POP MART(09992)

Search documents

北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-22 17:11

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as Pop Mart and Xiaomi, while other stocks like Alibaba faced substantial net selling [2][6]. Group 1: Stock Performance - Pop Mart (09992) received a net inflow of HKD 11.2 billion, with a projected revenue growth of 245%-250% year-on-year for Q3 2025, driven by strong domestic and international sales [6]. - Xiaomi Group-W (01810) saw a net inflow of HKD 4.81 billion, following a share buyback of 10.7 million shares at prices between HKD 45.9 and HKD 46.76, totaling approximately HKD 4.94 billion [6]. - Semiconductor stocks, including Huahong Semiconductor (01347) and SMIC (00981), attracted net inflows of HKD 4.41 billion and HKD 1.28 billion, respectively, amid positive sentiment regarding the semiconductor industry's growth driven by AI [6]. Group 2: Company Earnings and Projections - China Mobile (00941) reported Q3 service revenue of HKD 216.2 billion, a year-on-year increase of 0.8%, with EBITDA declining by 1.7% to HKD 79.4 billion, slightly below market expectations [7]. - China Life (02628) projected a net profit of approximately HKD 156.79 billion to HKD 177.69 billion for the first three quarters, reflecting a year-on-year growth of 50% to 70% [7]. - The report indicated that the net profit for Q3 could grow by 75% to 106% year-on-year, driven by improved investment returns and optimized asset allocation [7]. Group 3: Market Sentiment and Trends - The overall market sentiment showed a divergence in fund flows, with significant net selling in stocks like Alibaba (09988) and Tencent (00700), indicating cautious investor sentiment amid global economic uncertainties [8]. - The report highlighted that the current market volatility is influenced more by emotional factors rather than fundamental reversals, suggesting a need for careful timing in investment strategies [7].

中国潮玩迈向品牌“出海”

Zheng Quan Ri Bao Zhi Sheng· 2025-10-22 16:40

Core Insights - The article highlights the significant growth of Chinese潮玩 (trendy toys) brands in overseas markets, particularly by泡泡玛特 (Pop Mart), which reported substantial revenue increases across various regions in Q3 2025 [1][4] - The trend of self-owned IPs going global is emphasized, with companies focusing on their own intellectual properties rather than licensed ones [1][4] Group 1: Revenue Growth - In Q3 2025,泡泡玛特's overseas revenue in the Asia-Pacific region grew by 170% to 175%, in the Americas by 1265% to 1270%, and in Europe and other regions by 735% to 740% [1] - The overall export of toys from China, including trendy toys, exceeded 500 billion yuan in the first three quarters of 2025, reaching over 200 countries and regions [1] Group 2: Self-Owned IP Expansion -潮玩 brand HERE奇梦岛 has accelerated the international expansion of its self-owned IPs like WAKUKU and SIINONO, successfully launching multiple pop-up stores in Dubai, Indonesia, and Thailand [2] - 52TOYS showcased its self-owned IPs at major international exhibitions, with its变形机甲猛兽匣 series gaining significant attention and sales in overseas markets [2][3] Group 3: Market Strategy and Localization - The transition from "product export" to "brand export" is noted, indicating a shift towards exporting IP, culture, and complete consumer experiences [4] - HERE奇梦岛 emphasizes the importance of deep localization for emotional resonance, which includes understanding local cultural symbols and social habits [5]

港股通(深)净买入33.25亿港元

Zheng Quan Shi Bao Wang· 2025-10-22 14:29

Core Viewpoint - On October 22, the Hang Seng Index fell by 0.94% to close at 25,781.77 points, while southbound funds through the Stock Connect recorded a net purchase of HKD 10.018 billion [1] Group 1: Market Activity - The total trading volume for the Stock Connect on October 22 was HKD 106.582 billion, with a net purchase of HKD 10.018 billion [1] - The Shanghai Stock Connect accounted for HKD 66.693 billion in trading volume, with a net purchase of HKD 6.693 billion, while the Shenzhen Stock Connect had a trading volume of HKD 39.887 billion and a net purchase of HKD 3.325 billion [1] Group 2: Active Stocks - In the Shanghai Stock Connect, Alibaba-W had the highest trading volume at HKD 41.14 billion, followed by SMIC and Innovent Biologics with HKD 34.07 billion and HKD 32.39 billion respectively [1] - The top net purchase stock was the Tracker Fund of Hong Kong (盈富基金) with a net purchase of HKD 12.93 billion, despite a closing price drop of 1.05% [1] - Alibaba-W recorded the highest net sell amount at HKD 1.80 billion, closing down by 1.94% [1] Group 3: Shenzhen Stock Connect Activity - In the Shenzhen Stock Connect, Innovent Biologics led with a trading volume of HKD 26.84 billion, followed by Alibaba-W and Pop Mart with HKD 24.66 billion and HKD 23.36 billion respectively [2] - The Tracker Fund of Hong Kong (盈富基金) also had a net purchase of HKD 7.02 billion, closing down by 1.05% [2] - Innovent Biologics had the highest net sell amount at HKD 2.53 billion, with a closing price drop of 1.96% [2]

