CBOT小麦

Search documents

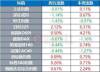

2026年春节假期期间国际品种涨跌幅

Ge Lin Qi Huo· 2026-02-24 08:03

Report Summary 1. Core View - The report presents the price changes of various international varieties from February 13th, 15:00 to February 23rd, 18:00 in 2026, including stock indices, commodities, and currency indices [3]. 2. Key Points by Category Stock Indices - The FTSE A50 Index rose from 14,684 to 14,919, a 1.60% increase [3]. - The Hang Seng Index increased from 26,595.15 to 27,081.91, a 1.83% rise [3]. - The Dow Jones Industrial Index went up from 49,451.98 to 49,625.97, a 0.35% increase [3]. - The S&P 500 Index climbed from 6,832.76 to 6,909.51, a 1.12% gain [3]. - The NASDAQ Composite Index advanced from 22,597.15 to 22,886.07, a 1.28% increase [3]. - The Nikkei 225 Index dropped from 56,941.97 to 56,825.7, a 0.20% decline [3]. Commodity Indices - The Baltic Dry Index decreased from 2,083 to 2,043, a 1.92% fall [3]. Energy Commodities - Brent Crude Oil rose from $67.55 to $71.04, a 5.17% increase [3]. - US Crude Oil increased from $62.83 to $66.23, a 5.41% rise [3]. Precious Metals - CMX Gold climbed from $4,986.7 to $5,170.1, a 3.68% gain [3]. - CMX Silver advanced from $77.105 to $86.515, a 12.20% increase [3]. Base Metals - LME Copper rose from $12,894.5 to $12,966, a 0.55% increase [3]. - LME Aluminum increased from $3,062.5 to $3,102.5, a 1.31% rise [3]. - LME Zinc went up from $3,352.5 to $3,377.5, a 0.75% increase [3]. - LME Lead dropped from $1,976.5 to $1,963, a 0.68% decline [3]. - LME Nickel advanced from $17,255 to $17,600, a 2.00% increase [3]. - LME Tin climbed from $46,940 to $47,500, a 1.19% gain [3]. Iron Ore - TSI Iron Ore decreased from $97.15 to $95.85, a 1.34% fall [3]. Agricultural Commodities - CBOT Soybeans rose from $1,134.75 to $1,146.75, a 1.06% increase [3]. - CBOT Soybean Meal increased from $308.6 to $309.7, a 0.36% rise [3]. - CBOT Soybean Oil advanced from $57.26 to $59.67, a 4.21% increase [3]. - CBOT Corn climbed from $430.25 to $438.75, a 1.98% gain [3]. - CBOT Wheat rose from $550.75 to $575.75, a 4.54% increase [3]. - MDE Crude Palm Oil increased from 3,996 to 4,084, a 2.20% rise [3]. - ICE No. 2 Cotton advanced from 64.26 to 65.46, a 1.87% increase [3]. - ICE No. 11 Sugar climbed from 13.53 to 13.9, a 2.73% gain [3]. Currency Indices - The US Dollar Index rose from 97.0775 to 97.6349, a 0.57% increase [3]. Currency Pairs - The US Dollar against Offshore RMB decreased from 6.908 to 6.8852, a 0.33% decline [3].

