Wen Hua Cai Jing

Search documents

两地库存增加 日本三大港口铝库存继续回升

Wen Hua Cai Jing· 2025-10-17 10:56

Core Insights - Marubeni Corp reports that aluminum inventory at Japan's three major ports is expected to rise to 341,300 tons by the end of September 2025, reflecting a 1.8% increase from the previous month [1] - The inventory situation shows a decline in Yokohama, while Nagoya and Osaka have seen increases [1] - Ongoing low demand has led to prolonged negotiations for aluminum premiums in Japan's fourth quarter [1] Inventory Data - As of 2019, the aluminum inventory levels at Japan's three major ports have been tracked, with specific figures provided in tons [3]

日本第四季度铝升水谈判久拖不决 难以弥合分歧

Wen Hua Cai Jing· 2025-10-17 10:55

Group 1 - The quarterly pricing negotiations between Japanese aluminum buyers and global producers are unusually prolonged due to a significant gap in opinions regarding the premium for primary aluminum for the October-December shipping period [1] - Japanese buyers are negotiating with global suppliers like Rio Tinto and South32, with initial premium offers ranging from $98 to $103 per ton, reflecting a decrease of 5% to 9% compared to the previous quarter [1] - A Japanese processing plant representative indicated that the demand is weak and inventory levels are high, leading buyers to seek premiums in the $80 range, while current spot premiums are noted to be in the $70 range [1] Group 2 - As premiums continue to rise in the US and Europe, it is expected to tighten supply in Asia, prompting sellers to insist on higher premium levels [2] - The negotiations are anticipated to extend until the end of the month due to the ongoing discrepancies in pricing expectations [2]

印度斯坦锌业季度利润增长 得益于白银和锌价走强

Wen Hua Cai Jing· 2025-10-17 10:55

Core Viewpoint - Hindustan Zinc reported a nearly 14% increase in net profit for the second quarter, driven by record high silver prices, steady zinc price increases, and strong demand [1] Financial Performance - The consolidated net profit for the quarter ending September 30 rose from 23.27 billion INR to 26.49 billion INR year-on-year [1] - Total revenue increased by 3.6%, reaching 85.49 billion INR [1] Silver and Zinc Business - Hindustan Zinc is the world's third-largest silver producer and India's largest integrated silver company [1] - Domestic silver demand surged in the September quarter due to record high prices, with consumers viewing silver as an alternative investment to gold [1] - Analysts previously estimated a year-on-year increase in silver prices between 32% and 39% [1] - Zinc prices are expected to have increased by nearly 2% during the same period [1] - The company's zinc business revenue grew by approximately 2%, while silver business revenue increased by 10% [1] Market Position - Hindustan Zinc holds nearly three-quarters of the domestic zinc market share [1] - The demand for zinc remains strong due to ongoing growth in India's manufacturing sector, particularly for zinc used in steel corrosion protection coatings [1]

10月16日LME金属库存及注销仓单数据

Wen Hua Cai Jing· 2025-10-17 08:40

Core Insights - The article provides an overview of the changes in warehouse inventories for various metals, including copper, aluminum, zinc, tin, and nickel, highlighting the fluctuations in registered and canceled warehouse receipts. Group 1: Copper Inventory Changes - The total copper inventory decreased to 137,225 tons, down from 137,450 tons, reflecting a change of -0.38% [1][3] - Registered warehouse receipts for copper increased by 3.64% to 7,825 tons, while the cancellation ratio rose to 5.70% [1][3] Group 2: Aluminum Inventory Changes - Aluminum inventory stands at 491,225 tons, a decrease of 4,100 tons from the previous day, marking a change of -0.83% [5][7] - The cancellation ratio for aluminum is reported at 17.42%, with registered receipts totaling 85,575 tons [5][7] Group 3: Zinc Inventory Changes - Zinc inventory is recorded at 38,025 tons, showing a decrease of 275 tons, which is a change of -0.72% [9] - The cancellation ratio for zinc is 35.77%, with registered receipts at 13,600 tons [9] Group 4: Tin Inventory Changes - Tin inventory increased to 2,735 tons, up by 160 tons, reflecting a change of +7.05% [11] - The cancellation ratio for tin is 8.41%, with registered receipts at 230 tons [11] Group 5: Nickel Inventory Changes - Nickel inventory rose to 250,530 tons, an increase of 186 tons, marking a change of +0.07% [13] - The cancellation ratio for nickel is 2.46%, with registered receipts totaling 6,168 tons [13]

丸红:日本9月底三大港口铝库存环比增长

Wen Hua Cai Jing· 2025-10-17 08:34

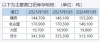

Core Insights - Marubeni Corporation reported an increase in aluminum inventory at Japan's three major ports to 341,300 tons as of the end of September, reflecting a 1.8% rise from the previous month [1] Inventory Details - Yokohama port: 144,700 tons in September, down from 146,100 tons in August and down from 153,200 tons in September 2024 [2] - Nagoya port: 176,900 tons in September, up from 170,300 tons in August and up from 140,100 tons in September 2024 [2] - Osaka port: 19,700 tons in September, up from 18,900 tons in August and slightly down from 19,800 tons in September 2024 [2] - Total inventory across the three ports: 341,300 tons in September, up from 335,300 tons in August and up from 313,100 tons in September 2024 [2]

