CNOOC(600938)

Search documents

中国石化等在辽宁朝阳新设公司,注册资本4000万元

3 6 Ke· 2025-10-27 11:48

Core Insights - A new company named Chaoyang Zhongneng Petrochemical Co., Ltd. has been established with a registered capital of 40 million RMB [1] - The company is co-owned by Sinopec Sales Co., Ltd. (51% stake) and Chaoyang Energy Group Co., Ltd. (49% stake) [1] Company Overview - The legal representative of the new company is Li Xiangbo [1] - The business scope includes sales of petroleum products, retail of clothing and daily necessities, hardware products, electronic products, lubricants, cameras and equipment, automobiles, auto parts, and sales of new energy vehicle charging facilities and complete vehicles [1]

油气开采板块10月27日涨0.82%,中国海油领涨,主力资金净流出1.13亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:24

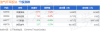

Group 1 - The oil and gas extraction sector increased by 0.82% compared to the previous trading day, with China National Offshore Oil Corporation (CNOOC) leading the gains [1] - On the same day, the Shanghai Composite Index closed at 3996.94, up 1.18%, while the Shenzhen Component Index closed at 13489.4, up 1.51% [1] - The trading volume and turnover for key stocks in the oil and gas extraction sector showed varied performance, with notable increases for certain companies [1] Group 2 - The net outflow of main funds in the oil and gas extraction sector was 113 million yuan, while retail investors saw a net inflow of 44.63 million yuan [1] - Specific stocks like CNOOC experienced a significant net outflow of 101 million yuan from main funds, indicating a shift in investor sentiment [2] - The data indicates that while main funds were withdrawing, retail investors were actively buying into the sector, suggesting differing strategies among investor types [2]

中国海油涨2.01%,成交额10.82亿元,主力资金净流出3822.93万元

Xin Lang Cai Jing· 2025-10-27 05:25

Group 1 - The core viewpoint of the news is that China National Offshore Oil Corporation (CNOOC) has experienced fluctuations in its stock price, with a recent increase of 2.01% and a total market capitalization of 1,324.185 billion yuan [1] - CNOOC's stock price has decreased by 1.34% year-to-date, but has shown positive trends in the last five days (up 6.74%), twenty days (up 8.26%), and sixty days (up 9.71%) [2] - The company primarily engages in the exploration, production, and sales of crude oil and natural gas, with its main revenue sources being oil and gas sales (82.73%), trading (14.96%), and other activities (2.31%) [2] Group 2 - As of June 30, CNOOC reported a total revenue of 207.608 billion yuan for the first half of 2025, reflecting a year-on-year decrease of 8.45%, and a net profit of 69.533 billion yuan, down 12.79% year-on-year [3] - CNOOC has distributed a total of 255.995 billion yuan in dividends since its A-share listing, with 179.051 billion yuan distributed over the past three years [4] - The number of shareholders for CNOOC as of June 30 is 232,800, a decrease of 0.25% from the previous period, with an average of 12,936 circulating shares per shareholder, an increase of 5.50% [3]

国内和海外需求共振,储能市场高景气!央企现代能源ETF(561790)冲击3连涨

Sou Hu Cai Jing· 2025-10-27 03:54

Core Insights - The Central State-Owned Enterprises Modern Energy Index has seen a strong increase of 1.70%, with notable gains from stocks such as China Xidian up 6.61% and Shanghai Electric up 6.40% [3] - The National Development and Reform Commission has released a plan aiming for a new energy storage capacity of over 180 million kilowatts by 2027, enhancing project economics through supportive policies [5] - The demand for energy storage is expected to maintain a high growth rate, with projections indicating a 30%-40% increase in global energy storage installations over the next two years [4] Group 1: Market Performance - The Central State-Owned Enterprises Modern Energy ETF (561790) has increased by 1.63%, marking a three-day consecutive rise, with a latest price of 1.25 yuan [3] - The ETF has seen a weekly cumulative increase of 2.85% as of October 24, 2025, ranking in the top third among comparable funds [3] - The ETF's trading volume reached 416.82 million yuan with a turnover rate of 9.1% [3] Group 2: Policy and Economic Outlook - The new energy storage plan outlines a target of 180 million kilowatts by 2027, with supportive measures from provinces like Henan to enhance project viability [5] - The energy storage market is experiencing robust demand, driven by new pricing policies and increased investment from social capital [4] - The lithium battery demand is projected to exceed 2700 GWh next year, with a year-on-year growth rate of over 30% [4] Group 3: Industry Composition - The top ten weighted stocks in the Central State-Owned Enterprises Modern Energy Index account for 47.72% of the index, including major players like Yangtze Power and China Nuclear Power [6] - The Central State-Owned Enterprises Modern Energy ETF closely tracks the index, which includes 50 listed companies involved in green energy and fossil energy sectors [5]

