows - High net inflows were observed in the electronics, communications, and power equipment sectors, with significant net subscriptions for the A500 ETF [3] - The information technology ETF saw substantial net subscriptions, while the military industry ETF experienced notable redemptions [3] - The highest net subscription was for the Huatai-PB CSI A500 ETF, while the highest net redemption was for the Fuguo CSI Military Leaders ETF [3] Group 4: Overseas Economic Indicators - In the U.S., the November non-farm payroll and CPI significantly fell below expectations, with the overall CPI rising 2.74% year-on-year, lower than the expected 3.06% [3] - The core CPI also rose 2.63% year-on-year, below the consensus expectation of 3.03%, indicating inflation is nearing the Federal Reserve's target level [3] - The unemployment rate in the U.S. rose to 4.6% in November, the highest level since October 2021 [3]

ETF开盘:标普生物科技ETF涨2.54% 通信设备ETF跌1.34%

Xin Lang Cai Jing· 2025-12-04 03:47

Group 1 - The opening of ETFs on December 4 showed mixed performance, with the S&P Biotechnology ETF (159502) increasing by 2.54% [1][2] - The Robotics Industry ETF (560630) rose by 2.23% [1][2] - The S&P Oil & Gas ETF (513350) experienced a gain of 2.15% [1][2] Group 2 - The Communication Equipment ETF (159583) declined by 1.34% [1][2] - The Information Technology ETF (562560) fell by 1.2% [1][2] - The Satellite ETF (159206) decreased by 1.16% [1][2]

AI算力盘中重挫,创业板人工智能ETF华夏、5G通信ETF、信息技术ETF跌超3%

Mei Ri Jing Ji Xin Wen· 2025-11-21 05:45

Core Viewpoint - A-shares experienced a decline influenced by external market sentiment, particularly affecting sectors like lithium battery new energy, AI computing power, and optical module CPO, with several stocks dropping over 5% [1] Market Performance - A-shares opened lower, with significant declines in previously strong sectors such as lithium battery new energy and AI computing power [1] - Popular ETFs also saw declines, with the 5G communication ETF down over 4%, and the AI and information technology ETFs down over 3% [1] Economic Indicators - The U.S. non-farm payroll report for September showed an increase of 119,000 jobs, significantly above expectations, which dampened investor hopes for a Federal Reserve rate cut in December [1] - This economic data led to a substantial drop in U.S. stock markets, with the Nasdaq index falling by 2.16% [1] Company Performance - Nvidia reported a 62% year-over-year increase in revenue for Q3, reaching $57.01 billion, exceeding Wall Street expectations [1] - The company provided a strong sales guidance for Q4, reinforcing market confidence in the sustained demand for its AI chips [1]

资产配置模型月报:全天候模型仓位平稳,行业策略推荐科技/有色/新能源等板块-20251103

Orient Securities· 2025-11-03 11:44

Group 1 - The core view of the report emphasizes a stable allocation in the all-weather model, with industry strategies recommending sectors such as technology, non-ferrous metals, and new energy [2][7][40] - The dynamic all-weather strategy has shown a year-to-date annualized return of 7.2%, while the industry rotation strategy has outperformed the benchmark with a return of 43% [7][20] - The report indicates a slight reduction in positions for gold and US stocks, while increasing holdings in bonds for November [7][18][40] Group 2 - The industry rotation strategy recommends sectors such as non-ferrous metals, technology, and electric power equipment for November, based on historical market conditions [7][29][40] - The report highlights that the industry rotation strategy has consistently outperformed benchmarks since 2017, with an annualized return of 22.6% [21][22] - For ETFs, the report recommends non-ferrous metals, communication, information technology, automotive, and new energy sectors, indicating a strong correlation with the respective industry indices [30][39][40]

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

金融市场流动性与监管动态周报:四季度风格日历效应如何?-20251014

CMS· 2025-10-14 12:42

Group 1 - The report indicates that in the past 15 years (2010-2024), the probability of large-cap style outperforming in October is relatively high, with a 67% chance of outperforming the broad market index [9][4]. - Value style has a slightly higher probability of outperforming growth style, with a 53% chance of outperforming the broad market index [9][4]. - The main drivers for significant style shifts in the fourth quarter typically include policy changes, disruptions in strong sector logic, or new developments that reinforce other sector logics [4][22]. Group 2 - In terms of liquidity, the report notes that the central bank conducted a net withdrawal of 15,263 billion yuan in the week of October 6-12, with a future expectation of 10,210 billion yuan in reverse repos [26][29]. - The report highlights that the average weekly trading volume in the A-share market increased to 22,704.16 billion yuan, indicating heightened market activity [4][37]. - The net inflow of financing funds reached 473.1 billion yuan, marking a shift from previous net outflows [4][37]. Group 3 - The report identifies that financial real estate and TMT sectors have historically performed well in the fourth quarter, with financial style appearing superior in 4 out of the past 15 years [17][18]. - The report also notes that large-cap style has a higher occurrence rate, appearing in 9 out of the past 15 fourth quarters [18][21]. - The technology leader index has the highest probability of outperforming the broad market index at 62%, with an average return of 3.58% [21][22]. Group 4 - The report mentions that the market sentiment has shown increased trading activity in financing funds, with the proportion of financing transactions in the A-share market rising to 13.9% [46][48]. - The VIX index has increased, indicating a decline in market risk appetite, with the Nasdaq and S&P 500 indices also experiencing declines [48][49]. - The report highlights that the demand for funds has decreased, with no IPO financing in the week of October 9-10, and a reduction in planned share reductions by major shareholders [41][42].

ETF开盘:科创成长ETF南方涨9.61% 通信设备ETF跌1.98%

Shang Hai Zheng Quan Bao· 2025-09-29 03:25

Group 1 - The ETF market opened with mixed performance on September 29, with notable gains in specific sectors [1] - The Southern Science and Technology Growth ETF (589700) increased by 9.61%, indicating strong investor interest in this sector [1] - The Energy Storage Battery ETF from GF (159305) rose by 2.24%, reflecting positive sentiment in the energy storage market [1] Group 2 - The Information Technology ETF (562560) saw a gain of 2.09%, suggesting a stable outlook for technology investments [1] - Conversely, the Communication Equipment ETF (159583) declined by 1.98%, indicating potential challenges in this sector [1] - The ChiNext Artificial Intelligence ETF from Huaan (159279) fell by 1.7%, and the Innovative Drug ETF from Tianhong (517380) decreased by 1.65%, highlighting some volatility in these emerging sectors [1]