LABUBU卡牌带火“纸片经济”,二手平台溢价约30%

Mei Ri Jing Ji Xin Wen· 2025-10-22 13:45

Core Insights - The focus of the "Double 11" shopping festival has unexpectedly shifted to collectible cards, particularly the TOPPS X THE MONSTERS/LABUBU series, which sold out quickly despite high purchase limits and pre-sale conditions [1][2] - The collectible card market in China is experiencing significant growth, with major players like Pokémon and various entertainment giants entering the space, leading to a competitive landscape [1][6] - Bubble Mart, a leading player in the trendy toy industry, reported a projected revenue growth of 245%-250% year-on-year for Q3 2025, indicating strong performance in the collectible market [1][4] Market Dynamics - The overlap between trendy toy users and card users is significant, with many card players also engaging with Bubble Mart products, although marketing strategies differ [2][5] - The traditional IP-licensed cards are facing challenges as the market becomes saturated, leading to increased competition primarily based on price and volume [2][5] - The LABUBU card's appeal lies in its unique scarcity and artistic value, featuring limited edition items that enhance its collectible nature [3][5] Competitive Landscape - The global collectible trading card market is projected to grow from $7.267 billion in 2025 to $15.433 billion by 2032, with a compound annual growth rate of 11.36% [3][4] - China has emerged as one of the largest trading card markets, with significant growth potential as consumer spending is still relatively low compared to markets like Japan and the U.S. [4][6] - Major companies in the first tier of the market include Pokémon, Konami, and Topps, with a clear competitive hierarchy forming [4][6] Industry Trends - The Chinese card market is witnessing an influx of new players, with over 2,000 card-related companies currently operating, primarily concentrated in Guangdong, Liaoning, and Hainan [6][7] - The market is evolving towards a more mature and diversified structure, with a broader age demographic engaging with various IPs [7][8] - The future of the card market may hinge on the development of trading card games (TCG) that offer gameplay and competitive events, moving away from purely collectible cards [8]

北水成交净买入100.18亿 内资抢筹盈富基金近20亿港元 继续加仓中海油

Zhi Tong Cai Jing· 2025-10-22 13:29

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as China National Offshore Oil Corporation (CNOOC), Semiconductor Manufacturing International Corporation (SMIC), and Pop Mart International. Conversely, stocks like Hua Hong Semiconductor, Xiaomi, and Alibaba faced net selling pressure [2][7]. Group 1: Northbound Trading Activity - Northbound trading recorded a net inflow of 100.18 billion HKD, with 66.93 billion HKD from the Shanghai Stock Connect and 33.25 billion HKD from the Shenzhen Stock Connect [2]. - The most bought stocks included the Tracker Fund of Hong Kong (02800), CNOOC (00883), and SMIC (00981) [2]. - The most sold stocks were Hua Hong Semiconductor (01347), Xiaomi Group-W (01810), and Alibaba Group-W (09988) [2]. Group 2: Stock Performance and Analysis - SMIC saw a net inflow of 18.49 billion HKD in buying, with a selling amount of 15.57 billion HKD, resulting in a total transaction volume of 34.07 billion HKD [3]. - CNOOC received a net buy of 14.24 billion HKD, supported by reports indicating a focus on increasing reserves and production amid external uncertainties [7]. - Pop Mart reported a strong third-quarter performance with revenue growth of 245% to 250% year-on-year, leading to an upgrade in earnings forecasts by Bank of America [8]. Group 3: Sector Insights - The semiconductor sector showed divergence, with SMIC gaining net inflows of 6.42 billion HKD while Hua Hong Semiconductor faced net outflows of 2.97 billion HKD [7]. - Analysts remain optimistic about the semiconductor industry's growth driven by artificial intelligence and domestic production capabilities amid U.S. export controls [7]. - The collaboration between Innovent Biologics and Takeda Pharmaceuticals is expected to yield significant financial benefits, with potential payments reaching up to 114 billion USD [8].