能源周报(20251020-20251026):欧美强化对俄制裁,本周油价上涨-20251027

Huachuang Securities· 2025-10-27 03:35

Investment Strategy - Crude oil supply growth is slowing due to declining global oil and gas capital expenditure, which has decreased significantly since the Paris Agreement in 2015. In 2021, global oil and gas capital expenditure was $351 billion, down nearly 22% from the 2014 peak. Major energy companies are cautious about capital spending due to long-term low oil prices and increasing decarbonization pressures [9][27][28] - The Brent crude oil spot price was $63.48 per barrel, up 1.25% week-on-week, while WTI crude oil was $59.31 per barrel, up 1.75% week-on-week. The outlook suggests that oil prices will remain volatile due to geopolitical risks and OPEC+ production cuts [10][32] Crude Oil - The report indicates that the overall supply of crude oil is limited, with demand remaining resilient. The OPEC+ production cuts are expected to continue, leading to limited supply growth in the coming year [9][27] - The report suggests focusing on companies that benefit from mid-to-high oil price fluctuations, such as China National Offshore Oil Corporation (CNOOC), China National Petroleum Corporation (CNPC), and Sinopec [10][49][50] Coal - The average market price for thermal coal at Qinhuangdao Port was 757.9 yuan per ton, up 4.84% week-on-week. The increase in demand due to falling temperatures and the tightening of supply due to safety inspections at coal mines are driving coal prices higher [11][12] - The report highlights companies with strong resource endowments and integrated operations, such as China Shenhua Energy and Shaanxi Coal and Chemical Industry, as potential investment opportunities [12][13] Coking Coal - Coking coal prices are experiencing slight increases due to ongoing demand from steel companies, despite some resistance to high-priced coal. The price of main coking coal at Jing Tang Port was 1,760 yuan per ton, up 2.92% week-on-week [14] - The report emphasizes the structural scarcity of high-quality coking coal resources in China and suggests focusing on companies like Huabei Mining and Pingmei Shenma Group that have strong resource acquisition capabilities [14] Natural Gas - The European Union is expected to ban Russian natural gas by the end of 2027, which has led to an increase in natural gas prices. The average price of natural gas in the U.S. was $3.41 per million British thermal units, up 13.0% week-on-week [15][16] - The report notes that the EU's price cap agreement on natural gas could exacerbate liquidity issues in the market, potentially leading to supply shortages [16] Oilfield Services - The oilfield services industry is expected to maintain its prosperity due to government policies supporting energy security. In 2023, the total capital expenditure of the three major oil companies was 583.3 billion yuan, with CNOOC showing a compound growth rate of 13.1% [17][18] - The report indicates that the number of active drilling rigs globally was 1,812, with a slight increase in the U.S. and Middle East regions, suggesting a stable demand for oilfield services [18]

