供应短缺

Search documents

美国铝溢价飙升155%创历史新高,关税叠加供应紧张推升成本压力

Hua Er Jie Jian Wen· 2025-11-10 14:06

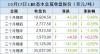

Core Insights - The aluminum market in the U.S. has reached a historical high in premiums, significantly increasing the cost of acquiring aluminum, driven by tariffs and global supply constraints [1][3] - The Midwest U.S. aluminum premium hit $0.8810 per pound (equivalent to $1942 per ton), with the actual price for U.S. spot buyers rising to $4792 per ton, reflecting a cumulative increase of over 155% since June [1] Tariff Impact - The increase in aluminum import tariffs from 25% to 50% by the Trump administration in June has led to a current tariff burden of $1425 per ton, more than doubling from $560 at the beginning of the year [3] - The expectation of permanent tariffs has intensified following the cancellation of trade negotiations with Canada, which is the largest aluminum supplier to the U.S., accounting for over 70% of imports [3] Global Supply Constraints - A structural supply shortage in the global aluminum market is contributing to rising costs, with an anticipated supply gap of 1.8 million tons this year [3] - China's net exports of refined metals and semi-finished products have decreased significantly, alongside a decline in aluminum production outside of China, leading to a total reduction of 2 million tons in global aluminum supply [3]

对二甲苯:单边趋势中期偏强, PTA:供应压力仍存,高位震荡市,月差反套, MEG:供应压力仍较大,趋势偏弱

Guo Tai Jun An Qi Huo· 2025-11-10 07:07

Report Industry Investment Ratings - PX: Unilateral trend is moderately strong in the medium term [1] - PTA: Supply pressure persists, high - level volatile market, backwardation in calendar spreads [1] - MEG: Supply pressure remains high, trend is weak [1] Core Views - PX: The unilateral trend is strong. It is recommended to go long on PX and short on PTA/MEG. Despite the restart of some devices and the high operating rate, the cost support and demand factors make the unilateral strong pattern clear [5]. - PTA: With positive demand feedback and cost support, it should be regarded as unilaterally strong. Although the inventory accumulation in November narrows, the supply is still in excess after some device overhauls end, and the processing fee may continue to be under pressure [6]. - MEG: It is short - term oscillating weakly. The supply pressure persists, and it is recommended to maintain the backwardation operation in calendar spreads. Although the supply pressure eases slightly in the short term, it remains in the long term [6]. Summary by Related Catalogs Market Dynamics - A 300,000 - ton/year polyester bottle - chip device in the southwest has been shut down for maintenance since early November, with a total of 600,000 tons of production shut down at the factory [3]. - The price increase in the previous trading day was mainly driven by increased stock market activity. The sudden increase in market activity may be due to the entry of external funds [3]. - The PX market is currently quite stable fundamentally, and there is no obvious weakness in the short term. The main support for PX comes from China's higher PTA production capacity, especially from new factories launched this year [3]. - Formosa Chemicals & Fiber Corp. restarted its 720,000 - ton/year PX production line in Mailiao on November 4 after completing the planned turnaround, and has been operating at about 70% capacity since then. A 350,000 - ton/year production line has been shut down since early April for planned turnaround [5]. Futures Price and Spread Data | Futures | Yesterday's Closing Price | Change | Change Rate | | --- | --- | --- | --- | | PX Main | 6780 | - 40 | - 0.59% | | PTA Main | 4664 | - 24 | - 0.51% | | MEG Main | 3942 | 18 | 0.46% | | PF Main | 6214 | - 30 | - 0.48% | | SC Main | 460.6 | 0.2 | 0.04% | | Calendar Spread | Yesterday's Closing Price | Previous Day's Closing Price | Change | | --- | --- | --- | --- | | PX1 - 5 | 0 | 14 | - 14 | | PTA1 - 5 | - 64 | - 62 | - 2 | | MEG1 - 5 | - 77 | - 80 | 3 | | PF12 - 1 | - 38 | - 34 | - 4 | | SC11 - 12 | 0.9 | 1 | - 0.1 | | Spot | Yesterday's Price | Previous Day's Price | Change | | --- | --- | --- | --- | | PX CFR China ($/ton) | 825.67 | 826 | - 0.33 | | PTA East China (Yuan/ton) | 4572 | 4540 | 32 | | MEG Spot | 4013 | 3978 | 35 | | Naphtha MOPJ | 581.75 | 575.75 | 6 | | Dated Brent ($/barrel) | 63.61 | 63.66 | - 0.05 | | Spot Processing Fee | Yesterday's Price | Previous Day's Price | Change | | --- | --- | --- | --- | | PX - Naphtha Spread | 250.25 | 238.5 | 11.75 | | PTA Processing Fee | 120.65 | 141.93 | - 21.29 | | Short - Fiber Processing Fee | 259.02 | 267.68 | - 8.66 | | Bottle - Chip Processing Fee | 54.06 | 99.6 | - 45.54 | | MOPJ Naphtha - Dubai Crude Spread | - 4.34 | - 4.34 | 0 | [2] Trend Intensity - PX trend intensity: 0 (neutral) - PTA trend intensity: 0 (neutral) - MEG trend intensity: - 1 (weakly bearish) [5] Supply and Demand Analysis PX - Supply: Fushun Petrochemical and Formosa Plastics' devices restarted, and the domestic and Asian PX operating rates reached new highs. Yulong Petrochemical was sanctioned, resulting in weak MX prices. Although the short - process profit is strong, the operating rate has not actually recovered [5]. - Demand: Some PTA devices were shut down or had reduced loads, and the PTA load declined. The stock prices of polyester leaders rose sharply, but the actual probability of production reduction is low [5]. PTA - Supply: Some factories without supporting facilities reduced their loads, and the inventory accumulation in November narrowed. After the overhaul of some devices such as Xin凤鸣 ended, the supply was still in excess [6]. - Demand: The polyester load remained high (91.5% in November), and the rigid demand for PTA was acceptable [6]. MEG - Supply: The overall operating rate of MEG declined this week, with multiple devices shut down or reducing loads. However, Zhenhai Refining & Chemical's 800,000 - ton device is about to restart, and the long - term supply pressure remains due to concentrated imports [6]. - Demand: Downstream weaving orders weakened locally, and the operating rate declined. However, the polyester load remained high in the short term, providing some demand support [6]. Valuation and Strategy - PX: The PXN spread has risen to a high level, and producers can hedge at high prices. It is recommended to go long on PX and short on PTA/MEG [5]. - PTA: The processing fee of the 01 contract has reached a new low of 219 Yuan/ton, and the spot processing fee is 173 Yuan/ton. The processing fee may continue to be under pressure [6]. - MEG: It is recommended to maintain the backwardation operation in calendar spreads [6].