经营的本质是什么?

Hu Xiu· 2025-10-22 13:24

Core Insights - The article discusses the importance of both external cycles and internal organization in determining a company's success or failure during different market conditions [1][2][3] - It presents a four-quadrant model to categorize companies based on their organizational strength and market cycles, illustrating how these factors interact to shape business outcomes [3][4] Quadrant Analysis Quadrant 1: Upward Cycle + Organizational Evolution - Companies like Mixue Ice City and Pop Mart thrive during industry booms due to strategic accuracy and efficient execution, benefiting from favorable market conditions [6][7] - Mixue Ice City's success is attributed to its low-cost model and 100% self-sourced supply chain, achieving high gross and net profit margins in the new tea beverage sector [10][11][12] - Pop Mart capitalizes on global expansion and market adaptability, demonstrating a keen understanding of market dynamics despite periods of lower visibility [14][15][16] Quadrant 2: Downward Cycle + Organizational Evolution - Companies such as Bottle Planet and Midea exemplify resilience in challenging environments, adapting their strategies to align with market demands [17][18] - Bottle Planet, known for its brand Jiangxiaobai, pivoted to a "new liquor" strategy to counteract declining traditional liquor sales, leading to renewed growth [20][21][24] - Midea's transformation into a technology ecosystem company, driven by a focus on organizational strength over individual leadership, has resulted in significant market value growth [26][27] Quadrant 3: Upward Cycle + Organizational Degeneration - Wahaha and Li Ning illustrate how poor organizational management can squander opportunities during favorable market conditions [28][29] - Wahaha's leadership struggles have hindered its ability to capitalize on the bottled water market, while Li Ning's missteps in brand strategy have led to significant market value decline [30][34][35] Quadrant 4: Downward Cycle + Organizational Degeneration - Companies like Master Kong and Three Squirrels face compounded challenges from external market pressures and internal management issues [37][38] - Master Kong's sales have declined due to the rise of food delivery services, while its strategies have failed to adapt effectively to changing consumer preferences [39][41] - Three Squirrels struggles with maintaining quality and adapting to market changes, resulting in significant revenue losses and competitive disadvantages [43][44] Conclusion - The analysis emphasizes that while market cycles are constant, the organizational structure and adaptability of a company are crucial for long-term survival and success [45][46][47]

泡泡玛特(09992.HK)25Q3经营情况前瞻:新品上新势能强劲 预计各渠道持续高速增长

Ge Long Hui· 2025-10-22 12:55

Core Viewpoint - The company is expected to show strong growth in Q3 2025, with significant increases in revenue and adjusted net profit driven by new product launches and continuous channel growth [1][2] Financial Performance - For Q3 2025, the company anticipates a revenue growth of 154.2% year-on-year, reaching approximately 9.17 billion yuan, and an adjusted net profit growth of 198.6%, amounting to about 3.03 billion yuan [1] - The adjusted profit margin is projected to be 33% [1] Product Development - In Q3 2025, the company plans to launch 31 new series of blind box figures and plush products, with a slight decrease in new series compared to the previous quarter but maintaining year-on-year levels [1] - Popular new products include various themed series that sold out on their launch day [1] Retail Expansion - As of the end of August, the company had 513 retail stores in mainland China, a 6.4% increase year-on-year, and 1,837 robot stores [1] - The average revenue per store increased by 57% to 2.48 million yuan for the July-August period [1] Online Sales Performance - The company's official Douyin flagship store achieved a GMV of 1.31 billion yuan in Q3 2025, a year-on-year increase of 302.2%, with sales volume reaching 9.49 million, up 677.9% [2] - The Tmall flagship store generated revenue of 251 million yuan, a 73.1% increase year-on-year, while JD.com saw a revenue increase of 99.6% for the same period [2] Future Outlook - The company has adjusted its profit forecasts for 2025-2027, with expected adjusted net profits of 10.96 billion, 14.92 billion, and 18.31 billion yuan respectively [2] - The adjusted PE ratios for 2025-2027 are projected to be 32.3x, 23.8x, and 19.4x [2]