美国制裁两家俄罗斯石油公司,国际油价上涨 | 投研报告

Zhong Guo Neng Yuan Wang· 2025-10-27 02:09

Oil Market Overview - The average weekly price for Brent and WTI crude oil futures is $63.4 and $59.3 per barrel, respectively, with increases of $1.4 and $1.0 compared to the previous week [1][2] - U.S. crude oil production stands at 13.63 million barrels per day, showing a decrease of 10,000 barrels per day week-on-week [2] - Active oil rigs in the U.S. increased by 2 to a total of 420, while active fracturing fleets rose by 3 to 175 [2] Crude Oil Inventory - Total U.S. crude oil inventory is 830 million barrels, with commercial inventory at 420 million barrels, strategic inventory at 410 million barrels, and Cushing inventory at 20 million barrels. Changes from the previous week include decreases of 1.4 million barrels and 0.96 million barrels in total and commercial inventories, respectively, while strategic inventory increased by 0.82 million barrels and Cushing inventory decreased by 0.77 million barrels [1][2] Refinery Activity - U.S. refinery crude processing volume is 15.73 million barrels per day, up by 600,000 barrels per day from the previous week, with a refinery utilization rate of 88.6%, an increase of 2.9 percentage points [2] Oil Trade Dynamics - U.S. crude oil imports, exports, and net imports are 5.92 million, 4.20 million, and 1.72 million barrels per day, respectively, with imports increasing by 390,000 barrels per day and exports decreasing by 260,000 barrels per day [2] Refined Product Overview - Average prices for gasoline, diesel, and jet fuel are $78, $95, and $89 per barrel, respectively, with week-on-week changes of +$1.1, +$2.0, and -$5.1 [3] - Refined product inventories for gasoline, diesel, and jet fuel are 220 million, 120 million, and 40 million barrels, respectively, with decreases of 2.15 million, 1.48 million, and 1.49 million barrels week-on-week [4] - Production levels for gasoline, diesel, and jet fuel are 959, 463, and 164 thousand barrels per day, with increases of 24, 4, and decreases of 7 thousand barrels per day, respectively [5] Refined Product Demand and Trade - Consumption of gasoline, diesel, and jet fuel is 845, 385, and 172 thousand barrels per day, with no change in gasoline, a decrease of 39 thousand barrels per day in diesel, and an increase of 3 thousand barrels per day in jet fuel [6] - Gasoline imports, exports, and net exports are 80, 1.21 million, and 1.14 million barrels per day, with changes of -30, +190, and +230 thousand barrels per day, respectively [6] Recommended Companies - Companies recommended for investment include China National Offshore Oil Corporation (CNOOC), PetroChina, Sinopec, CNOOC Services, and others [6]

俄乌局势扰动,油价低位反弹 | 投研报告

Zhong Guo Neng Yuan Wang· 2025-10-27 01:21

Core Insights - The article discusses the recent developments in the oil processing industry, highlighting a rebound in international oil prices due to easing trade tensions and supportive inventory data [1][2]. Oil Price Review - As of October 24, 2025, Brent crude oil futures settled at $65.20 per barrel, up $3.91 per barrel (+6.38%) from the previous week, while WTI crude oil futures settled at $61.50 per barrel, up $4.35 per barrel (+7.61%) [2]. - The Urals crude oil spot price remained stable at $65.49 per barrel, while the ESPO crude oil spot price increased by $2.62 per barrel (+4.54%) to $60.35 per barrel [2]. Offshore Drilling Services - As of October 20, 2025, the number of global offshore self-elevating drilling rigs decreased by 3 to 370, with reductions in Africa, the Middle East, North America, and other regions, while Europe saw an increase of 1 rig [2]. - The number of global offshore floating drilling rigs remained unchanged at 132, with decreases in Africa and Europe, and increases in Southeast Asia and other regions [2]. U.S. Crude Oil Supply - As of October 17, 2025, U.S. crude oil production was 13.629 million barrels per day, a decrease of 0.07 million barrels per day from the previous week [3]. - The number of active drilling rigs in the U.S. increased by 2 to 420 as of October 24, 2025, while the number of hydraulic fracturing fleets increased by 3 to 178 [3]. U.S. Crude Oil Demand - As of October 17, 2025, U.S. refinery crude oil processing volume was 15.730 million barrels per day, an increase of 0.600 million barrels per day, with a refinery utilization rate of 88.60%, up 2.9 percentage points from the previous week [3]. U.S. Crude Oil Inventory - As of October 17, 2025, total U.S. crude oil inventory was 831 million barrels, a decrease of 0.142 million barrels (-0.02%) from the previous week [3]. - Strategic crude oil inventory increased by 0.819 million barrels (+0.20%) to 409 million barrels, while commercial crude oil inventory decreased by 0.961 million barrels (-0.23%) to 423 million barrels [3]. U.S. Refined Oil Inventory - As of October 17, 2025, U.S. gasoline, diesel, and jet fuel inventories were 21,667.9 million barrels, 11,555.1 million barrels, and 4,292.9 million barrels, respectively, with changes of -0.2147 million barrels (-0.98%), +0.028 million barrels (+0.18%), and -0.1485 million barrels (-3.34%) [4]. Biofuel Prices - As of October 24, 2025, the FOB price for ester-based biodiesel was $1,190 per ton, while hydrocarbon-based biodiesel was $1,900 per ton, both unchanged from the previous week [4]. - The FOB price for biojet fuel in China was $2,400 per ton, and in Europe, it was $2,710 per ton, both remaining stable [4].