外盘表现:春节假期外盘市场涨跌幅统计

Guan Tong Qi Huo· 2026-02-23 07:40

Report Industry Investment Rating - Not provided in the given content Core Viewpoints - The report presents the price and cumulative percentage change of various commodities, stock market indices, and other important indicators during the Spring Festival holiday in the overseas market [2] Summaries by Related Catalogs Commodities - NYMEX crude oil closed at $66.31 on February 20, with a cumulative increase of 5.57% during the holiday [2] - NYMEX natural gas closed at $2.99 on February 20, with a cumulative decrease of 6.41% during the holiday [2] - COMEX gold closed at $5130.00 on February 20, with a cumulative increase of 1.31% during the holiday [2] - COMEX silver closed at $84.57 on February 20, with a cumulative increase of 9.45% during the holiday [2] - LME copper closed at $12964.00 on February 20, with a cumulative increase of 0.25% during the holiday [2] - LME zinc closed at $3382.50 on February 20, with a cumulative increase of 1.20% during the holiday [2] - LME nickel closed at $17435.00 on February 20, with a cumulative increase of 2.59% during the holiday [2] - LME aluminum closed at $3102.50 on February 20, with a cumulative increase of 0.39% during the holiday [2] - LME tin closed at $46559.00 on February 20, with a cumulative decrease of 0.62% during the holiday [2] - LME lead closed at $1965.00 on February 20, with a cumulative decrease of 0.35% during the holiday [2] - TSI iron ore CFR China (62% iron powder) closed at $95.30 on February 20, with a cumulative decrease of 1.60% during the holiday [2] - CBOT soybeans closed at $1153.75 on February 20, with a cumulative increase of 1.67% during the holiday [2] - CBOT corn closed at $428.00 on February 20, with a cumulative decrease of 0.87% during the holiday [2] - CBOT soybean oil closed at $59.34 on February 20, with a cumulative increase of 3.80% during the holiday [2] - CBOT soybean meal closed at $314.20 on February 20, with a cumulative increase of 1.58% during the holiday [2] - CBOT wheat closed at $581.75 on February 20, with a cumulative increase of 5.97% during the holiday [2] - CBOT rice closed at $10.52 on February 20, with a cumulative decrease of 4.54% during the holiday [2] - ICE 11 - sugar closed at $13.86 on February 20, with a cumulative increase of 2.29% during the holiday [2] - ICE 2 - cotton closed at $65.55 on February 20, with a cumulative increase of 2.13% during the holiday [2] Stock Market - The S&P 500 closed at 6909.51 on February 20, with a cumulative increase of 1.07% during the holiday [2] - The Nasdaq Index closed at 22886.07 on February 20, with a cumulative increase of 1.51% during the holiday [2] - The UK FTSE 100 closed at 10686.89 on February 20, with a cumulative increase of 2.30% during the holiday [2] - The French CAC40 closed at 8515.49 on February 20, with a cumulative increase of 2.45% during the holiday [2] - The German DAX closed at 25260.69 on February 20, with a cumulative increase of 1.39% during the holiday [2] - The Nikkei 225 closed at 56825.70 on February 20, with a cumulative decrease of 0.20% during the holiday [2] - The Hang Seng Index closed at 26413.35 on February 20, with a cumulative decrease of 0.58% during the holiday [2] Other Important Indicators - The US dollar index closed at 97.74 on February 20, with a cumulative increase of 0.91% during the holiday [2]

近十年春节期间外盘涨跌幅统计

Guan Tong Qi Huo· 2026-02-11 06:28

| 冠通期货 研究咨询部 王静 | | --- | | 执业资格证书编号:F0235424/Z0000771 | | 联系方式:010-85356618 | 使用本报告及其内容所引发的任何直接或间接损失概不负责 本报告仅向特定客户传送 任何机构和个人均不得以任何形式翻版 载。如引用、转载、刊发,须注明出处为冠通期货股份有限公司。 近五年涨跌幅均值 NYMEX原油 NYMEX天然 气 COMEX黄金 COMEX白银 LME铜 LME锌 LME镍 LME铝 LME锡 LME铅 CBOT大豆 CBOT玉米 CBOT豆油 CBOT豆粕 CBOT小麦 CBOT稻谷 ICE11号糖 ICE2号棉 花 标普500 美元指数 CRB商品指 数 BDI 近十年平均 0.01% -3.23% 0.82% 1.95% 0.00% 0.11% 0.44% 0.27% 1.70% 0.53% 0.61% -0.19% -0.43% 0.81% -0.53% -1.71% -0.07% 1.28% 0.08% -0.03% 0.01% 0.67% -4.00% -3.00% -2.00% -2.00% 0.00% 2.00% 4.00% ...