泡泡玛特Q3运营情况点评

Xin Lang Cai Jing· 2025-10-22 12:19

Core Viewpoint - The company reported a significant year-on-year revenue growth of 245%-250% for Q3 2025, exceeding market expectations, with strong performance across various channels and regions [1][2]. Revenue Performance - Domestic revenue in China grew by 185%-190%, with offline channels increasing by 130%-135% and online channels by 300%-305% [1]. - Overseas revenue surged by 365%-370%, with specific growth rates of 170%-175% in the Asia-Pacific region, 1265%-1270% in the Americas, and 735%-740% in Europe and other regions [1]. IP Development and Longevity - The commercial value curve of the labubu IP does not align with its popularity curve, indicating that high-quality IPs have a longer lifecycle than market perceptions suggest [1]. - Historical data shows that most of the company's key IPs have achieved continuous year-on-year revenue growth, with MOLLY, an early artist IP, maintaining a CAGR of 22% from 2019 to 2023 [1]. Global Market Expansion - The company is leveraging its diverse IP matrix to enhance its presence in global markets, which is crucial for catering to varying cultural preferences [2]. - The success of multiple IPs in overseas markets, such as crybaby and 星星人, demonstrates a notable increase in popularity, with regional differences in demand [2]. - The company is optimistic about expanding its store presence in overseas markets, which will allow for greater audience reach and maximize the commercial value of its diverse IP matrix [2].

智通港股通活跃成交|10月22日

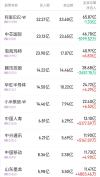

智通财经网· 2025-10-22 11:06

Core Insights - On October 22, 2025, Alibaba-W (09988), SMIC (00981), and Innovent Biologics (01801) were the top three stocks by trading volume in the Southbound Stock Connect, with trading amounts of 4.114 billion, 3.407 billion, and 3.239 billion respectively [1] - In the Southbound Stock Connect for the Shenzhen-Hong Kong Stock Connect, Innovent Biologics (01801), Alibaba-W (09988), and Pop Mart (09992) led the trading volume, with amounts of 2.684 billion, 2.466 billion, and 2.336 billion respectively [1] Southbound Stock Connect (Hong Kong-Shanghai) - Top three active stocks by trading amount: - Alibaba-W (09988): 4.114 billion, net buy of -0.18 billion - SMIC (00981): 3.407 billion, net buy of 0.292 billion - Innovent Biologics (01801): 3.239 billion, net buy of 0.374 billion [2] - Other notable stocks include: - Pop Mart (09992): 2.730 billion, net buy of 0.199 billion - Tencent Holdings (00700): 1.716 billion, net buy of 0.259 billion [2] Southbound Stock Connect (Shenzhen-Hong Kong) - Top three active stocks by trading amount: - Innovent Biologics (01801): 2.684 billion, net buy of -0.253 billion - Alibaba-W (09988): 2.466 billion, net buy of 0.172 billion - Pop Mart (09992): 2.336 billion, net buy of 0.041 billion [2] - Other notable stocks include: - SMIC (00981): 1.857 billion, net buy of 0.350 billion - Tencent Holdings (00700): 1.081 billion, net buy of 0.049 billion [2]

泡泡玛特(09992):财务数据一览

BOCOM International· 2025-10-22 10:27

Investment Rating - The report maintains a "Buy" rating for the company, Pop Mart (9992 HK) [2][15]. Core Insights - The report highlights a sustained growth momentum, leading to an upward revision of profit forecasts and target price, reaffirming the "Buy" rating [2][6][7]. - The target price has been raised to HKD 401.60, indicating a potential upside of 60.4% from the current price of HKD 250.40 [1][15]. Financial Performance Summary - Revenue projections for 2025 have been increased by 11%, with expectations of continued sales momentum into Q4 due to the retail peak season [6][7]. - The company is expected to achieve significant revenue growth, with 2025 revenue estimated at RMB 35,899 million, reflecting a year-on-year growth of 175.3% [5][16]. - Net profit for 2025 is projected to reach RMB 12,421 million, representing a year-on-year increase of 296.7% [5][16]. Market Growth Dynamics - The company reported a 245-250% year-on-year revenue growth in Q3 2025, with the domestic market growing by 185-190% and overseas markets experiencing a remarkable growth of 365-370% [6][7]. - The domestic market's online sales grew by 300-305%, driven by effective live-streaming e-commerce and refined online membership operations [6][7]. - The overseas market, particularly the Americas, showed exceptional performance, with revenue growth of 1265-1270% in Q3 [6][7]. Profitability and Valuation Metrics - The report anticipates an increase in profit margins, with gross profit margin expected to reach 70.8% in 2025 [8][11]. - The company’s price-to-earnings ratio is projected to be 24.5 times for 2025, indicating an attractive valuation given the expected growth [5][16]. - The report notes that the company’s ability to monetize its IP platform continues to strengthen, with significant contributions expected from new IPs and product innovations [6][7].