美元持续走强施压 沪铜价格高位回调

Jin Tou Wang· 2025-11-04 06:34

Core Viewpoint - The strengthening of the US dollar is pressuring copper prices, leading to a high-level correction in domestic copper futures, with the main contract reported at 85,760 yuan/ton, down 1.52% [1] Market Overview - LME copper futures have declined due to the strong US dollar, which has dampened market sentiment. However, concerns over supply shortages are helping to limit the decline in copper prices [2] - Chile's copper production in September was 456,663 tons, showing a month-on-month increase of 7.79% but a year-on-year decrease of 4.5% [2] - As of November 3, domestic electrolytic copper inventories were at 206,000 tons, an increase of 17,400 tons from October 27. Shanghai's inventory rose by 12,800 tons, Guangdong's by 200 tons, and Jiangsu's by 6,000 tons [2] - The US ISM manufacturing PMI for October fell to 48.7%, indicating continued contraction for eight months, with weak demand and employment, while inflation is cooling. The Eurozone's manufacturing PMI for October was finalized at 50, with Germany and France continuing to contract, and weak new orders hampering recovery [2] Institutional Insights - According to a report from Industrial Futures, the strong dollar is pressuring copper prices, but the trend of liquidity easing remains unchanged. The easing of US-China trade tensions is seen as a positive macro environment, and ongoing supply concerns from major mining companies reducing annual production guidance are supporting copper prices. The strategy suggests that the recent correction in copper prices is limited, and previous long positions can be maintained [3] - Everbright Futures noted that the recent high-to-low fluctuations in copper prices indicate weak short-term bullish sentiment. November marks a transition between peak and off-peak seasons, and the continuous inventory accumulation in the domestic market raises concerns about demand at high copper prices. However, there is no panic sentiment in the market, suggesting that the correction in copper prices may be limited, presenting a buying opportunity on dips, with a focus on long positions in the first half of next year [3]

市场受供应短缺影响 焦煤期货呈区间震荡偏强态势

Jin Tou Wang· 2025-10-30 06:09

Core Viewpoint - The main focus is on the recent surge in coking coal futures, with prices reaching a peak of 1316.0 yuan and currently trading at 1291.0 yuan, reflecting a 1.85% increase [1] Group 1: Market Dynamics - Coking coal futures are experiencing wide fluctuations, with expectations of a third round of price increases from coking enterprises due to historically low inventory levels [2] - Domestic production is being constrained by environmental policies and supply shortages, leading to a decrease in mining activity and a reduction in premium coal output by approximately 1.79 million tons [2] - The demand side shows that coking enterprises are facing significant losses, which may affect their operational enthusiasm, while steel mills are also experiencing profit compression, leading to a slight reduction in iron and steel production [2] Group 2: Supply and Demand Factors - The supply side is impacted by low operating rates in open-pit mines and proactive production cuts in Shanxi coal mines, with daily average production from 523 sample mines decreasing by 70,000 tons compared to May [3] - On the import side, Mongolian coal is facing challenges due to political instability and reduced capacity quotas, resulting in a significant drop in inventory levels and a decline in quality, which increases delivery premiums [3] - Despite slight losses in steel mills, the overall production remains stable at around 2.4 million tons per day, supported by high profit margins earlier in the year and expectations for winter stockpiling in November [3]