原油周报:美国制裁两家俄罗斯石油公司,国际油价上涨-20251026

Soochow Securities· 2025-10-26 13:52

Report Information - Report Title: Crude Oil Weekly Report: US Sanctions Two Russian Oil Companies, International Oil Prices Rise [1] - Report Date: October 26, 2025 [1] - Analysts: Chen Shuxian, Zhou Shaowen [1] Industry Investment Rating - Not provided in the report Core Viewpoints - This week, Brent/WTI crude oil futures had weekly average prices of $63.4/$59.3 per barrel, up $1.4/$1.0 per barrel from last week. Various data on US crude oil and refined oil, including inventory, production, demand, and import/export, showed different changes [2]. - Recommended related listed companies include CNOOC, PetroChina, Sinopec, etc.; companies to be concerned about include Sinopec Oilfield Service, CNPC Engineering, etc. [3] Summary by Directory 1. Crude Oil Weekly Data Briefing - **Upstream Key Company Performance**: The stock prices of companies such as CNOOC, PetroChina, and Sinopec showed different percentage changes in the recent week, month, three - month, one - year, and year - to - date periods. Their valuations, including total market value, net profit attributable to the parent company, PE, and PB, also varied [9]. - **Crude Oil Price**: Brent, WTI, Russian Urals, and Russian ESPO crude oil had different weekly average prices and percentage changes. The LME copper spot price and the US dollar index also had corresponding fluctuations [9]. - **Inventory**: US crude oil total inventory, commercial crude oil inventory, strategic crude oil inventory, and Cushing crude oil inventory had different inventory levels and changes [9]. - **Production**: US crude oil production, the number of active crude oil rigs, and the number of active fracturing fleets had corresponding changes [9]. - **Refinery**: US refinery crude oil processing volume and operating rate, as well as the operating rates of Chinese local and major refineries, showed different changes [9]. - **Import/Export**: US crude oil import, export, and net import volumes had corresponding changes [9]. 2. This Week's Petroleum and Petrochemical Sector Market Review - **Petroleum and Petrochemical Sector Performance**: The report presents the performance of the petroleum and petrochemical sector, but specific data is not detailed here [12]. - **Sector Listed Company Performance** - **Refined Oil Price and Spread**: The weekly average prices and spreads of gasoline, diesel, and jet fuel in China, the US, Europe, and Singapore showed different changes [22]. - **Inventory**: The inventories of gasoline, diesel, and jet fuel in the US and Singapore had different inventory levels and changes [22]. - **Production**: The production of gasoline, diesel, and jet fuel in the US had corresponding changes [22]. - **Consumption**: The consumption of gasoline, diesel, and jet fuel in the US had corresponding changes [22]. - **Import/Export**: The import, export, and net export volumes of gasoline, diesel, and jet fuel in the US had corresponding changes [22]. - **Oil Service Sector**: The daily rates of offshore jack - up drilling platforms and semi - submersible drilling platforms had different changes [22]. 3. Crude Oil Sector Data Tracking - **Crude Oil Price**: Analyzes the prices and spreads of various crude oils, as well as the relationship between the US dollar index, LME copper price, and WTI crude oil price [28][35]. - **Crude Oil Inventory**: Discusses the relationship between US commercial crude oil inventory and oil prices, as well as the inventory levels and changes of US total crude oil, commercial crude oil, strategic crude oil, and Cushing crude oil [41][54]. - **Crude Oil Supply**: Analyzes US crude oil production, the number of crude oil rigs, and the number of fracturing fleets and their relationship with oil prices [57][61]. - **Crude Oil Demand**: Analyzes US refinery crude oil processing volume, operating rate, and the operating rates of Shandong and Chinese major refineries [65][69]. - **Crude Oil Import/Export**: Analyzes US crude oil import, export, and net import volumes [75]. 4. Refined Oil Sector Data Tracking - **Refined Oil Price**: Analyzes the relationship between international oil prices and domestic gasoline, diesel retail prices, as well as the prices and spreads of crude oil and refined oil in different regions [80][107]. - **Refined Oil Inventory**: Analyzes the inventory levels and changes of gasoline, diesel, and jet fuel in the US and Singapore [121][133]. - **Refined Oil Supply**: Analyzes the production of gasoline, diesel, and jet fuel in the US [140]. - **Refined Oil Demand**: Analyzes the consumption of gasoline, diesel, and jet fuel in the US and the number of US airport passenger security checks [143]. - **Refined Oil Import/Export**: Analyzes the import, export, and net export volumes of gasoline, diesel, and jet fuel in the US [150][153]. 5. Oil Service Sector Data Tracking - Analyzes the average daily rates of self - elevating drilling platforms and semi - submersible drilling platforms in the oil service sector [165][169].