国内商品期市收盘多数上涨,化工品涨幅居前

Zhong Xin Qi Huo· 2026-01-23 01:15

Report Industry Investment Rating - No information provided in the report Core Viewpoints - On January 22, 2026, most domestic commodity futures markets closed higher, with chemicals leading the gains [14]. - The US economy maintains a "slight to moderate" expansion, inflation continues to cool, and consumption shows a "K-shaped" characteristic [14]. - In 2025, China's consumer market scale exceeded 50 trillion yuan, with service retail sales growing faster. In 2026, consumption is expected to grow steadily [14]. - In the short term, risk assets may continue to adjust, but in the medium term, it is recommended to go long on stock indices, non - ferrous metals, gold, and silver [14]. Summary by Directory Financial Market Fluctuations - **Stock Index Futures**: On January 22, 2026, the CSI 300 futures price was 4719.4, down 0.26; the SSE 50 futures price was 3061.2, down 0.61; the CSI 500 futures price was 8400, up 0.25; the CSI 1000 futures price was 8292.6, up 0.56 [3]. - **Treasury Bond Futures**: The 2 - year treasury bond futures price was 102.408, down 0.02; the 5 - year was 105.835, down 0.04; the 10 - year was 108.15, down 0.04; the 30 - year was 112.17, down 0.03 [3]. - **Foreign Exchange**: The US dollar index was 98.7693, up 0.23; the US dollar central parity rate was 6.9646, down 57 pips [3]. - **Interest Rates**: The 7 - day inter - bank pledged repo rate was 1.4952%, up 0.04%; the 10 - year Chinese treasury bond yield was 1.8312%, down 0.14 bp; the 10 - year US treasury bond yield was 4.26%, down 4 bp [3]. Popular Industry Fluctuations - On January 22, 2026, industries such as national defense and military industry, steel, and petroleum and petrochemicals had relatively large daily increases, while industries such as food and beverage, non - bank finance, and banking had declines [6]. Overseas Commodity Fluctuations - **Energy**: On January 21, 2026, NYMEX WTI crude oil was at $59.52, up 0.3%; ICE Brent crude was at $64.62, up 0.67%; NYMEX natural gas was at $3.891, up 25.39%; ICE UK natural gas was at $105.29, up 12.07% [9]. - **Precious Metals**: COMEX gold was at $4769.1, up 3.78%; COMEX silver was at $94.46, up 6.69% [9]. - **Non - ferrous Metals**: LME copper was at $12810, up 0.44%; LME aluminum was at $3115, up 0.24%; LME zinc was at $3175, up 0.06% [9]. - **Agricultural Products**: CBOT soybeans were at $1053, down 0.45%; CBOT soybean oil was at $54.05, up 2.83%; CBOT corn was at $424, down 0.18% [9]. Domestic Commodity Fluctuations - On January 22, 2026, most domestic commodities rose. Chemicals, new energy materials, non - metal building materials, energy products, etc. all had increases, while precious metals had declines [14]. Macro Summary - **Today's Market**: Domestic commodity futures markets closed mostly higher, with chemicals leading the gains [14]. - **Overseas Macro**: The US economy maintains a "slight to moderate" expansion, inflation cools, and consumption shows a "K - shaped" characteristic. Attention should be paid to upcoming GDP and inflation data [14]. - **Domestic Macro**: In 2025, China's consumer market scale exceeded 50 trillion yuan, and in 2026, consumption is expected to grow steadily [14]. - **Asset Views**: The scenario of no interest rate cut in January is basically confirmed, and the first interest rate cut by the Fed within the year is expected to be postponed to June. Short - term risk assets may adjust, while in the medium - term, it is recommended to go long on certain assets [14]. Viewpoint Highlights - **Financial**: Stock markets continue to wait for the main line, and bond markets still have disturbing factors. The short - term judgments for stock index futures, index options, and treasury bond futures are oscillatory rise, oscillation, and oscillation respectively [15]. - **Precious Metals**: After oscillatory adjustment, they maintain an upward trend. Gold and silver are expected to rise oscillatory [15]. - **Shipping**: Pay attention to the resumption of voyages in the far - month. The short - term judgment for the container shipping European line is oscillation [15]. - **Black Building Materials**: Fundamentals are lackluster. Most varieties are expected to oscillate [15]. - **Non - ferrous Metals and New Materials**: Wait for the macro - situation to become clearer. Base metals are oscillating and consolidating. Some varieties are expected to rise oscillatory, while others are expected to oscillate [15]. - **Energy and Chemicals**: The trade tension eases slightly, but the supply - demand pattern is still under pressure. Most varieties are expected to oscillate [17]. - **Agriculture**: Sentiment warms up but trends diverge. Some varieties are expected to rise oscillatory, while others are expected to oscillate or decline oscillatory [17].

