地产

Search documents

收评:三大指数全天震荡调整 锂电概念逆市活跃

Jing Ji Wang· 2025-10-30 08:24

Core Points - The Shanghai Composite Index closed at 3986.90 points, down 0.73%, with a trading volume of 1,070.059 billion yuan [1] - The Shenzhen Component Index closed at 13,532.13 points, down 1.16%, with a trading volume of 1,351.618 billion yuan [1] - The ChiNext Index closed at 3,263.02 points, down 1.84%, with a trading volume of 641.419 billion yuan [1] Sector Performance - Sectors such as coal, brokerage, semiconductor, oil, real estate, and pharmaceuticals experienced declines [1] - Conversely, the steel and non-ferrous metals sectors saw gains despite the overall market downturn [1] - The banking sector showed an upward trend, while lithium battery and quantum technology concepts remained active [1]

收评:沪指跌0.73%失守4000点,煤炭、券商等板块走低,锂电概念逆市活跃

Zheng Quan Shi Bao Wang· 2025-10-30 07:48

Core Viewpoint - The stock market experienced a decline, with major indices falling below key levels, indicating a challenging environment for investors and sectors [1] Market Performance - The Shanghai Composite Index fell by 0.73% to 3986.9 points, the Shenzhen Component Index decreased by 1.16% to 13532.13 points, and the ChiNext Index dropped by 1.84% to 3263.02 points [1] - Over 4000 stocks in the market were in the red, reflecting widespread selling pressure [1] - The total trading volume in the Shanghai and Shenzhen markets reached 246.46 billion yuan [1] Sector Analysis - Sectors such as coal, brokerage, semiconductors, oil, real estate, and pharmaceuticals saw declines, while steel and non-ferrous metals sectors performed positively [1] - The banking sector showed an upward trend, and sectors related to lithium batteries and quantum technology were active [1] Economic Outlook - Dongguan Securities noted that the current macroeconomic environment remains favorable for emerging growth sectors, supported by ongoing economic recovery, accelerated technological iteration, and policy emphasis on innovation [1] - Policies related to mergers, acquisitions, and IPOs continue to favor technology innovation enterprises [1] - The weight of large-cap emerging growth companies has increased, leading to a more balanced impact on market styles compared to the past [1] Future Market Expectations - The market is expected to continue the oscillating upward trend observed since September, with a relatively gentle slope of ascent [1] - The inflow of incremental capital remains steady, providing crucial support for stable upward movement in the market [1]

亮点前瞻|启航新征程·国泰海通2026年度策略会

国泰海通证券研究· 2025-10-30 06:47

Group 1 - The main forum gathers prominent guests from institutions like the Chinese Academy of Social Sciences and the China Financial Forty Forum, focusing on insights into the US-China economy and major power relations [2] - Nearly 30 sub-forums cover hot topics such as humanoid robots, AI ecosystem, automotive extensions, new energy, new consumption, real estate chain, and innovative pharmaceuticals, featuring a comprehensive research lineup and senior industry experts to analyze industry trends [3] - The event will take place from November 4-6 at the China Grand Hotel in Beijing [4] Group 2 - Over 800 listed companies will participate, with more than 1,000 small-scale exchanges covering over 40 industries, providing a comprehensive, high-quality, and efficient communication platform for professional institutions [5] - Multiple specialized forums will be set up by various departments, including policy and industry research institutes, sales departments, futures research institutes, margin financing departments, and asset allocation departments, creating a one-stop communication and dialogue platform [6] - High-end dialogues between domestic and foreign investors will be specially arranged, with several international relations experts decoding the political and economic landscape of key regions such as US-China, China-Europe, Middle East, and Africa [8] Group 3 - A total forum live broadcast will be presented on Junhong APP and Daohuo APP, led by chief analysts in macro and strategy research, forecasting investment strategies for 2026 [10]