石油石化行业行深业度周报告:美加大对俄油企业制裁,油价涨幅走扩-20251026

Ping An Securities· 2025-10-26 12:56

Investment Rating - The report maintains an "Outperform" rating for the oil and petrochemical sector [1]. Core Viewpoints - The oil price has seen an increase due to intensified sanctions by the U.S. and Canada on Russian oil companies, with WTI crude futures rising by 6.53% and Brent crude futures by 7.09% from October 17 to October 24, 2025 [6]. - Geopolitical tensions, particularly regarding the fragile ceasefire in Gaza and the ongoing conflict between Russia and Ukraine, continue to impact oil prices [6]. - The U.S. government plans to purchase 1 million barrels of oil to replenish its strategic reserves, which may provide short-term support for oil prices [6]. - In the fluorochemical sector, the supply of popular refrigerants is tight, leading to sustained price increases, with domestic demand for refrigerants expected to rise in the fourth quarter [6]. - The semiconductor materials sector is experiencing a positive trend with inventory reduction and improving fundamentals, driven by domestic substitution [7]. Summary by Sections Oil and Petrochemicals - The report highlights the impact of U.S. sanctions on Russian oil companies and geopolitical tensions on oil prices [6]. - Basic data tracking indicates a slight decrease in U.S. commercial crude oil inventories, while gasoline and jet fuel inventories continue to decline [6][15]. - The report suggests that domestic oil companies are diversifying their oil and gas sources to reduce sensitivity to oil price fluctuations [7]. Fluorochemicals - The supply of second-generation refrigerants is decreasing due to policy restrictions, while demand for third-generation refrigerants is expected to grow, driven by government incentives [6]. - The report notes that the production of household air conditioners is projected to increase significantly in the last quarter of 2025, which will boost demand for refrigerants [6]. Semiconductor Materials - The semiconductor materials sector is witnessing an upward cycle, with inventory reduction trends and improving end-market conditions [7]. - The report recommends focusing on companies in the semiconductor materials sector that are benefiting from domestic substitution and cyclical recovery [7].

深圳三大港区LNG燃料加注全覆盖

Shen Zhen Shang Bao· 2025-10-25 17:24

Core Insights - Shenzhen's Dalanwan Terminal has successfully completed its first LNG bunkering service using the "ship-to-ship" method, marking a significant milestone in the region's green shipping capabilities [1] - The LNG bunkering business in Shenzhen has shown remarkable growth, with a year-on-year increase of 157% in LNG bunkering volume from January to July 2023, reaching 310,200 cubic meters [1] - The total LNG bunkering volume for the first three quarters of 2023 has further increased to 370,600 cubic meters, maintaining a year-on-year growth rate of 103% [1] Group 1 - Yantian Port has established a mature service system for LNG bunkering, completing Shenzhen's first LNG bunkering in 2022 and achieving the first bonded LNG bunkering in South China in 2023 [2] - In 2024, Yantian Port set a record for simultaneous bunkering of two 20,000 TEU container ships, with a single operation supplying over 9,700 cubic meters of fuel [2] - The comprehensive coverage of LNG bunkering across Shenzhen's three major port areas is expected to attract international vessels to choose Shenzhen as their fuel supply port [2] Group 2 - The "CMA CGM Seine" vessel, the world's largest dual-fuel ship, has frequently received LNG bunkering in Shenzhen, with each operation supplying around 8,000 cubic meters [2] - The "Mediterranean Catania" vessel completed an 8,000 cubic meter bonded LNG bunkering at Yantian Port earlier this year [2] - The LNG bunkering business not only enhances port services but also generates significant economic benefits, with Yantian Port projected to achieve an LNG bunkering volume of 300,000 cubic meters in 2024, nearly six times the total for 2023 [2]