中信期货晨报:国内期货主力合约涨多跌少,碳酸锂大幅收涨-20251111

Zhong Xin Qi Huo· 2025-11-11 01:41

1. Report Industry Investment Rating No relevant content provided. 2. Core Views of the Report - In November, the macro environment enters a vacuum period, and major asset classes lack further positive drivers. The market needs to digest previous gains, so major assets may enter a short - term shock period. However, the overall allocation strategy for the fourth quarter remains unchanged, and the macro environment is still favorable for risk assets. It is recommended that investors allocate major asset classes evenly in the fourth quarter, hold long positions in stock indices, non - ferrous metals (copper, lithium carbonate, aluminum, tin), and precious metals, and increase positions appropriately if there is a correction in the fourth quarter [8]. 3. Summary by Sections 2.1 Macro Highlights - **Overseas Macro**: This week, the global macro focus is on changes in US dollar liquidity. Although there is a short - term tightening trend, it is not expected to have a significant impact on major asset prices. There are two factors that may improve US dollar liquidity: marginal easing of monetary policy and the normal release of funds in the TGA account once the US government resumes work [8]. - **Domestic Macro**: In October, China's export volume growth was weaker than expected and the previous value, and the month - on - month performance was also weaker than the seasonal average. However, more positive information was found in the October inflation data. Additionally, there is a possibility that the October consumption data may slightly exceed expectations [8]. 2.2 View Highlights Financial - **Stock Index Futures**: Driven by technology events, the growth style is active. With the congestion of small - cap funds, it is expected to fluctuate and rise [9]. - **Stock Index Options**: The overall market trading volume has slightly declined. With the option market liquidity falling short of expectations, it is expected to fluctuate [9]. - **Treasury Bond Futures**: The bond market continues to be weak. Considering factors such as policy, fundamental recovery, and tariffs, it is expected to fluctuate [9]. Precious Metals - **Gold/Silver**: With the easing of geopolitical and trade tensions, precious metals are in a phased adjustment. Affected by the US fundamentals, Fed's monetary policy, and global equity market trends, it is expected to fluctuate [9]. Shipping - **Container Shipping to Europe**: As the peak season in the third quarter fades, there is pressure on loading and a lack of upward drivers. Pay attention to the rate of freight decline in September, and it is expected to fluctuate [9]. Black Building Materials - **Steel**: In the off - season, demand is under pressure, and the futures price has fallen from a high level. Pay attention to the progress of special bond issuance, steel exports, and molten iron production, and it is expected to fluctuate [9]. - **Iron Ore**: The pressure of inventory accumulation is released in advance, and the supply - demand relationship is expected to improve. Affected by overseas mine production and shipment, domestic molten iron production, weather, port inventory, and policy, it is expected to fluctuate [9]. - **Coke**: Three rounds of price increases have been implemented, and a fourth round is proposed. Pay attention to steel mill production, coking costs, and macro sentiment, and it is expected to fluctuate [9]. Non - ferrous Metals and New Materials - **Copper**: Due to the tight US dollar liquidity, the copper price is in a short - term adjustment. Affected by supply disruptions, domestic policies, Fed's policy, and domestic demand, it is expected to fluctuate [9]. - **Aluminum**: With the linkage between stocks and futures, the aluminum price is expected to fluctuate and rise. However, it is affected by macro risks, supply disruptions, and demand [9]. - **Lithium Carbonate**: The resumption of production is uncertain, and there is a risk of significant price fluctuations. Affected by demand, supply, and new technologies, it is expected to fluctuate [9]. Energy and Chemicals - **Crude Oil**: Supply pressure persists, and geopolitical risks remain. Affected by OPEC+ production policies and the Middle East geopolitical situation, it is expected to fluctuate [11]. - **LPG**: Supply is still in surplus. Pay attention to the cost side, such as crude oil and overseas propane, and it is expected to fluctuate [11]. - **Low - Sulfur Fuel Oil**: With the strength of refined oil products, it may run strongly. Affected by crude oil prices, it is expected to fluctuate and rise [11]. Agriculture - **Pig**: There is a game between supply and demand, and the pig price is expected to fluctuate and fall. Affected by breeding sentiment, epidemics, and policies [11]. - **Natural Rubber**: The futures price rebounds strongly, and its sustainability needs attention. Affected by production area weather, raw material prices, and macro changes, it is expected to fluctuate and fall [11]. - **Cotton**: The price fluctuation range is limited. Affected by demand and inventory, it is expected to fluctuate [11].