国泰海通 · 晨报1030|策略、新股

国泰海通证券研究· 2025-10-29 13:18

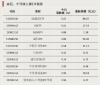

Core Viewpoint - The article highlights the accelerating rise in memory prices and the pressure on durable goods consumption, indicating a mixed performance in the macroeconomic landscape [4]. Group 1: Economic Trends - AI data center construction continues to show strong demand, driving growth in technology hardware and accelerating memory price increases [4][6]. - The real estate and construction sectors remain weak, with prices for steel and building materials showing a downward trend [4][6]. - Overall consumer spending is weak, with the effects of national subsidies being exhausted, leading to pressure on durable goods consumption [4][5]. Group 2: Real Estate and Durable Goods - Real estate sales are at a low point, with the transaction area of commercial housing in 30 major cities down by 23.2% year-on-year, and first-tier, second-tier, and third-tier cities seeing declines of 30.5%, 19.6%, and 20.4% respectively [5]. - Retail sales of durable goods, such as passenger cars, are also under pressure, with a year-on-year decline of 3.0% noted for the week of October 13-19, 2025 [5]. - The air conditioning industry is experiencing significant declines in both domestic and foreign sales, with production down by 21.2% and 13.8% respectively [5]. Group 3: Technology and Manufacturing - The price of DRAM memory chips has increased significantly, with a month-on-month rise of 11.7%, driven by strong demand from overseas AI server markets [6]. - The construction and building materials sector is facing challenges, with weak demand leading to price fluctuations in steel and building materials [6]. - Manufacturing activity has seen a slight increase in operating rates, with improved hiring intentions among companies [6]. Group 4: Consumer Behavior and Logistics - There is a slight recovery in long-distance travel demand, with a 5.5% month-on-month increase in the Baidu migration index [7]. - Freight demand remains stable, with logistics activity increasing as the "Double Eleven" shopping festival approaches [7]. - Port throughput has decreased, despite rising shipping prices [7]. Group 5: New Stock Market Insights - The new stock issuance pace remains steady, with first-day average gains for new stocks on the main board, ChiNext, and STAR Market at 199.27%, 297.09%, and 149.17% respectively [11]. - The average net asset of new stock funds in Q3 2025 is 2.97 billion, with a median return of 4.88% across all new stock funds [12]. - The top five sectors for new stock funds are electronics, non-ferrous metals, electric equipment, pharmaceuticals, and communications, with noticeable reductions in bank holdings [13].

大盘重返4000点,你的基金为何没跟上?

Guo Ji Jin Rong Bao· 2025-10-29 03:07

Core Insights - The A-share market has returned to the 4000-point level for the first time in ten years, with the Shanghai Composite Index reaching a high of 4010.73 points on October 28, 2023, before closing at 3988.22 points, down 0.22% for the day, and showing an annual increase of nearly 19% [1][2] - Despite the overall market rally, over 80 active equity funds reported negative returns year-to-date, with some funds experiencing net value losses exceeding 15%, indicating a significant divergence in fund performance during this bullish market [1][3] Market Performance - The Shanghai Composite Index has seen a "slow bull" market since April 7, 2023, rising nearly 1000 points, with the technology growth sector being a major contributor, as evidenced by the ChiNext Index and the STAR 50 Index rising 50.8% and 48.82% respectively year-to-date [2][3] - The average year-to-date returns for ordinary stock and mixed equity funds are 33.3% and 32.93%, respectively, with some funds doubling their net value [3] Fund Performance Discrepancies - A significant number of funds, particularly those heavily invested in traditional value sectors such as banking, real estate, and liquor, have underperformed. For instance, some mixed equity funds have reported losses exceeding 15% [5][6] - Long-term underperforming funds have continued to struggle in the current market, with several funds showing net value losses of over 30% in the past three years [6] Investment Strategies and Market Dynamics - The divergence in fund performance is attributed to differing investment strategies, with many funds failing to adapt to the rapidly changing market conditions and sector rotations [4][7] - Funds that have heavily invested in sectors with significant year-to-date declines, such as consumer and healthcare, have also faced challenges, leading to poor performance [7][8] Future Outlook - The recent breakthrough of the Shanghai Composite Index above 4000 points raises questions about potential upward momentum from previously lagging sectors, which may attract capital inflows [8] - Historical data suggests that sectors that have lagged may see a rebound following such market milestones, although caution is advised against overly relying on historical trends for future performance predictions [8]