一场“完美风暴”来袭!继金银后,铜价再创历史新高

Jin Shi Shu Ju· 2025-10-29 11:17

Group 1 - Copper prices have reached a new historical high in London, driven by easing trade tensions and previous supply disruptions due to tariffs and mining issues [1][2] - Year-to-date, copper prices have increased by over 25%, potentially marking the best annual performance since 2017 [2] - Major mining disruptions in Chile, Africa, and Indonesia have significantly impacted global copper supply, while U.S. tariffs have created price distortions between domestic and global markets [2][3] Group 2 - Recent warnings from Teck Resources and Anglo American indicate that copper production at key mines may fall short of expectations next year, leading to the first annual decline in global copper production since the pandemic [3] - Long-term optimism for copper demand in renewable energy, electric vehicles, and data centers is tempered by short-term concerns over escalating trade tensions [3] - The weak U.S. dollar has made copper and other dollar-denominated commodities more attractive to foreign buyers, with expectations of further interest rate cuts by the Federal Reserve potentially exerting additional pressure on the dollar [3]

金属普涨 期铜创17个月新高,因贸易协议乐观情绪升温【10月27日LME收盘】

Wen Hua Cai Jing· 2025-10-28 00:46

Group 1 - LME copper prices reached a 17-month high due to signs of easing global trade tensions and strong economic growth expectations, with three-month copper rising by $66.5 to $11,029.0 per ton [1] - The three-month aluminum price increased by $15.5 to $2,874.5 per ton, while zinc rose by $29.5 to $3,055.0 per ton, indicating a positive trend in base metal prices [2][7] - A recent survey of 30 industry analysts projected an increase in average copper prices, estimating 2025 LME spot copper at $9,752 per ton, up from previous estimates [6] Group 2 - The Chinese economy showed signs of strengthening, with September industrial profit growth being the fastest in nearly two years, which may enhance demand for industrial metals [4] - The weakening of the US dollar against the Chinese yuan made dollar-denominated commodities cheaper for Chinese buyers, although the copper premium in China has decreased, indicating a slower purchasing pace [5] - Zinc inventories in LME registered warehouses have dropped to 37,050 tons, the lowest level since March 2023, reflecting supply concerns [8]

期铜逼近11000美元,受助于对供应短缺的担忧及乐观【10月24日LME收盘】

Wen Hua Cai Jing· 2025-10-26 06:07

Core Viewpoint - The London Metal Exchange (LME) copper prices are rising, nearing $11,000 per ton, driven by ongoing supply concerns and optimistic trade outlooks [1] Group 1: Copper Market Insights - On October 24, LME three-month copper rose by $108.5, or 1%, closing at $10,962.5 per ton, with an intraday high of $10,979.50, marking the highest level since October 9 [1] - LME copper inventory has decreased to 136,350 tons, the lowest since the end of July, while Shanghai Futures Exchange copper inventory has fallen to 104,792 tons [4] Group 2: Supply and Demand Factors - Analyst John Meyer from SP Angel indicates that copper prices are expected to continue rising due to tightening supply, influenced by the mudslide incident at the Grasberg mine in Indonesia and persistent global copper demand [4] - Freeport's Grasberg copper mine has been out of production since the incident on September 8, and Antofagasta has projected its 2025 copper output to be at the lower end of the forecast range of 660,000 to 700,000 tons [4] Group 3: Other Base Metals Performance - Other base metals also experienced fluctuations; LME three-month aluminum fell by $3.5, or 0.12%, closing at $2,859.0 per ton, with an intraday peak of $2,883.50, the highest since May 2022 [2][4]

金属多飘红,期铜回升,受强劲数据带动【10月20日LME收盘】

Wen Hua Cai Jing· 2025-10-21 00:57

Core Insights - LME copper prices increased by $87, or 0.82%, closing at $10,691.5 per ton, driven by a rebound in the stock market and strong industrial output data from China [1][4] - The industrial value-added in China for September grew by 6.5% year-on-year, accelerating by 1.3 percentage points compared to August, and increased by 0.64% month-on-month [4] - Other base metals also saw price increases, with LME zinc rising by $45, or 1.53%, to $2,978.5 per ton [4] Market Data - LME three-month copper: $10,691.50, up $87.00 (+0.82%) [2] - LME three-month aluminum: $2,776.50, down $1.00 (-0.04%) [2] - LME three-month zinc: $2,978.50, up $45.00 (+1.53%) [2] - LME three-month lead: $1,988.50, up $18.50 (+0.94%) [2] - LME three-month nickel: $15,222.00, up $96.00 (+0.63%) [2] - LME three-month tin: $35,304.00, up $267.00 (+0.76%) [2] Supply Dynamics - LME zinc inventory dropped to 37,325 tons, the lowest level since March 2023 [5] - LME spot zinc premium surged to $230.29 per ton, the highest level since 1997, indicating tight short-term supply [5]