美媒称美将打击委内瑞拉境内目标 特朗普:尚未决定|环球市场

Sou Hu Cai Jing· 2025-10-31 23:23

Market Overview - The US stock market saw all three major indices close higher, with the Nasdaq rising by 0.61% and achieving a cumulative increase of 4.7% in October, marking its seventh consecutive monthly gain [1] - Amazon's stock surged over 9%, reaching an all-time high [1] - The Nasdaq China Golden Dragon Index rose by 0.53%, ending a previous five-month decline with a cumulative drop of 4.19% in October [1] Commodity Market - International crude oil futures experienced slight increases, with WTI crude oil futures rising by 0.68% to settle at $60.98 per barrel, reflecting a cumulative decline of 3.89% in October [2] - Brent crude oil futures increased by 0.11% to $65.07 per barrel, with a cumulative drop of 4.26% in October [2] - Gold prices saw a slight decrease of 0.51%, settling at $4004.02 per ounce, while cumulative gains for October stood at 3.74% [3] Economic Policy and Market Sentiment - Bank of America strategists indicated that gold and Chinese stocks are the best hedging tools against the AI boom, as the forward P/E ratio of the S&P 500 has reached 23 times, significantly above the 20-year average of 16 times [14] - Federal Reserve officials expressed caution regarding excessive interest rate cuts, indicating that the path forward for monetary policy should be data-driven [11][12]

深度丨国庆假期,海外发生了什么?【陈兴团队•财通宏观】

陈兴宏观研究· 2025-10-07 09:01

Global Asset Performance - Global stock indices mostly rose during the holiday week, with the MSCI global index up 0.8%, and Taiwan and Korea indices leading with gains of 3.6% each [2][5] - The US stock market saw slight increases in major indices, with the Nasdaq, Dow Jones, and S&P 500 rising by 0.5%, 0.8%, and 0.4% respectively [5][7] - In the bond market, US Treasury yields declined, while government bond yields in several other countries also fell [10][12] - The US dollar index decreased by 0.1% to 97.7, while the offshore RMB slightly depreciated by 0.1% to 7.14 [16][18] Overseas Economic Developments Monetary Policy in the US and Europe - There is a divergence in views regarding potential interest rate cuts by the Federal Reserve, with some officials advocating caution [18][20] - The European Central Bank's president indicated that the impact of tariffs on inflation is lower than expected, with inflation in the Eurozone remaining stable at around 2% [20][36] US Economic Indicators - The ADP report indicated a decrease of 32,000 jobs in September, with the leisure and hospitality sector seeing the largest declines [22][24] - The ISM non-manufacturing PMI fell to 50%, indicating weak business activity and continued pressure on employment [24][26] - The US housing market shows signs of recovery, with new home sales increasing by 20.5% month-on-month, although home prices remain under pressure [29][31] Government Shutdown Impact - The US government shutdown, which began on October 1, may last over a week, affecting the release of key economic data [27][31] - Historical data suggests that government shutdowns can slightly impact GDP growth, with estimates indicating a reduction of 0.1-0.2 percentage points per week [31][34] Commodity Market Trends - Global commodity prices, excluding oil, generally rose, with LME tin leading the gains at 4.2% [14][16] - Precious metals also saw increases, with COMEX gold up 2.7% and silver up 3.9% during the holiday week [14][16] Regional Economic Insights - Eurozone inflation remains stable, with a CPI increase to 2.2% in September, driven mainly by service costs [36][37] - Japan's political landscape is shifting with the election of the first female president of the ruling party, who is expected to continue a conservative policy approach [37]