国信证券荀玉根:“买好的”看科技主线 “买得好”关注地产、券商、白酒消费

Zhi Tong Cai Jing· 2025-10-28 11:47

Core Viewpoint - The report by Guosen Securities highlights an extreme divergence between "old" and "new" assets in the market, emphasizing that high growth does not necessarily equate to high investment returns, and that finding fundamentally sound valuation opportunities can lead to significant returns [1][2]. Group 1: Performance Divergence - Since 2025, "small new stocks" have significantly outperformed "old stocks," with the "small new stock" portfolio rising by 183.8% compared to just 3.9% for "old stocks" [2]. - From April 7, 2025, "small new stocks" surged over 200%, while "old stocks" only increased by 13.6% [2]. - The "small new ETF" has risen by 53.1% since 2025, while the "old ETF" has only seen a 13.1% increase [2]. Group 2: Valuation and Market Activity - As of October 24, the PE ratio for "small new" sectors like electronics and computing is at the 99th percentile since 2019, while "old" sectors like real estate and liquor are at the 56th percentile [8]. - The trading volume for "small new" sectors has increased to 33%, while "old" sectors have dropped to below 2.8%, indicating a significant divergence in market activity [8]. Group 3: Investment Strategy - The report stresses the importance of not only selecting high-quality stocks ("buy good") but also ensuring they are purchased at favorable valuations ("buy well") to achieve high returns [11]. - Historical examples illustrate that higher growth does not guarantee better returns, as seen in the comparison between IBM and New Jersey Standard Oil from 1950 to 2003 [11][12]. - The banking sector has shown resilience, with a decline of only 3.9% compared to a 31.1% drop in the overall market, highlighting the potential for finding undervalued stocks with solid fundamentals [15]. Group 4: Market Trends and Seasonal Effects - The current market is characterized by a "small new stock" era, but there are seasonal opportunities for "old stocks," particularly in real estate, liquor, and brokerage sectors [20][29]. - Historical bull markets have shown that each cycle has a leading sector that aligns with prevailing economic trends, with AI and technology being the current focus [21]. - Seasonal effects suggest that value sectors may outperform in the fourth quarter, with historical data indicating a 64% success rate for value over growth during this period [23].

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

中资美元债周报:一级市场发行略有回落,二级市场小幅上涨-20251027

Guoyuan Securities2· 2025-10-27 10:08

1. Report Industry Investment Rating - No relevant information provided 2. Core Views of the Report - Last week, the issuance volume in the primary market of Chinese offshore bonds slightly declined, with 12 new bonds issued, totaling approximately $2.79 billion. The secondary market showed a slight increase. The yields of most US Treasuries moved slightly upwards. The Chinese US dollar bond index and return index both rose on a weekly basis [1][5]. - Various macro - events occurred globally, including changes in economic data in the US, Europe, Asia, and policy adjustments in different countries. In China, there were changes in GDP growth, real - estate market, and bond financing in the real - estate industry [6]. 3. Summary by Directory 3.1 Primary Market - The issuance volume of Chinese offshore bonds in the primary market slightly declined last week. Twelve new bonds were issued, with a total scale of about $2.79 billion. The largest issuance was a $700 million bond by China Three Gorges Corporation, and the bond with the highest coupon rate was a 175 million RMB bond issued by Weifang Ocean Investment Group Co., Ltd. with a coupon rate of 6.9% [7][10]. 3.2 Secondary Market 3.2.1 Chinese US Dollar Bond Index Performance - The Chinese US dollar bond index (Bloomberg Barclays) rose 0.14% on a weekly basis, and the emerging - market US dollar bond index rose 0.45%. The investment - grade index closed at 202.7346, up 0.15% week - on - week, and the high - yield index closed at 164.2079, up 0.06% week - on - week. The Chinese US dollar bond return index (Markit iBoxx) rose 0.16% on a weekly basis [5][11][15]. 3.2.2 Chinese US Dollar Bond Industry Performance - In terms of industries, the consumer staples and materials sectors led the gains, while the real - estate and healthcare sectors led the losses. The yield of the consumer staples sector decreased by 86.6bps, and that of the materials sector decreased by 64.1bps. The yield of the real - estate sector increased by 2.2Mbps, and that of the healthcare sector increased by 12.7bps [21]. 3.2.3 Chinese US Dollar Bond Different Rating Performance - According to Bloomberg composite ratings, investment - grade names all rose, with the weekly yield of A - rated names decreasing by 0.6bps and that of BBB - rated names decreasing by 16.1bps. High - yield names mostly fell, with the yield of BB - rated names decreasing by 0.1bps, the yield of DD+ to NR - rated names increasing by about 558.2bps, and the yield of unrated names increasing by 325.1bps [23]. 3.2.4 Last Week's Bond Market Hot Events - Zhenro Properties Holdings failed to pay the interest of about 12.65 million yuan on "H Zhenro 3 You". CIFI Holdings Group is expected to default on the principal and interest of CIFIHG 5.95 10/20/25 [26][27]. 3.2.5 Last Week's Subject Rating Adjustments - Ratings of some companies were adjusted, including Hangzhou Jintou, CRRC Zhuzhou, Orient Securities, Prudential, Jinjiang International, Vanke, New Oriental, China Tourism Group, and Longfor Group. Reasons for adjustments varied from policy functions, financial conditions, business operations, to market competition [29][31]. 3.3 US Treasury Quotes - The report provides quotes of 30 US Treasuries with maturities over 6 months, sorted by yield to maturity from high to low, including information such as code, maturity date, current price, yield to maturity, and coupon [32]. 3.4 Macro Data Tracking - As of October 24, the yields of US Treasuries were as follows: 1 - year (T1) was 3.583%, up 3.02bps from last week; 2 - year (T2) was 3.4799%, up 2.26bps; 5 - year (T5) was 3.6053%, up 1.37bps; 10 - year (T10) was 4.0007%, down 0.81bps [36]. 3.5 Macro News - The total US national debt exceeded $38 trillion for the first time. The US September CPI was lower than market expectations. The US October manufacturing PMI and services PMI were both better than expected. The Fed plans to relax the capital requirement proposal for large - scale banks. The US and Australia signed a critical minerals agreement. The US September existing - home sales reached the highest level in seven months. The Bank of Korea maintained the benchmark interest rate at 2.5%. The Central Bank of Turkey cut the benchmark interest rate by 100 basis points. Japan plans to launch a new round of economic measures. Japan's September exports increased by 4.2% year - on - year. The UK September CPI was lower than market expectations. Indonesia plans to issue sovereign bonds denominated in offshore RMB. FTSE Russell updated the inclusion criteria of the FTSE China On - shore RMB Bond Index. China's GDP in the first three quarters increased by 5.2% year - on - year. In September, the decline in new - home prices in first - and second - tier cities widened. The bond financing in the real - estate industry in September was 56.1 billion yuan, a year - on - year increase of 31% [35][36][38]