金属普涨,期铜盘中触及一周低点,受美国信贷担忧拖累【10月17日LME收盘】

Wen Hua Cai Jing· 2025-10-18 00:55

Core Viewpoint - The London Metal Exchange (LME) saw most base metals decline, with copper hitting a one-week low, influenced by concerns over credit pressures in U.S. regional banks, leading to a negative sentiment in the market [1][4]. Group 1: Market Performance - On October 17, LME three-month copper fell by $42.5, or 0.4%, closing at $10,604.5 per ton, with an intraday low of $10,430, marking a 2% drop and the lowest since October 10 [1][2]. - Other base metals also experienced declines, with three-month aluminum down by $11.00 (0.39%), zinc down by $39.50 (1.33%), and tin down by $735.00 (2.05%) [2]. Group 2: Economic Indicators - Copper is viewed as a barometer for the global economy, with recent supply concerns pushing prices to a 16-month high of $11,000 per ton last week [1]. - Recent reports indicate a temporary easing of supply concerns, as copper inventories at the Shanghai Futures Exchange increased by 550 tons, reaching the highest level since April [4]. Group 3: Market Sentiment - The environment is characterized by a general risk aversion, with high-risk assets under pressure due to concerns over the U.S. economic situation [4]. - The spread between spot copper contracts and three-month forward contracts widened, indicating a decrease in immediate demand for copper [4].

铜产业链周度数据报告:避险需求与供应缺口共振,电解铜仍在市场高位维持强势-20251014

Tong Hui Qi Huo· 2025-10-14 11:57

Report Summary 1. Investment Rating The report does not provide an industry investment rating. 2. Core Viewpoint The current copper market is influenced by the resonance of the US government shutdown - driven risk - aversion demand and the supply shortage caused by the Indonesian mine accident. Copper prices are fluctuating around 85,000. Before these two factors reverse, it is not advisable to easily short copper prices. Although the tariff issue has re - emerged, the "TACO" trading logic still holds, and there is a possibility of a repeat of the Qingming Festival market. For the future market, the current price is high, but shorting should not be done lightly. If one wants to participate, a small - position long - term allocation can be considered [5]. 3. Summary by Directory 3.1 Electrolytic Copper Market Price - **1.1 Electrolytic Copper Upstream Market Price**: The Indonesian mine accident has continuously pushed up the ore price. Charts show the market price of 20% copper concentrate, TC price, refined - scrap copper spot price, and copper import profit [7][9][11]. - **1.2 Electrolytic Copper Futures and Spot Market Price**: The mine accident has become the dominant factor. Charts display the Shanghai copper futures - spot price, Yangshan Free Trade Zone premium to LME, and foreign copper futures prices [14][16][18]. - **1.3 Outer - Market Copper Position Data**: Overseas long - position speculation has continued to increase. Charts present overseas exchange inventory, LME copper warehouse receipt composition, LME copper fund position, and COMEX copper non - commercial position [19][20][24]. 3.2 Electrolytic Copper Production and Inventory - **2.1 Electrolytic Copper Upstream Supply**: Charts show the net import volume of copper concentrate, electrolytic copper, and scrap copper [29][30][31]. - **2.2 Electrolytic Copper Production and Inventory**: Charts display the monthly production and operating rate of electrolytic copper, production cost and profit, and weekly inventory [34][35][36]. 3.3 Macroeconomic Data and Downstream Consumption - **3.1 US Dollar Index and US Treasury Yield**: Charts show the US dollar index, US Treasury yield spread, US Treasury yield, and the relationship between the US benchmark interest rate and inflation [42][43][45]. - **3.2 US Economic Data**: Charts present US employment data, market confidence index, social retail sales, and inventory data [51][52][53]. - **3.3 Chinese Economic Data**: In July, new loans turned negative, and the PMI was slightly above the boom - bust line. Charts show China's M1, M2 growth rate, new RMB loans, manufacturing PMI, and other data [59][60][64]. - **3.4 Chinese Copper Downstream Consumption Data**: The power grid and new energy sectors provide support. Charts show the monthly demand for electrolytic copper, copper foil operating rate, terminal production growth rate, and fixed - asset investment growth rate [71][72][73].