冠通期货:近十年国庆假期外盘涨跌幅统计

Guan Tong Qi Huo· 2025-09-26 10:16

Report Summary 1. Report Industry Investment Rating - No information provided in the given content. 2. Core Viewpoints - The report presents the average and median price changes of various commodities and indices during the National Day holidays over the past ten years and the past five years, including NYMEX crude oil, NYMEX natural gas, COMEX gold, COMEX silver, LME copper, LME zinc, LME nickel, LME aluminum, LME tin, LME lead, CBOT soybeans, CBOT corn, CBOT soybean oil, CBOT soybean meal, CBOT wheat, CBOT rice, ICE 11 - sugar, ICE 2 - cotton, S&P 500, US Dollar Index, CRB Commodity Index, and BDI [1][3] 3. Summary by Relevant Catalogs 3.1 NYMEX Crude Oil - Over the past ten years, the average price change during the National Day holiday was 3.18%, with a median of 3.33%. In the past five years, the average was 5.75%, and the median was 4.97% [1] 3.2 NYMEX Natural Gas - The ten - year average price change was 0.97%, and the median was - 1.57%. In the past five years, the average was 0.73%, and the median was - 3.19% [1] 3.3 COMEX Gold - The ten - year average price change was 0.08%, and the median was 0.30%. In the past five years, the average was 0.14%, and the median was 0.21% [1] 3.4 COMEX Silver - The ten - year average price change was 1.33%, and the median was 1.82%. In the past five years, the average was 1.54%, and the median was 2.01% [1] 3.5 LME Copper - The ten - year average price change was 0.26%, and the median was - 0.16%. In the past five years, the average was 0.44%, and the median was - 0.25% [1] 3.6 LME Zinc - The ten - year average price change was - 0.21%, and the median was 0.09%. In the past five years, the average was - 0.21%, and the median was - 0.29% [1] 3.7 LME Nickel - The ten - year average price change was 0.88%, and the median was 1.06%. In the past five years, the average was 1.67%, and the median was 2.20% [1] 3.8 LME Aluminum - The ten - year average price change was 1.87%, and the median was 1.91%. In the past five years, the average was 2.38%, and the median was 2.04% [1] 3.9 LME Tin - The ten - year average price change was 0.98%, and the median was 1.07%. In the past five years, the average was 0.58%, and the median was 1.47% [1] 3.10 LME Lead - The ten - year average price change was 0.92%, and the median was 1.02%. In the past five years, the average was 1.84%, and the median was 2.11% [1] 3.11 CBOT Soybeans - The ten - year average price change was 0.21%, and the median was 0.20%. In the past five years, the average was - 0.61%, and the median was - 0.82% [1] 3.12 CBOT Corn - The ten - year average price change was 0.78%, and the median was 0.73%. In the past five years, the average was 0.75%, and the median was 0.72% [1] 3.13 CBOT Soybean Oil - The ten - year average price change was 2.32%, and the median was 2.29%. In the past five years, the average was 2.74%, and the median was 2.96% [1] 3.14 CBOT Soybean Meal - The ten - year average price change was - 0.40%, and the median was - 0.24%. In the past five years, the average was - 1.73%, and the median was - 2.92% [1] 3.15 CBOT Wheat - The ten - year average price change was 0.09%, and the median was - 0.24%. In the past five years, the average was 0.34%, and the median was 1.71% [1] 3.16 CBOT Rice - The ten - year average price change was 1.03%, and the median was 0.34%. In the past five years, the average was 0.02%, and the median was - 0.53% [1] 3.17 ICE 11 - Sugar - The ten - year average price change was 3.04%, and the median was 1.12%. In the past five years, the average was 1.58%, and the median was - 0.31% [1] 3.18 ICE 2 - Cotton - The ten - year average price change was 0.78%, and the median was 0.14%. In the past five years, the average was 0.96%, and the median was 0.05% [1] 3.19 S&P 500 - The ten - year average price change was 0.74%, and the median was 0.70%. In the past five years, the average was 1.04%, and the median was 1.51% [1] 3.20 US Dollar Index - The ten - year average price change was 0.32%, and the median was 0.23%. In the past five years, the average was 0.38%, and the median was - 0.03% [1] 3.21 CRB Commodity Index - The ten - year average price change was 1.46%, and the median was 1.91%. In the past five years, the average was 2.03%, and the median was 2.37% [1][3] 3.22 BDI - The ten - year average price change was 3.82%, and the median was 4.44%. In the past five years, the average was 7.82%, and the median was 11.61% [1][3]