沪铜偏弱震荡 等待更多指引【10月17日SHFE市场收盘评论】

Wen Hua Cai Jing· 2025-10-17 07:36

Core Viewpoint - The copper market is experiencing weak fluctuations, with a closing drop of 0.79%, driven by macroeconomic uncertainties and general demand for copper, alongside accumulating social inventory [1] Group 1: Market Conditions - The Federal Reserve's dovish stance has led to strong market expectations for two interest rate cuts by the end of the year, despite ongoing risks such as the U.S. government shutdown and fluctuating U.S.-China trade tensions [1] - Supply-side disruptions previously caused a spike in copper futures, with ongoing concerns about tight mining supplies and persistently low processing fees for domestic copper concentrate [1] Group 2: Pricing and Supply Dynamics - Codelco, the Chilean state-owned copper company, is proposing to sell copper to European customers at a record premium of $325 per ton for next year, marking a 39% increase from this year [1] - Global mining supply remains tight, with domestic refined copper production cooling and limited rebound in social inventory, indicating strong resilience in the domestic market [1]

日本第四季度铝升水谈判久拖不决,难以弥合分歧

Wen Hua Cai Jing· 2025-10-17 07:03

Group 1 - The quarterly pricing negotiations between Japanese aluminum buyers and global producers are unusually prolonged due to significant differences in opinions regarding the premium for primary aluminum for the October-December shipment period [1] - Japanese buyers have set a regional benchmark for premiums based on the London Metal Exchange (LME) spot price, but the ongoing negotiations have lasted several weeks after the quarter began, which is atypical [1] - Initial premium offers from producers ranged from $98 to $103 per ton, reflecting a decrease of 5% to 9% compared to the previous quarter [1] Group 2 - A producer later adjusted their offer from $103 to $97 per ton, but buyers rejected this, seeking a premium in the $80 range, citing current spot premiums in the low $70s [1] - A representative from a Japanese processing plant indicated that the $97 offer had expired and requested a new quote from producers, emphasizing weak demand and high inventory levels as reasons for their lower price expectations [1] - As of the end of September, aluminum inventories at Japan's three major ports reached 341,300 tons, an increase of 1.8% month-on-month [1] Group 3 - A producer's representative noted that rising premiums in the U.S. and Europe are expected to tighten supply in Asia, leading sellers to insist on higher price levels [2] - The negotiations are anticipated to continue until the end of the month [2]

智利Codelco大幅上调2026年欧洲铜溢价至创纪录高位345美元/吨

Wen Hua Cai Jing· 2025-10-17 05:31

Core Insights - Codelco, the state-owned copper company in Chile, is proposing to sell copper to its European customers at a record premium of $325 per ton for next year, marking a 39% increase from this year [2] - The premium set by Codelco is based on the London Metal Exchange (LME) contracts and is used as a global benchmark for copper, which is widely used in the power and construction industries [2] - The record-high premium is driven by concerns over potential copper supply shortages next year, which has recently pushed LME copper prices to a 16-month high of $11,000 per ton [2] - Freeport-McMoRan announced that its Grasberg copper mine in Indonesia faced force majeure due to a landslide incident, contributing to supply concerns [2] - Other mines, including Kamoa-Kakula in the Democratic Republic of Congo and El Teniente in Chile, have also experienced disruptions this year [2] - Aurubis, Europe's largest copper smelting company, is also expected to charge a record premium of $315 per ton for refined copper to its European customers next year [2] Industry Challenges - China's copper industry faces three major challenges: increasing reliance on foreign resources in the upstream sector, overcapacity in the midstream processing segment, and suppressed downstream demand due to high copper prices [2] - To assist the industry in navigating these changes, Shanghai Nonferrous Metals Network is collaborating with copper industry enterprises to compile a bilingual distribution map of the Chinese copper industry chain for 2026 [2]

几内亚第三季度铝土矿出口跳增23% 尽管遭遇降雨和监管压力

Wen Hua Cai Jing· 2025-10-17 01:43

Group 1 - Guinea's bauxite exports surged by 23% year-on-year in Q3, reaching 39.41 million tons, despite challenges from heavy rainfall and regulatory hurdles [1] - The average monthly shipment volume for Q3 was 13.14 million tons, which is nearly a 19% decrease compared to the first half of the year due to disruptions in mining and port operations [1] - China accounted for 54.6% of Guinea's bauxite exports in Q3, with Guinea supplying about one-third of China's bauxite imports [1] Group 2 - The long-delayed Simandou iron ore project is set to make its first shipment, primarily of high-grade ore destined for China [1] - In Q3 2025, Guinea exported only 78,000 tons of alumina, as the government increased pressure on miners to build alumina refineries domestically [2]

哈萨克1-9月铜产量同比增加1.2%

Wen Hua Cai Jing· 2025-10-17 01:19

Group 1 - The core point of the article highlights the production changes in Kazakhstan's metal industry, with refined copper output increasing by 1.2% year-on-year to 355,305 tons, while refined zinc production decreased by 3% to 193,859 tons, and alumina and unprocessed aluminum production fell by 0.8% to 1,345,312 tons [2] Group 2 - The article discusses the challenges faced by China's copper industry, including rising dependence on foreign resources, overcapacity in the midstream processing sector, and suppressed downstream demand due to high copper prices [2] - To assist the industry in navigating these challenges, Shanghai Nonferrous Metals Network has collaborated with copper industry enterprises to compile a bilingual distribution map of the Chinese copper industry chain for 2026 [2]