宏观经济专题:“十五五”:坚持以经济建设为中心

KAIYUAN SECURITIES· 2025-10-27 02:12

Economic Growth - The "15th Five-Year Plan" aims for significant achievements in high-quality development and technological self-reliance, with a focus on enhancing social civilization and improving people's quality of life[2] - An estimated market space of approximately 10 trillion yuan will be added over the next five years through the promotion of key industry upgrades[8] - The plan emphasizes the importance of maintaining strategic determination and confidence in the face of challenges[8] Infrastructure and Industry Policy - Policies focus on new urbanization infrastructure construction, with an expected investment demand exceeding 5 trillion yuan for underground pipeline renovations during the "15th Five-Year Plan" period[9] - The government will strengthen the top-level design and systematic deployment of artificial intelligence, enhancing foundational research and core technology development[11] Monetary Policy - The central bank aims to construct a scientific and stable monetary policy system, ensuring the smooth operation of stock, bond, and foreign exchange markets[13] - A moderately loose monetary policy will continue to support consumption and effective investment, maintaining financial market stability[14] Fiscal Policy - The Ministry of Finance announced the allocation of 500 billion yuan to local governments to enhance fiscal capacity and support effective investment[15] - This allocation is an increase of 100 billion yuan compared to 2024, aimed at addressing existing government investment project debts[15] Real Estate Policy - Recent policies in cities like Chengdu and Chongqing focus on adjusting housing fund loans and promoting smart construction in the housing sector[17] - The issuance of infrastructure REITs is encouraged to support urban renewal projects[17] Trade Relations - There is a potential meeting between the leaders of China and the U.S. during the upcoming APEC conference, with ongoing discussions on bilateral trade relations[18] - The Chinese government has expressed strong opposition to unilateral sanctions imposed by the EU[19]

保利集团声明:与保利集团无关

Shang Hai Zheng Quan Bao· 2025-10-25 06:17

Group 1 - China Poly Group Corporation issued a statement clarifying that it has no involvement in any activities related to "Hong Kong Poly Stablecoin" or "Poly Stablecoin Fund" [1] - The companies registered in Hong Kong, such as "Poly Digital Industry Group Co., Ltd." and "Poly Digital Asset Issuance Co., Ltd.", have no equity or affiliation with Poly Group and are not involved in any investment or business relationships with it [1] - Poly Group urges the public to be vigilant and cautious in investment collaborations and to report any illegal activities to the police [1] Group 2 - Poly Group is a large central enterprise approved by the State Council and directly managed by the State-owned Assets Supervision and Administration Commission, established 40 years ago [4] - The company has developed a diversified business system known as "5+1", covering various sectors including trade, real estate, culture, technology, engineering, and finance, with operations in over 100 cities in China and nearly 100 countries globally [4] - Poly Group ranks 173rd in the 2024 Fortune Global 500 and has received an A grade in performance assessment from the State-owned Assets Supervision and Administration Commission 13 times [4] - The company has 10 main subsidiaries, employs 90,000 staff, and has 5 publicly listed companies [4]