近十年国庆假期外盘涨跌幅统计

Guan Tong Qi Huo· 2025-09-26 08:05

Report Summary 1) Report Industry Investment Rating - No investment rating information is provided in the given content. 2) Core View of the Report - The report presents the price change statistics of various commodities and indices during the National Day holidays in the past ten and five years, including NYMEX crude oil, NYMEX natural gas, COMEX gold, etc., to show their historical performance during the holidays [1][2][4]. 3) Summary by Related Catalog a. Ten - year Average and Median Statistics - The ten - year average price changes during the National Day holidays are as follows: NYMEX crude oil 3.18%, NYMEX natural gas 0.97%, COMEX gold 0.08%, etc. The ten - year median price changes are: NYMEX crude oil 3.33%, NYMEX natural gas - 1.57%, COMEX gold 0.30%, etc [1][4]. b. Five - year Average and Median Statistics - The five - year average price changes during the National Day holidays are: NYMEX crude oil 5.75%, NYMEX natural gas 0.73%, COMEX gold 0.14%, etc. The five - year median price changes are: NYMEX crude oil 4.97%, NYMEX natural gas - 3.19%, COMEX gold 0.21%, etc [2][4]. c. Annual Price Changes from 2015 - 2024 - The report details the price changes of each commodity and index during the National Day holidays from 2015 to 2024. For example, NYMEX crude oil had a 6.15% change in 2015, 3.12% in 2016, and - 4.63% in 2017 [4].

空头回补影响下 CBOT软红冬小麦期货震荡上涨

Jin Tou Wang· 2025-09-24 02:59

Market Insights - Chicago Board of Trade (CBOT) soft red winter wheat futures closed up by 2% due to short covering [1] - As of the week ending September 19, CBOT wheat deliverable stocks were 56.406 million bushels, a decrease of 1.11% from the previous week and a decrease of 2.94% from the same period last year [1] EU Export Data - According to the European Commission, the EU's barley export volume for 2025/26 is projected at 1.85 million tons, up from 1.52 million tons last year [1] - The EU's soft wheat export volume for 2025/26 is projected at 4.12 million tons, down from 6.13 million tons last year [1] Crop Progress Report - The USDA's weekly crop progress report indicated that as of September 21, the U.S. spring wheat harvest rate was 96%, below market expectations of 97%, and slightly above the previous week's 94% [1] - The winter wheat planting rate was reported at 20%, below market expectations of 22%, and up from 11% the previous week [1] - The winter wheat emergence rate remained at 4%, consistent with the same period last year and the five-year average [1]